![]() March 27, 2024

March 27, 2024

![]() 10320

10320

![]() 0

0

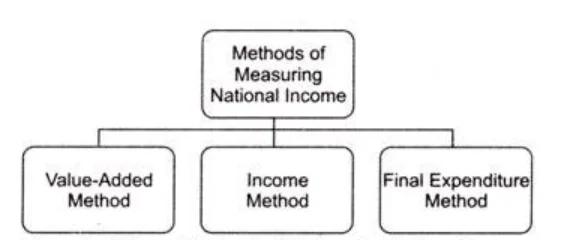

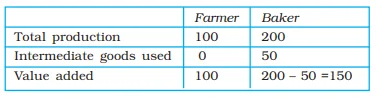

Calculating national income is essential for understanding the overall economic performance of a country. Various methods are employed to measure national income, each offering insights into different aspects of economic activity. These methods typically include the income approach, expenditure approach, and product approach.

Each method provides valuable perspectives on economic output, consumption, and production, contributing to a comprehensive understanding of a nation’s economic health and performance.

Expenditure Method: Calculating GDP from Demand-Side Perspective

Income Method: Determining GDP through Factor Incomes Distribution

Harmonizing GDP Calculation Methods and Managing Discrepancies

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

| Related Articles | |

| Indian Economy: Evolution | Basics of Money |

| Banks in India | Financial Market |

| Indian Insurance Sector | Financial Inclusion |

<div class="new-fform">

</div>

Latest Comments