Context:

| Relevancy for Prelims: RBI, Banking Sector of India, Banking sector reforms in India, NPA in India, and NBFCs.

Relevancy for Mains: Indian Economy and Banking sector reforms in India, and associated reforms taken, challenges and needed measures. |

Enroll now for UPSC Online Course

Banking sector reform in India: A Positive Development

- Innovation: India’s governance structures and policy measures, which have fostered innovation and positioned India as a hub of novel public goods.

Enroll now for UPSC Online Classes

What are the recent banking sector reforms in India?

- Consolidation in the public sector banking space.

- Emergence of private banks, specialized non-banking financial companies (NBFCs) and the emerging fintech ecosystem.

- Overcoming of non-performing assets (NPAs) issued by banks.

- Internal accruals have become a source of growth capital.

- Healthy projections of loan growth in the coming years due to decreasing capital costs.

- Departure from the “bricks-and-mortar” model to cutting-edge technology adoption.

- Adoption of Technology;

- Universal coverage of banking through Jan Dhan.

- To deliver financial services through digital channels, widespread use of technology is observed.

- Various examples like mobile banking applications, retail electronic fund transfers, UPI, Aadhaar e-KYC, Bharat Bill Payment System, scan and pay and digital pre-paid instruments.

- The emergence of public finance platforms.

- The Role of Artificial Intelligence (AI) in banking sector reforms in India: Banks are currently moving towards a knowledge-based regime, enabled by AI and cognitive computing.

- AI-enabled capabilities can help banks to personalize customer engagement and increase their ability to develop a deeper understanding of customers.

Also read: Asset Reconstruction Company (ARC) in India

Enroll now for UPSC Online Coaching

What are the challenges in the banking sector reforms in India?

- Emerging Lacunae: The rapid technological advancements and structural shifts in the banking sector reforms in India have created “regulatory blind spots” and vulnerabilities leading to various lacunae-like unregulated digital lending apps to crypto-currencies and cyber-attacks.

- Bearing Additional Responsibility: To guarantee the availability of essential support infrastructure for a secure payment settlement system, ATMs, internet/mobile banking, managing, cybersecurity risks, and addressing customer complaints.

- Climate Change: Banks will also need to account for a novel risk associated with climate change, which is challenging due to the absence of a clear methodology and adequate data.

- Quality of Human Resources: With a dynamic and rapidly changing environment, the skill gap is widening.

Enroll now for UPSC Online Course

How can we improve banking sector reforms in India?

- Need for Efficient Management: The era of digital banking brings with it increased obligations concerning the efficient management of customer complaints.

- Swift Issue Resolution: As part of the banking sector reforms in India, Banks need to put in place systems to swiftly address and resolve customer issues to guarantee the seamless provision of banking services.

- Adoption of Security Measures: These digitalization-related challenges require banks to adopt robust security measures and regulatory frameworks to protect both customers and the financial system.

- Need robust Risk Management Practices: Initiatives for decarbonization present opportunities in renewables, green hydrogen, and green goods trade and banks are expected to be major financiers in combating climate change, necessitating robust risk management practices.

- Upgradation of Human Resources: Banks and financial institutions must attract, train, and retain talent while fostering adaptability and upskilling.

- More Research & Innovation: Financial institutions should allocate resources to research and welcome innovative approaches to achieve smooth service delivery and tailor products to individual preferences.

- Need for Good Governance: Governance continues to serve as the foundation of organizations and is vital for maintaining financial stability.

