![]() March 27, 2024

March 27, 2024

![]() 16667

16667

![]() 0

0

The Government of India, with the approval of the President of India, has constituted the Fifteenth Finance Commission in pursuance of Article 280 of the Constitution, The Commission has made recommendations for the five years commencing on April 1, 2020. This Commission was headed by Shri. N.K.Singh.

| Parameter | Weightage (%) |

| Income Distance | 45 |

| Population (2011 Census) | 15 |

| Demographic Performance | 12.5 |

| State Area | 15 |

| Forest and Ecology | 10 |

| Tax and Fiscal Effort | 2.5 |

| Must Read | |

| Current Affairs | NCERT Notes |

| Upsc Notes | UPSC Blogs |

| Editorial Analysis | Free Main Answer Writing |

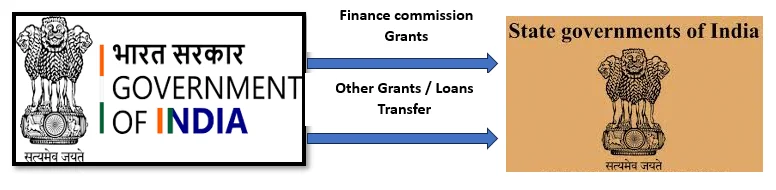

Additional Transfers from Central to State Governments:

Other recommendations

Conclusion

<div class="new-fform">

</div>

Latest Comments