![]() April 8, 2024

April 8, 2024

![]() 8980

8980

![]() 0

0

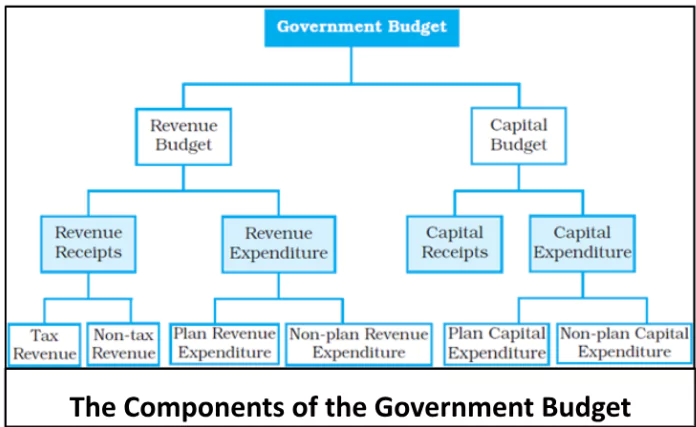

The budget is bifurcated into two main accounts:

The government increases the welfare of the people by intervening in the economy in the following ways.

A. Allocation Function

Classification of Goods: Goods are categorized into Public Goods and Private Goods based on their nature and the extent to which individuals can be excluded from their consumption.

Classification of Goods: Goods are categorized into Public Goods and Private Goods based on their nature and the extent to which individuals can be excluded from their consumption.Other than “estimated receipts and expenditure of the Government” the Budget also contains the following pieces of information:

|

B. Redistribution Function

Revenue Receipts

Tax Revenues

Non-Tax Revenues

Capital Receipts

It comprises expenses necessary for the normal functioning of government departments and services, interest payments on government debt, and grants distributed to state governments and other parties.

It comprises expenses necessary for the normal functioning of government departments and services, interest payments on government debt, and grants distributed to state governments and other parties.Classification of Revenue Expenditure

It is classified into plan and Non-Plan Expenditure as per budget documents:

| Feature | Revenue Budget | Capital Budget(UPSC 2016) |

| Focus | Day-to-day expenses and receipts | Long-term investments and asset creation |

| Income | Taxes, fees, fines, etc. | Borrowing, surplus, specific levies |

| Expenditure | Salaries, administration, subsidies, social programs | Infrastructure, capital projects |

| Objective | Fiscal stability | Economic growth |

| Impact | Short-term economic activity | Long-term economic development |

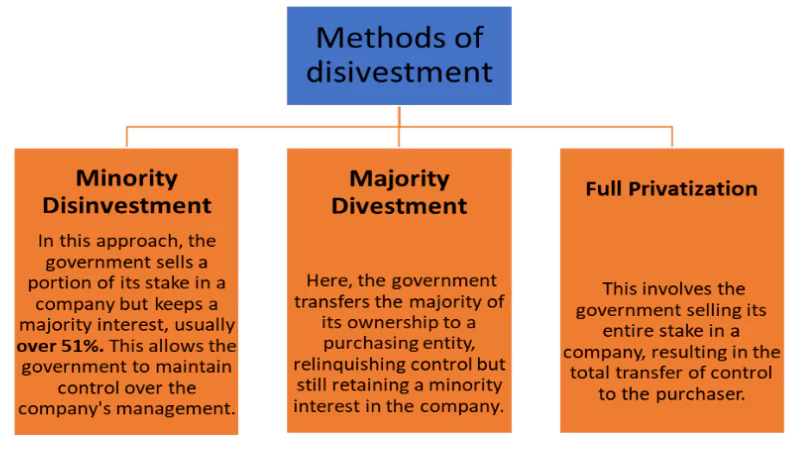

The disinvestment process involves the sale of government stake in public sector enterprises to strategic or financial buyers, either through the sale of shares on stock exchanges or through the sale of shares directly to buyers.

Procedure of disinvestment

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

| Related Articles | |

| Indian Economy: Evolution | Basics of Money |

| Banks in India | Financial Market |

| Indian Insurance Sector | Financial Inclusion |

<div class="new-fform">

</div>

Latest Comments