Enroll now for UPSC Online Classes

Conclusion

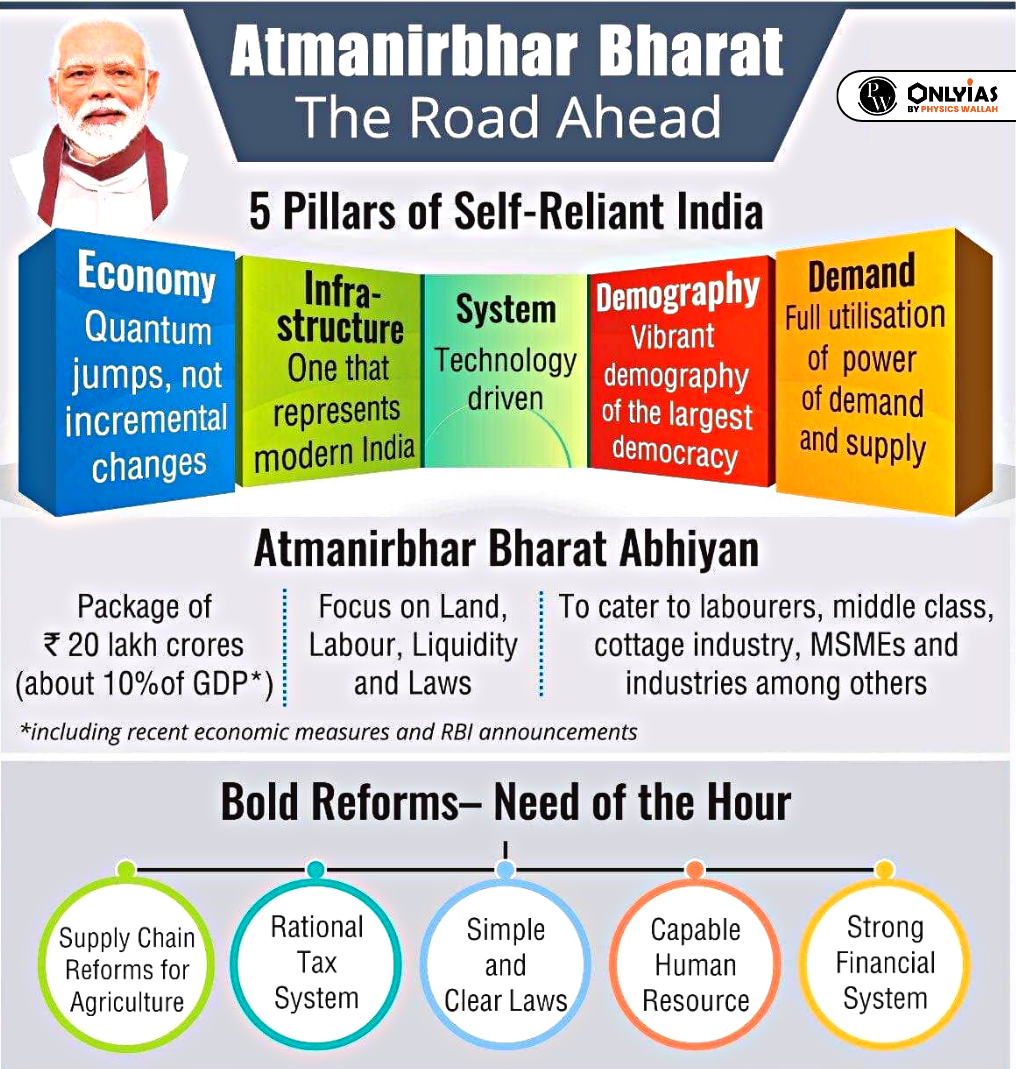

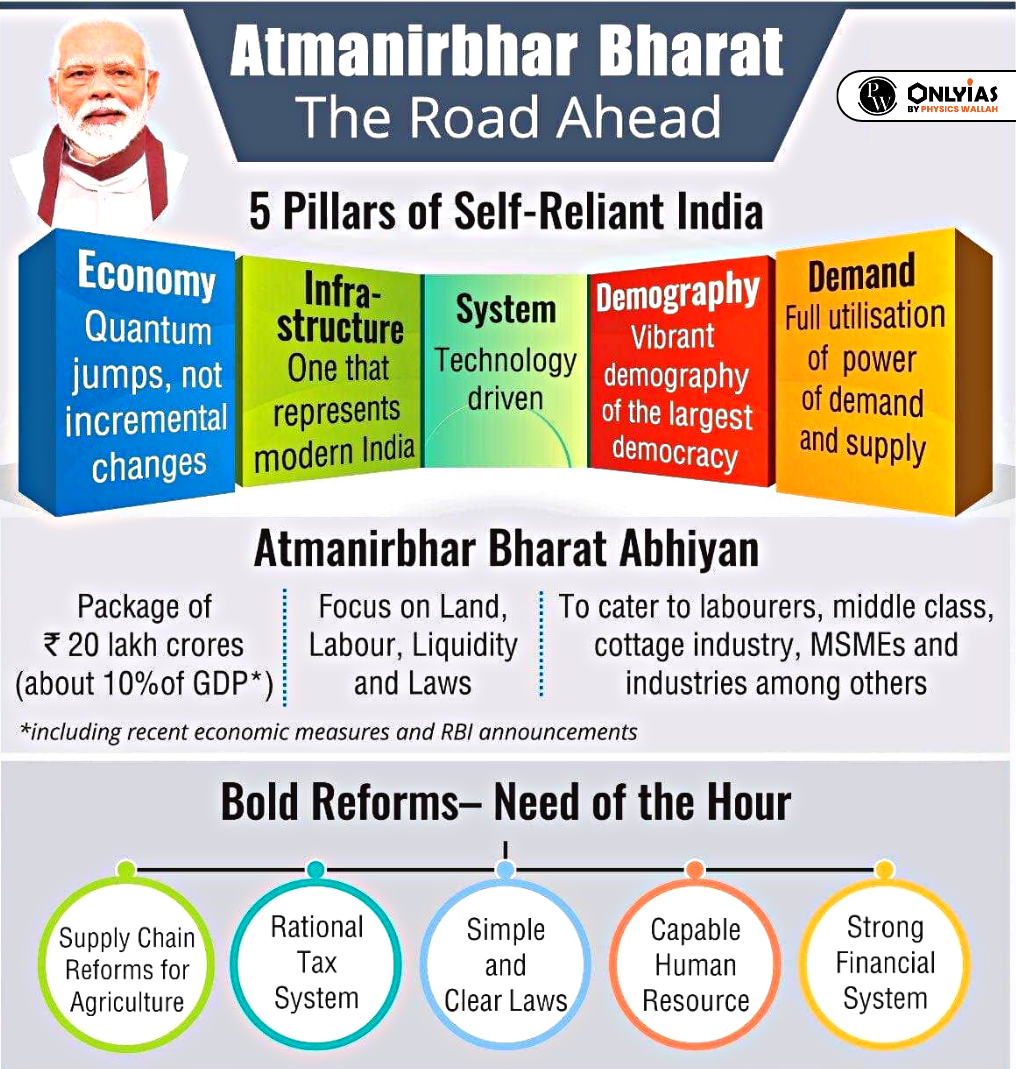

The recent banking sector reforms in India, marked by technological innovation, consolidation, and a shift toward digitalization, are pivotal for steering the nation towards an Atmanirbhar Bharat. However, addressing emerging challenges such as regulatory blind spots, cybersecurity risks, and skill gaps is imperative to ensure the resilience and sustained growth of the reformed banking landscape.

| Attempt the PY Prelims Question

Consider the following statements:

- In India, credit rating agencies are regulated by Reserve Bank of India.

- The rating agency popularly known as ICRA is a public limited company.

- Brickwork Ratings is an Indian credit rating agency.

Which of the statements given above are correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Ans: B |

Enroll now for UPSC Online Coaching

![]() 7 Oct 2023

7 Oct 2023