Context:

Recently Niti Aayog released a report titled “Towards Decarbonising Transport – Taking Stock of G20 Sectoral Ambition”.

Highlight of the Report:

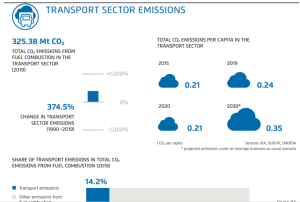

India’s Transport Sector and Carbon Emissions:

India’s NDC Target:

Transport related NDC targets

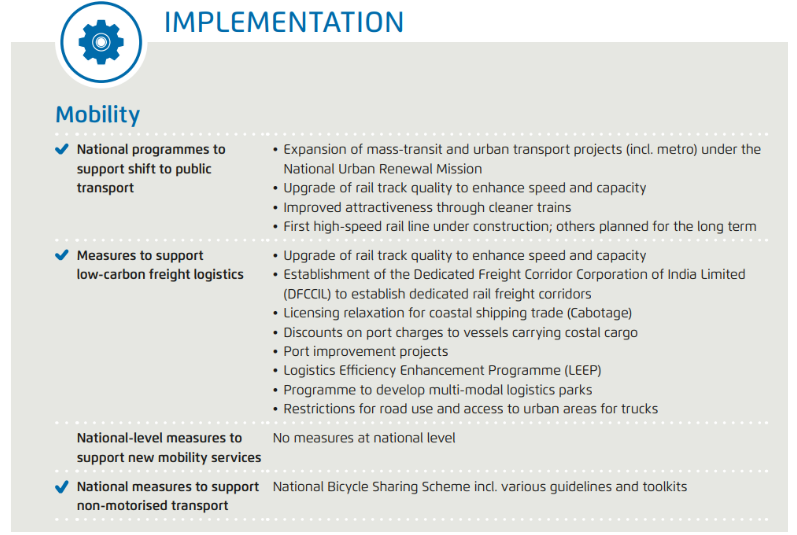

Transport related NDC measures

Future targets at national level

National EV deployment targets

|

Steps Taken to Control Transport Emissions in India:

Report Recommendation:

Power-to-X technologies

|

Just Energy Transition Partnerships

|

News Source: NITI Aayog

Context:

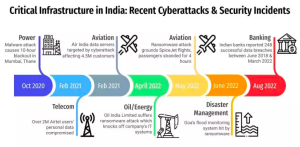

Recently, the Standing Committee on Finance submitted its report on ‘Cyber Security and Rising Incidence of Cyber/White Collar Crimes’.

Key Observation and Recommendation of the Standing Committee on Finance:

| Concern | Recommendation | |

| Regulation of Service Providers | Challenges in control over third-party service providers on cyber security matters, especially with big tech and telecom companies. | Enhance regulatory powers to oversee and control service providers, including big tech and telecom companies. Ensure their compliance with security standards and collaboration with regulatory bodies like the Reserve Bank of India (RBI). |

| Critical Payment Systems | Critical payment systems, essential for customer services, are not currently regulated, leading to disruptions and downtime. | Encourage closer collaboration between critical payment systems and financial institutions. Invest in infrastructure, conduct regular security assessments, and establish incident response mechanisms to ensure improved uptime and stability. |

| Complex Regulatory Landscape | Multiple agencies and bodies in the regulatory landscape result in challenges of coordination and efficient response to cyber threats. | Establish a centralized Cyber Protection Authority (CPA) to streamline regulatory efforts and coordination. This central authority can develop and implement unified cyber security policies, guidelines, and best practices. |

| Challenges faced by smaller financial institutions | Smaller financial institutions, like cooperative banks and NBFCs, face more cyber security incidents due to limited resources and technological capabilities. | Prioritize investments in cyber security infrastructure, advanced threat detection systems, and secure data storage practices. Conduct regular audits and assessments to identify vulnerabilities and bridge the gap in cyber security measures. |

| Inadequate Cyber Security Audits | Significant disparity in conducting cyber security audits, with only 11% of cooperative banks having undertaken such audits. | Ensure that all financial institutions, irrespective of size, conduct regular cyber security audits. Promote the adoption of best practices and encourage smaller entities to invest in cyber security measures. |

| Digital Landscape Vulnerability | The expansion of digital landscapes and the presence of search engines and tech companies increase vulnerability to cybercrime, including data breaches and fraudulent activities | Mandate application stores to share comprehensive metadata and information about hosted applications. Tech companies should maintain updated systems, patch vulnerabilities, and enforce stringent vetting processes for app approvals. |

| Compensation for Frauds | The existing compensation mechanism for cybercrime victims in the financial sector has limited scope, complex processes, and places the burden of proof on victims. | Shift the responsibility of compensating customers in cases of fraud from victims to financial institutions. This would provide more support to victims and encourage institutions to take preventive measures against cybercrime. |

| Inadequate Enforcement | The Information Technology Act, 2000, faces challenges of inadequate enforcement and the bailable nature of most offenses, allowing fraudulent activities to persist. | Strengthen the Information Technology Act by implementing stricter penal provisions, imposing stricter bail conditions, and considering provisions for local surety. |

| Central Negative Registry | The Committee recommended the creation of a Central Negative Registry which would be maintained by the CPA.

The registry should consolidate information on fraudsters’ accounts. The registry should be made available to banks and NBFCs which would proactively deter and prevent the opening of accounts associated with fraudulent activities. |

|

About Cyber Security:

Some of the major areas covered in cybersecurity include:

Need to secure Cyberspace in India:

Initiatives regarding Cyber Security:

Challenges in Securing India’s Cyber Space:

Way Forward for Securing India’s Cyber Space:

News Source: PRS

Context:

The Government has hiked the windfall profit tax on crude oil produced in the country and on export of diesel.

More on News:

Excise Duty:

|

About Windfall Tax:

|

Pros |

Cons |

|

|

|

|

|

|

News Source: The Hindu

Context:

The National Medical Commission (NMC) released its new guidelines- ‘Regulations relating to Professional Conduct of Registered Medical Practitioners”.

About ‘Regulations relating to Professional Conduct of Registered Medical Practitioners”:

About Generic Medicines:

|

News Source: The Indian Express

Context:

The Tamil Nadu government sought the Supreme Court’s intervention to make Karnataka immediately release 24,000 cubic feet per second (cusecs) from its reservoirs.

About Cauvery Water Dispute:

Article 262:

Inter-State River Water Disputes Resolution Mechanism:

News Source: The Hindu

Context:

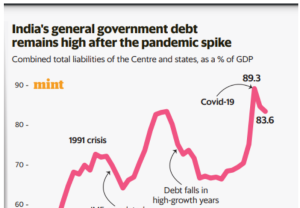

At the start of 2023, experts at the World Economic Forum warned that the global rise in public debt was a ‘fiscal ticking bomb’.

About Public Debt:

General government debt-to-GDP ratio

Reasons for rise in Indebtedness:

Forecast About India’s Public Debt:

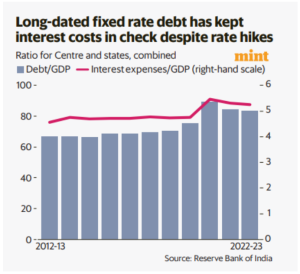

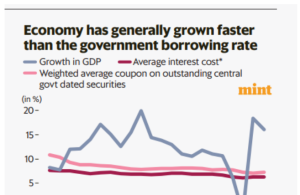

Tenor Matters:

Sustainability Strategy:

|

|

|

|

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>