![]() March 27, 2024

March 27, 2024

![]() 186

186

![]() 0

0

Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of limited resources. Key concepts in microeconomics include supply and demand, which determine prices and quantities in markets; consumer behavior, which examines how individuals make decisions about what goods and services to purchase; producer behavior, which explores how firms decide what to produce and how much to produce; and market structures, such as perfect competition, monopoly, oligopoly, and monopolistic competition, which characterize different types of markets and their implications for efficiency and distribution of resources.

|

Supply Side of the Economy: Laws, Determinants, and Market Equilibrium

Market Equilibrium and Competition

Theory of the Firm in Microeconomics: Microeconomic Perspectives on Market Structures

|

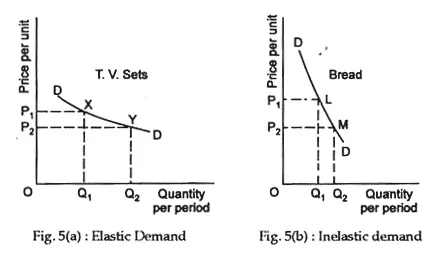

Elasticity of Demand

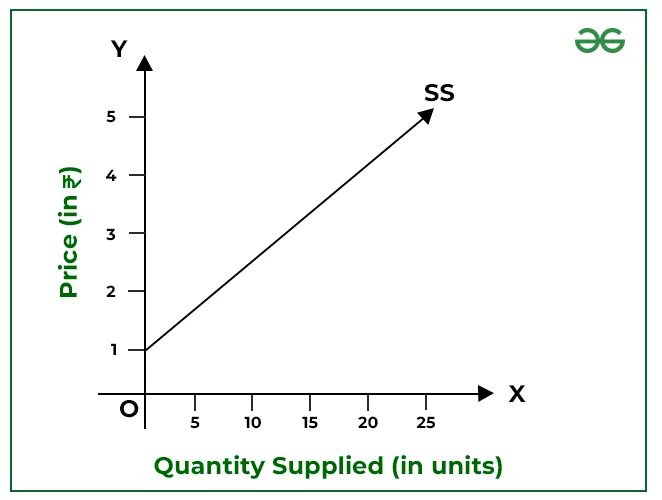

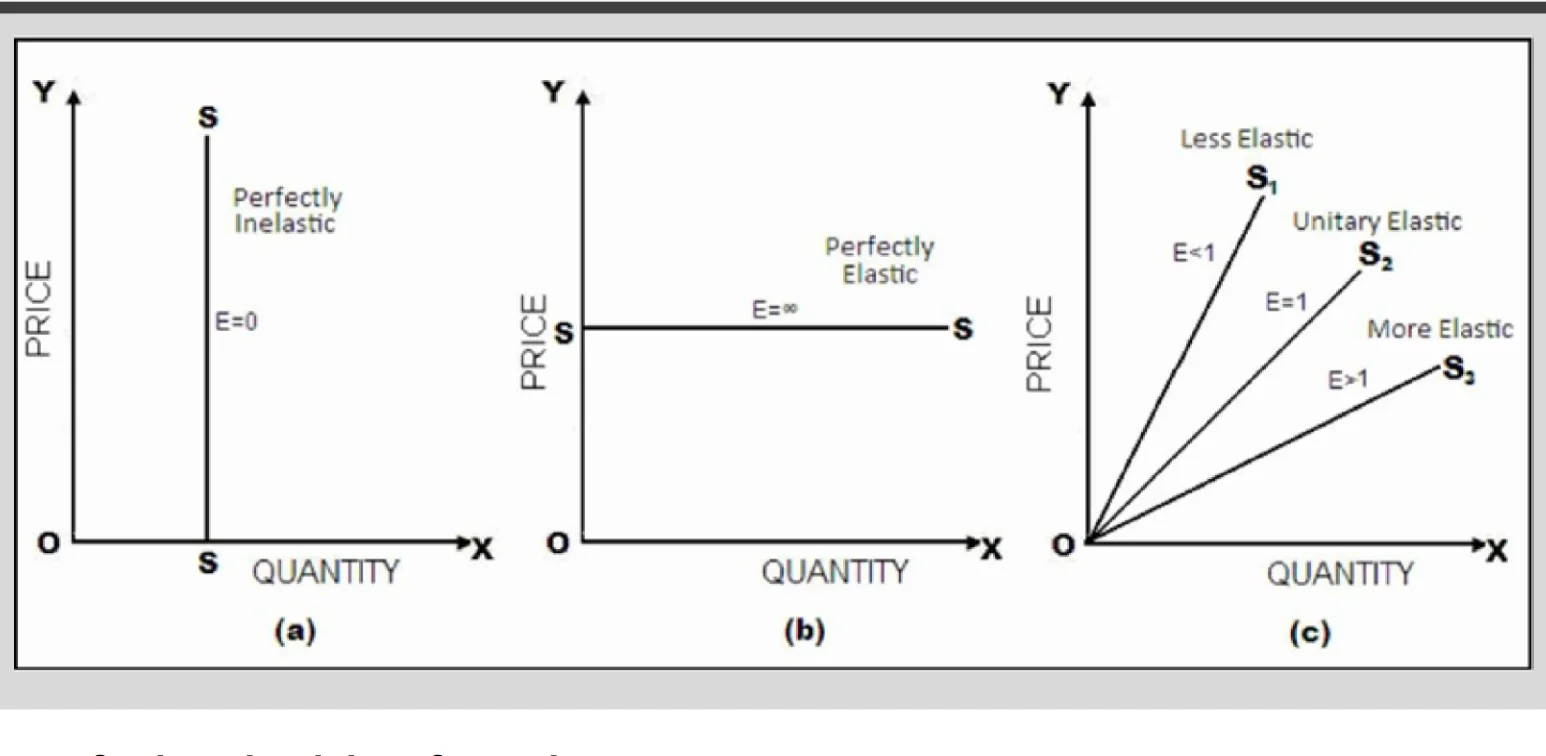

Elasticity of Supply

In addition to price elasticity, there are other relevant concepts:

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Some Basic Terms and Concepts

| Related Articles | |

| Indian Economy: Evolution | Basics of Money |

| Banks in India | Financial Market |

| Indian Insurance Sector | Financial Inclusion |

<div class="new-fform">

</div>

Latest Comments