Introduction

A budget deficit occurs when government expenses exceed revenue. It can be used as an indicator of the financial health of a country. It is a term more commonly used to refer to government spending and receipts rather than businesses or individuals.

When a budget deficit occurs, it means that the current expenses surpass the income generated from regular operations. To correct its nation’s budget deficit, often referred to as a fiscal deficit, a government may cut back on certain expenditures or increase revenue-generating activities.

Different Types of Deficit

Here are the different types of deficits and the methods to calculate them.

A. Revenue Deficit

- This deficit is seen when the actual amount of revenue or expenditure does not correspond with the budgeted revenue or expenditure.

- Revenue Deficit= Revenue Expenditure − Revenue Receipts

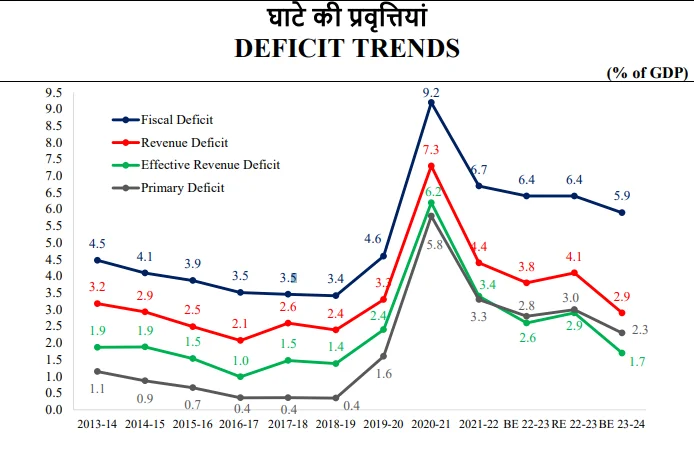

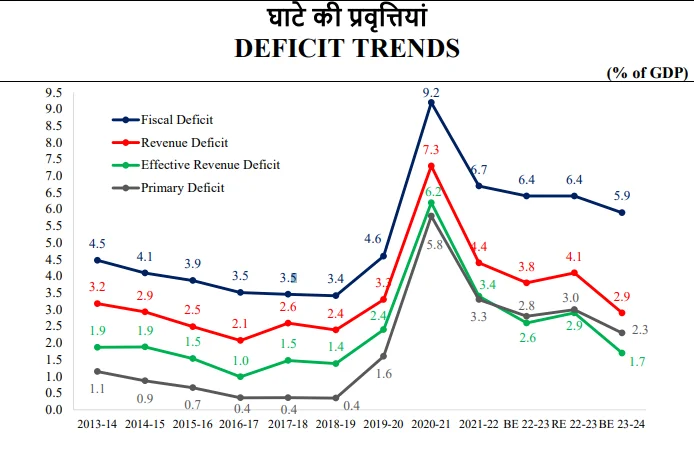

- In 2022-23, the revenue deficit was reported to be 4.1% of GDP.

- Revenue Surplus: When the net income is more than the net expenditure this scenario is known as Revenue surplus.

- Scope: It only accounts for transactions affecting the current income and expenditure of the government.

- Government Borrowing: A revenue deficit indicates government dis-saving, utilising savings from other economic sectors to finance part of its consumption expenditure, thereby necessitating government debt for both investment and consumption requirements.

- Such borrowing is considered regressive as it is for consumption and not for creating assets.

B. Fiscal Deficit (UPSC 2017)

- Gross Fiscal Deficit = Total Expenditure − Revenue Receipts+Non-debt creating capital receipts.

- Non-debt-creating Capital Receipts: Include recoveries of loans and proceeds from the sale of PSUs, which do not give rise to debt.

- In 2022-23 fiscal deficit amounting to 6.4% of GDP, indicates the total borrowing requirements from all sources:

- Financing the Fiscal Deficit: The fiscal deficit will have to be financed through borrowing, it indicates the total borrowing requirements of the government from all sources

- Gross Fiscal Deficit (From the financing side) = Net borrowing at home + Borrowing from RBI + Borrowing from abroad.

- Net Borrowing at Home: includes directly borrowing from the public through debt instruments and indirectly from commercial banks through SLR.

- Significance of Fiscal Deficit:

- It is a crucial indicator of the financial health of the public sector and economic stability.

- A significant share of revenue deficit in fiscal deficit implies a large portion of borrowing is used for consumption expenditure rather than investment.

