![]() April 5, 2024

April 5, 2024

![]() 9591

9591

![]() 1

1

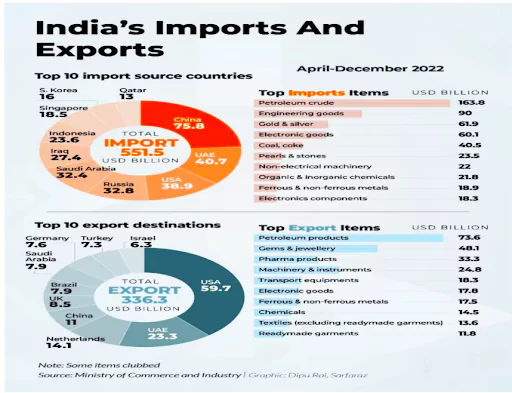

Balance of Payment is a systematic record of all economic transactions between the residents of one country with the residents of the other country in a financial year. It consists of balance of trade, balance of current account and capital account.

|

Actions which the government can take to reduce the current account deficit [UPSC 2011]

|

|

RoDTEP

|

External Commercial borrowings

|

|

Government Initiatives to promote trade

|

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

<div class="new-fform">

</div>

Thankyou for sharing this blog. This is very informative for me. If any one looking for trade current account then content to Myforexeye.