The conclusion of the India-European Union Free Trade Agreement (FTA) on January 27, 2026, marks a historic pivot in India’s trade strategy.

- Often called the “mother of all deals,” it creates a unified market for 2 billion people and serves as a critical strategic counterweight to rising U.S. trade protectionism.

Strategic Significance

- Market Scale: The deal integrates economies representing 25% of global GDP.

- While previous FTAs covered only 16% of India’s trade, the EU alone accounts for nearly 12%.

Diplomatic Maturity: Negotiators successfully resolved a 13-year stalemate (since 2013) by using a pragmatic approach to sensitive sectors like automobiles and dairy.

Diplomatic Maturity: Negotiators successfully resolved a 13-year stalemate (since 2013) by using a pragmatic approach to sensitive sectors like automobiles and dairy.- Geopolitical Hedge: The timing is critical; as 50% U.S. tariffs pressure the rupee and capital flows, the FTA offers a stable, rules-based alternative for Indian exporters.

Key Trade Concessions

- Export Gains: The EU will eliminate tariffs on 99.5% of Indian export value. Labour-intensive sectors like textiles, leather, and gems & jewellery will move to zero-duty access immediately.

- Balanced Imports: India provided concessions on 97.5% of EU exports but successfully excluded strategic agriculture and dairy to protect domestic farmers.

- The “Auto-Wine” Compromise: Automobiles: India will slash duties from 110% to 10% but only for a quota of 250,000 vehicles, protecting local mass-market manufacturers while opening the luxury segment.

- Wine & Spirits: Tariffs will drop from 150% to 75% immediately, eventually reaching 20–30%, benefiting French winemakers without crushing India’s domestic industry.

Broader Strategic Pillars

- Security & Defence: A separate partnership was signed to cooperate on maritime security, cyber-defence, and counter-terrorism.

- Mobility & Talent: A new framework facilitates the movement of skilled workers and students, including “uncapped mobility” for Indian students in certain EU programs.

- Technology: Both sides renewed agreements on Scientific and Technological Cooperation, focusing on AI, green hydrogen, and semiconductors.

Challenges & Concerns

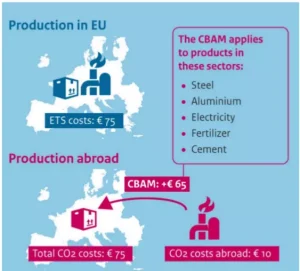

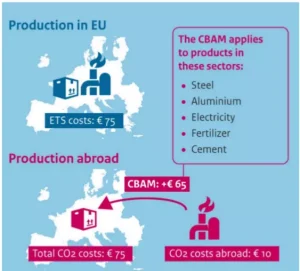

- The CBAM Hurdle: India failed to secure exemptions from the Carbon Border Adjustment Mechanism (CBAM). Indian steel and aluminium exports will still face carbon-linked costs starting in 2026.

- Implementation Lag: The document must be translated into 27 languages and ratified by all EU member states. If not fast-tracked, the benefits may come too late to offset the current U.S. tariff pain.

- Manufacturing Reforms: To truly benefit, India must accelerate domestic reforms to encourage large-scale manufacturing for investors seeking a “China Plus One” alternative.

Conclusion

The India-EU FTA is a landmark in diplomatic maturity, securing massive market access while protecting sensitive sectors. By diversifying trade, it provides a vital economic shield against U.S. tariff pressures, though success hinges on swift implementation and manufacturing reforms.

![]() 29 Jan 2026

29 Jan 2026

Diplomatic Maturity: Negotiators successfully resolved a 13-year stalemate (since 2013) by using a pragmatic approach to sensitive sectors like automobiles and dairy.

Diplomatic Maturity: Negotiators successfully resolved a 13-year stalemate (since 2013) by using a pragmatic approach to sensitive sectors like automobiles and dairy.