The Indian National Centre for Ocean Information Services (INCOIS) has issued a warning to the coastal states about the “complete suspension of operational and recreational activities.

These waves are formed by an ocean swell, hence the name swell waves/swell surge. A swell wave is the formation of long wavelength waves on the surface of the seas. They propagate along the interface between water and air. Thus, they are often referred to as surface gravity waves.

Earlier Instances of Swell Waves in India: The swell waves in March were generated after a low atmospheric pressure system moved over the region from the South Atlantic Ocean.

Indian National Centre for Ocean Information Services (INCOIS):

Swell Surge Forecast System: To forecast swell waves, INCOIS launched it in 2020 which can give forewarning seven days in advance. |

|---|

Unlike swell waves, a tsunami is a series of enormous waves created by an underwater disturbance usually associated with earthquakes occurring below or near the ocean.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The Reserve Bank of India (RBI) revised the guidelines for custodian banks to issue Irrevocable Payment Commitments (IPCs) in light of the T+1 settlement regime for stocks.

| Custodian Bank: It is a financial institution that holds customers’ securities for safekeeping to prevent them from being stolen or lost. The custodian may hold stocks, bonds, or other assets in electronic or physical form on behalf of its customers.

Irrevocable Payment Commitments (IPCs): IPC are defined as an obligation on the part of credit institutions to pay their contributions in the future through a contract signed between the financial arrangement and an institution that opts for the IPC. |

|---|

It refers to the transfer of securities and funds between buyers and sellers after a trade is executed. A trade settlement is said to be complete once purchased securities of a listed company are delivered to the buyer, and the seller gets the money.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Foreign portfolio investors (FPIs) domiciled at the GIFT International Financial Services Centre (IFSC) and registered with the Securities and Exchange Board of India (SEBI) have been allowed to issue participatory notes (P notes).

International Financial Services Centres Authority (IFSCA)It is a statutory authority established under the International Financial Services Centres Authority Act, 2019.

GIFT (Gujarat International Finance Tec-City) City:

|

|---|

This can broadly be classified into two categories: Foreign direct investment (FDI) and investment made by foreign institutional investors (FIIs).

FPI involves an investor buying foreign financial assets. It involves financial assets like fixed deposits, stocks, and mutual funds. All the investments are passively held by the investors.

Participatory notes/p-notes are used for making investments in the stock markets. However, they are not used within the country. They are used outside India for making investments in shares listed in the Indian stock market. Thus, they are called offshore derivative instruments.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

On the occasion of the artist’s 176th birth anniversary, the first authentic copy of Raja Ravi Varma’s painting “Indulekha” will be revealed at Kilimanoor Palace in Kerala.

Raja Ravi Varma was an Indian painter.

Some of Ravi Varma’s most renowned paintings are:

Some of Ravi Varma’s most renowned paintings are:

He received two gold medals for his contributions.

He received two gold medals for his contributions.

It is a 19th-century painting. The famous painting ‘Reclining Lady’ was made by Ravi Varma.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