C. Primary Deficit

- Gross Primary Deficit= Gross Fiscal Deficit – Net interest liabilities.

- Net Interest Liabilities: These include interest payments minus interest receipts by the government on net domestic lending.

D. Effective Revenue Deficit

- Effective revenue deficit excludes certain revenue expenditures that are considered productive or developmental.

- The idea is to distinguish between regular revenue expenditures and those that contribute to capital formation or asset creation.

|

Effective Revenue Deficit = Revenue Deficit − Net Grants for Capital Creation

|

Significance of Deficit Measures – Implications and Consequences

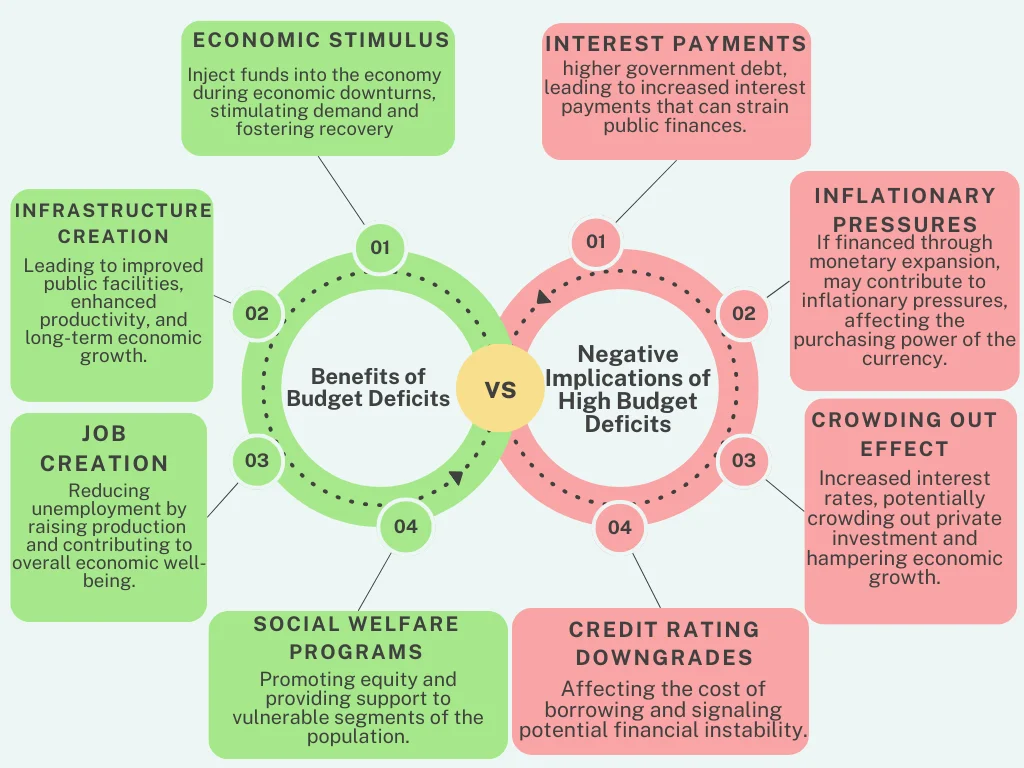

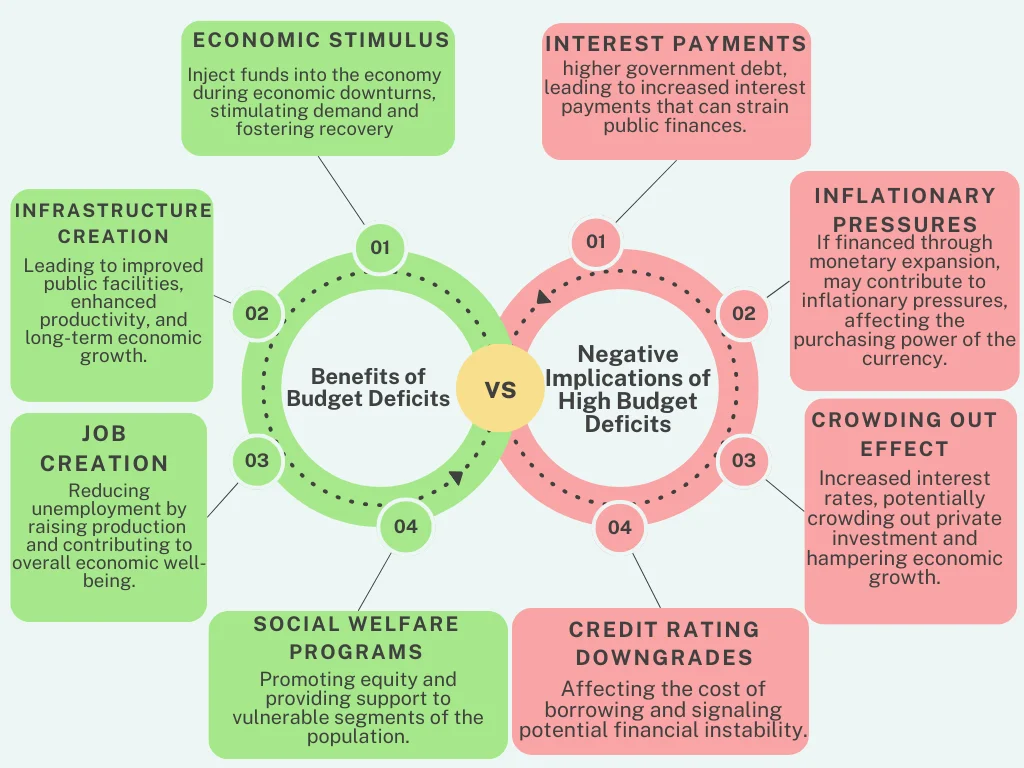

- Importance of Deficit Measures: These deficit measures are crucial for evaluating the government’s fiscal discipline, borrowing requirements, and the economic impact on stability and growth.

- Persistent Deficits: Especially revenue deficits, may lead to unsustainable borrowing, accumulation of debt, and eventual expenditure cuts, which could adversely affect growth and welfare. (UPSC 2016)

Monetization of Deficit and Deficit Financing (UPSC 2022)

| Particular |

Monetization of Deficit |

Deficit Financing |

| Definition |

- The process of financing a budget deficit by directly creating new money, often involving the central bank purchasing government securities.

|

- The broader concept of funding a budget deficit, which can be achieved through various means, including borrowing, issuing securities, or creating new money.

|

| Primary Actor |

|

- Government (Treasury/Finance Ministry)

|

| Mechanisms |

- Open Market Operations (purchase of government securities).

- Direct lending to the government by creating new money.

|

- Borrowing through issuing bonds, Issuing securities such as

- Treasury bills, and Creating new money (printing money) in extreme cases.

|

| Source of Funds |

- Newly created money by the central bank.

|

- Borrowed funds from the public, financial institutions, or other governments.

|

