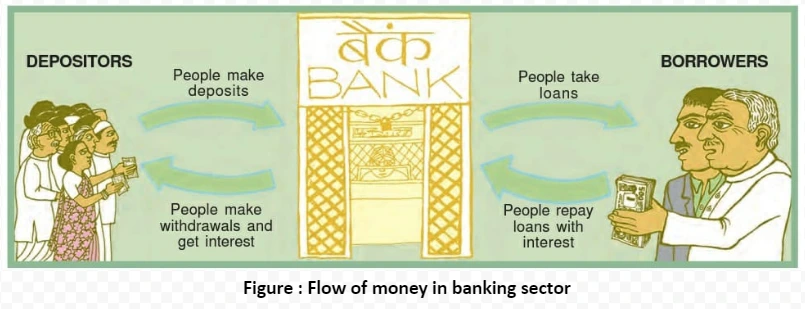

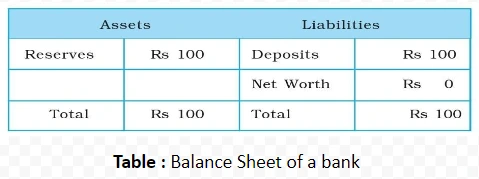

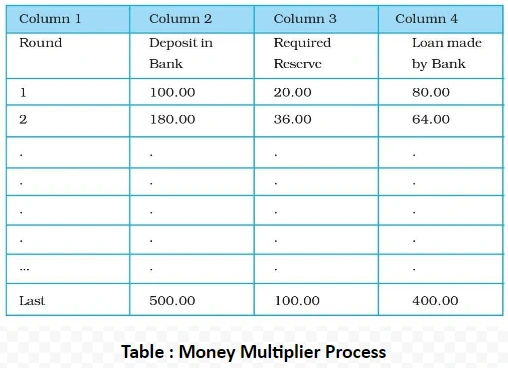

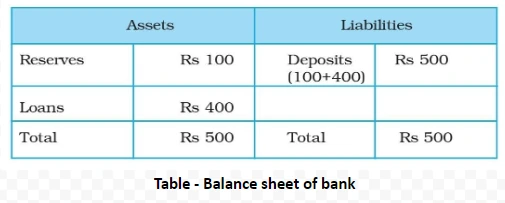

The Major function of the bank is accepting deposits from depositors and giving loans or credit to borrowers. Banks are able to perform these functions effectively with their ability to create money in the banking system.

Currency is generated by the RBI through the process of printing and backing it with the assurance of its value. This implies that the RBI has the capacity to produce any necessary amount of money. Have you considered the factors that discourage countries from simply printing money to fulfill their requirements, and what potential repercussions might arise from such a practice?

M1 = Currency + Deposits = 0 +100 =100

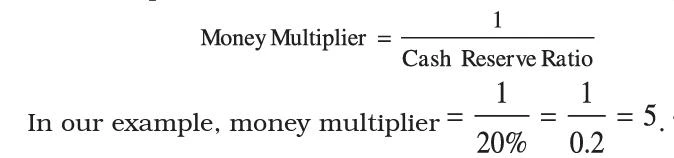

Cash Reserve Ratio (CRR) = Percentage of deposits which a bank must keep as cash reserves with the bank.

The Real interest rate is the difference between nominal interest rate and inflation. So the interest that we receive on our deposits is also influenced by inflation.

These terms play a pivotal role in shaping the credit landscape within the banking system.

<div class="new-fform">

</div>