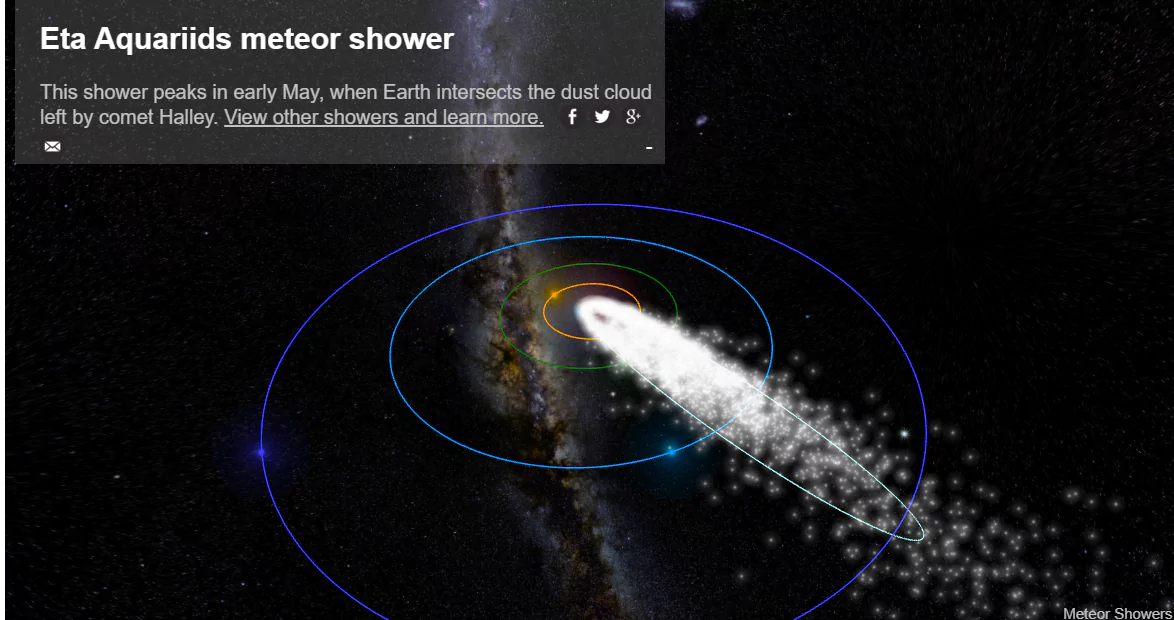

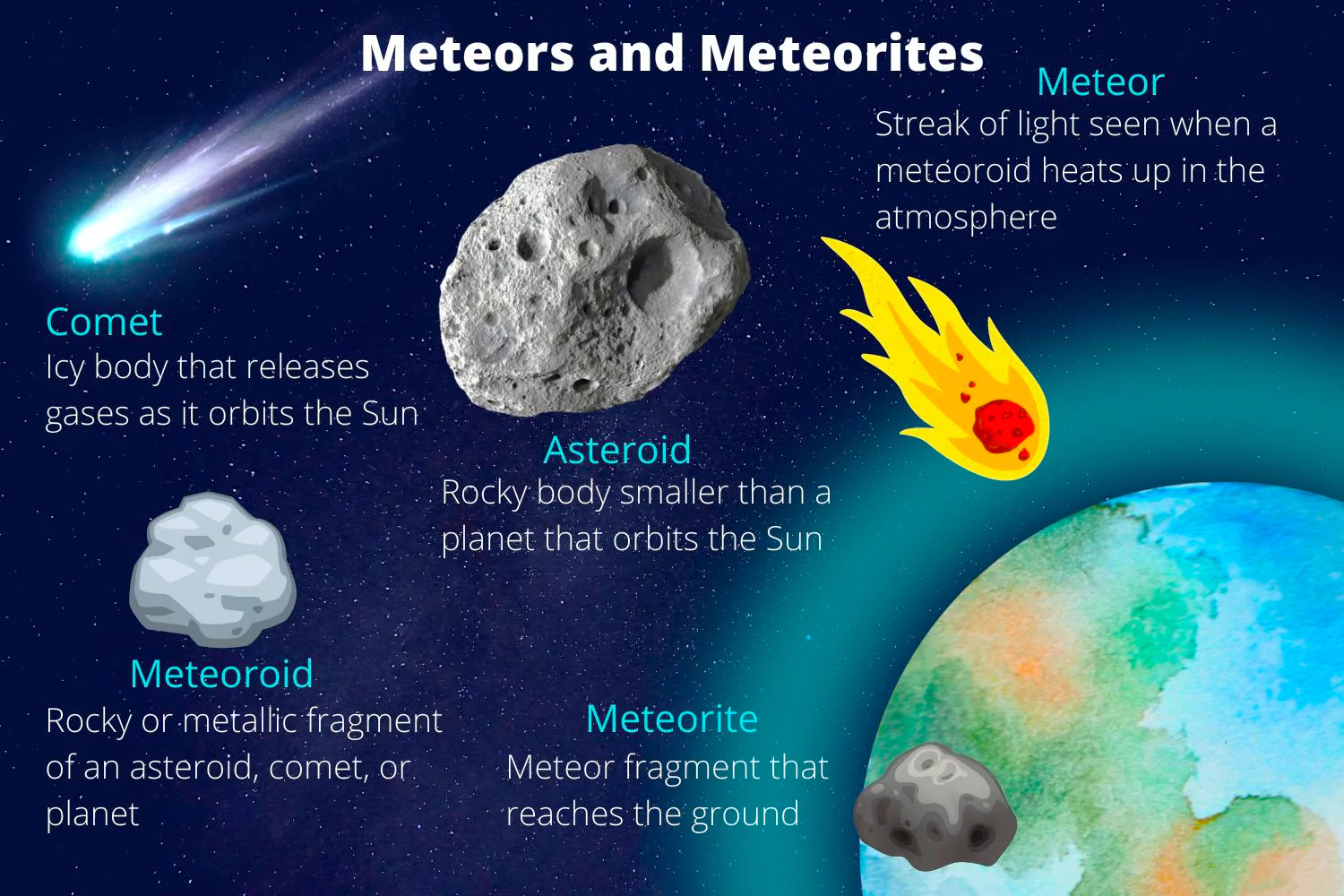

The Eta Aquariid meteor shower which has been active since April 15 is about to reach its peak on May 5 and 6.

The Eta Aquarid meteor shower is one of two annual showers. It is formed when Earth passes through the orbital path of Halley’s Comet.

Comets are icy leftovers from when our solar system formed about 4.6 billion years ago.

The released material from comets forms tails that can stretch millions of miles away from the comet.

The released material from comets forms tails that can stretch millions of miles away from the comet.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