| Inflationary Impact |

- Can lead to inflation due to the increase in the money supply without a corresponding increase in goods and services.

|

- Inflationary impact is possible, particularly if deficit financing involves creating new money.

- However, it may not be as direct or immediate as in monetization.

|

| Market Mechanism Distortion |

- Direct involvement of the central bank in purchasing government securities may distort market mechanisms.

|

- Relies on market mechanisms like bond markets and can lead to more conventional market interactions.

|

| Interest Rates Impact |

- Can influence short-term interest rates as a result of open market operations.

|

- Impact on interest rates is more indirect and depends on various factors, including market demand for government securities.

|

| Exchange Rate Impact |

- May contribute to the depreciation of the currency due to inflation concerns.

|

- Impact on exchange rates is generally influenced by market perception, inflation, and overall economic conditions.

|

| Debt Accumulation |

- May contribute to the accumulation of national debt over time.

|

- Results in the accumulation of debt when funds are borrowed, but the direct creation of new money is not the primary cause.

|

| Long-Term Consequences |

- Can lead to a cycle of debt dependency and potential challenges in controlling inflation.

|

- While accumulating debt is a concern, the focus is on managing debt through sustainable fiscal policies.

|

| Examples in History |

- Instances of hyperinflation, such as in some developing countries during economic crises.

|

- Common practice in various economies, especially during economic downturns or periods of significant public spending.

|

Conclusion

- Various types of deficits, such as fiscal and revenue deficits, highlight the imbalance between government expenditures and revenues.

- Financing these deficits through borrowing underscores the importance of prudent fiscal management to avoid unsustainable debt accumulation, which could hamper economic growth and welfare in the long term.