Context:

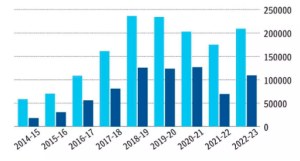

Banks have written off bad loans worth ₹14.56 lakh crore in the last nine financial years starting 2014-15.

More on News

Current Status of Loan Write-off in India:

| Period | Recovery Amount (₹ crore) |

| April 2014 – March 2023 | ₹2,04,668 crore |

| Financial Year | Net Write off In crore |

| FY18 | 1.18 lac |

| FY22 | 0.91 lac |

| FY23 | 0.84 lac |

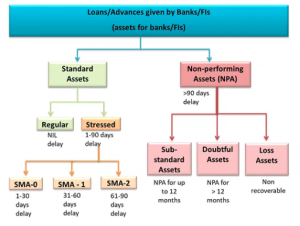

About Bad Loan and NPA:

Substandard Assets: Assets that have remained NPA for a period less than or equal to 12 months.

Substandard Assets: Assets that have remained NPA for a period less than or equal to 12 months.What is a loan write-off?

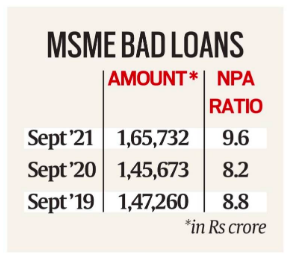

Status of NPA:

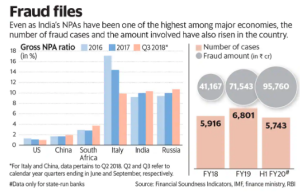

Factors Behind the Surge in NPAs:

Structural Economic Inefficiencies: Project delays, cost overruns, and regulatory processes create inefficiencies that contribute to NPA generation.

Structural Economic Inefficiencies: Project delays, cost overruns, and regulatory processes create inefficiencies that contribute to NPA generation. Manipulation of Restructuring: Before the Insolvency and Bankruptcy Code, promoters had significant influence on restructuring.

Manipulation of Restructuring: Before the Insolvency and Bankruptcy Code, promoters had significant influence on restructuring.

How NPAs affect banks?

Laws and Provisions related to NPAs:

Way Forward:

News Source: The Hindubisinessline

| News | Description |

| National Handloom Day |

Steps to Promote Handloom In India

|

| ASEAN India S&T Development Fund (AISTDF) |

About ASEAN India S&T Development Fund (AISTDF)

|

| Internet Paradox in India |

Advantage India

Paradox in India

|

Context:

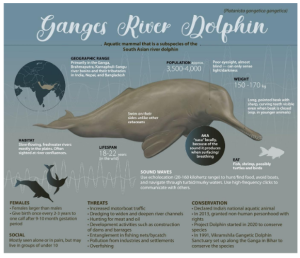

About Gangetic River Dolphin:

They hunt by emitting ultrasonic sounds, which bounces off of fish and other prey, enabling them to “see” an image in their mind.

They hunt by emitting ultrasonic sounds, which bounces off of fish and other prey, enabling them to “see” an image in their mind.Government Efforts for conservation of Gangetic River Dolphin:

Other River Dolphins around World:

News Source: PIB

Context:

About Deepor Beel:

Simang:

Kumbhi Kagaz:

News Source: DTE

Context:

North East Venture Fund (NEVF):

News Source: Financial Express

Context:

More about the news:

Key Highlights from the Research:

Significance: The research contributes to bridging the gap between climate science and real-world financial indicators.

Sovereign Credit Rating:

News Source: DTE

Context:

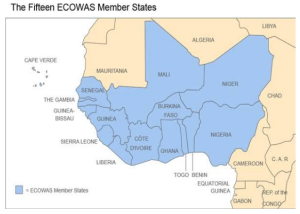

About ECOWAS(Economic Community of West African States):

Sub-regional blocks of ECOWAS:

Significance of ECOWAS:

News Source: DTE

Context:

Recently, the Parliament has passed the Mines and Minerals (Development and Regulation) Amendment Bill, 2023 to amend the Mines and Minerals (Development and Regulation) Act, 1957.

| PYQ:

Q. “In spite of adverse environmental impact, coal mining is still inevitable for development”. Discuss. (2017) |

Key Features of Mines and Minerals (Development and Regulation) Amendment Bill, 2023:

| Provision | Mines and Minerals (Development and Regulation) Act, 1957 | Mines and Minerals (Development and Regulation) Amendment Bill, 2023 |

| Exploration License for Specified Minerals: |

|

|

| Validity of exploration License: | ____ |

|

| Auction of Certain minerals by the Central Government: |

|

|

| Maximum area in which activities are Permitted: |

|

|

| Incentive for exploration licencee: | __ | If the resources are proven after exploration, the state government must conduct an auction for mining lease within six months of the submission of the report by the exploration licencee. The licencee will receive a share in the auction value of the mining lease for the mineral prospected by them. |

Why did the need arise to amend the Mines and Minerals (Development and Regulation) Act, 1957?

Issues with the Bill’s proposals:

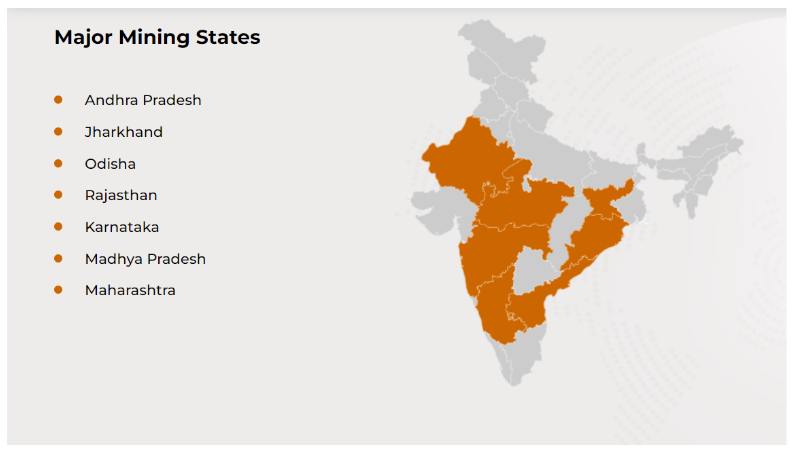

Mining Sector in India:

Image Credits:ibef

Image Credits:ibef

Government Initiatives:

Challenges:

Way Forward:

News Source: The Hindu

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>