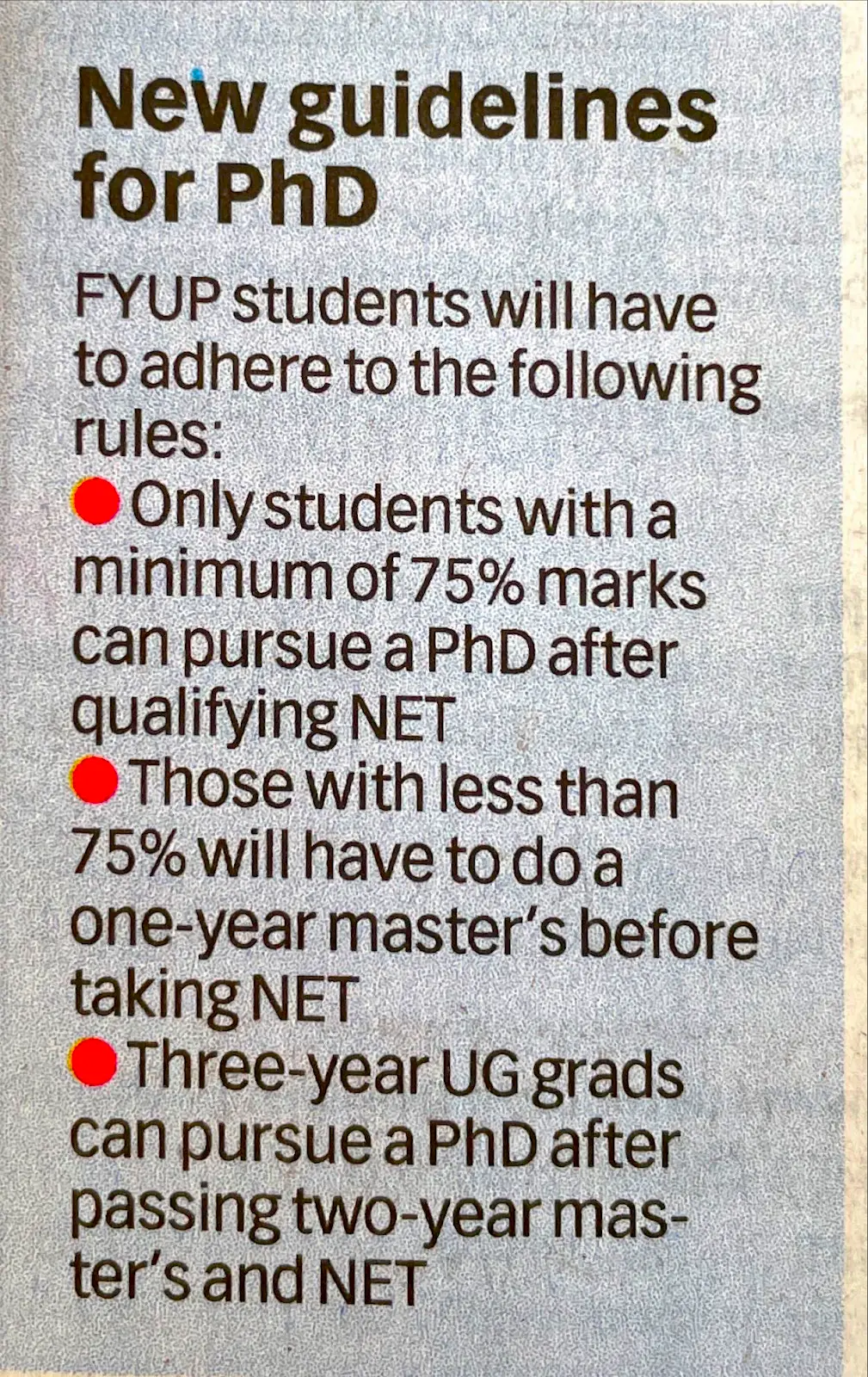

Recently, The University Grants Commission (UGC) released new guidelines for PhD admissions following expert committee recommendations.

These new PhD guidelines, applicable from the academic session 2024–25,

First would be those who are eligible for

First would be those who are eligible for

Unleashing the Full Potential of Graduates into the Mainstream

While UGC’s new PhD guidelines aim to democratize access to higher education, concerns persist regarding the potential impact on the elite status of universities and the maintenance of research standards. Therefore, Balancing inclusivity with rigor and ensuring adequate mentorship is crucial for fostering a vibrant and equitable research ecosystem.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The Madras High Court criticized the students securing admission to postgraduate medical courses in government colleges by signing bonds to serve in public hospitals for two years after their studies.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

According to Reporters Without Borders (RSF for Reporters sans Frontières), India’s position in the World Press Freedom Index declined from 36.62 to 31.28.

The World Press Freedom Index is compiled by RSF annually assessing the ability of journalists to work and report freely and independently.

Reporters Without Borders (RWB)It is an international non-profit organization governed by principles of democratic governance. It defends the right of every human being to have access to free and reliable information. Headquarter: Paris Press Freedom:It is the ability of journalists to select, produce, and disseminate news in the public interest independent of political, economic, legal, and social interference and in the absence of threats to their physical and mental safety. |

