![]() 1 Dec 2023

1 Dec 2023

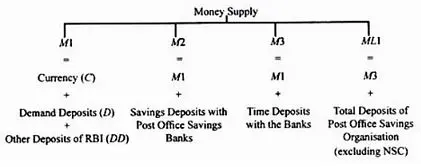

The Reserve Bank is the sole institution capable of issuing currency and providing funds to commercial banks for credit creation, shaping the nation’s money supply. The Central Bank provides funds through various instruments and is considered the lender of last resort due to its constant lending capacity to banks.

The RBI uses both quantitative and qualitative tools to regulate the money supply in the economy.

<div class="new-fform">

</div>