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

2024 is an election year across the world and newly elected governments need to focus on the all-important sustainability issue.

Difference of Sustainable Development Goals (SDGs) from Millennium Development Goals (MDGs):

|

|---|

About Sustainable DevelopmentThese are the developments that meet the needs of the present without compromising the ability of future generations to meet their own needs.

Role of NITI Aayog in Achieving Sustainable Development Goals:

Brundtland Report:

|

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently, the Supreme Court has constituted a nine-judge Bench to interpret the Directive Principles of State Policy (DPSP) with respect to ownership and control of material resources.

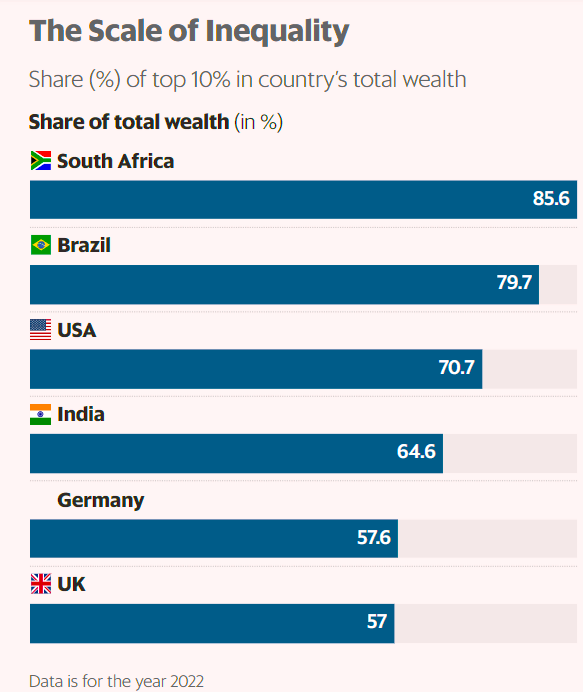

The debate surrounding the redistribution of wealth has gained prominence during the ongoing election campaign.

About the Maharashtra Housing and Area Development Act, 1976 (MHADA)Maharashtra Housing and Area Development Act, 1976 (MHADA) was enacted in 1976.

Challenge to the Provisions:

Appeal to the Supreme Court:

|

|---|

Redistribution of Wealth is the transfer of wealth from one individual to another through a social mechanism such as taxation, charity, or public services.

The Inheritance Tax:

|

|---|

|

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>