Context: Recently, Rajasthan Platform Based Gig Workers (Registration and Welfare) Bill, 2023 was passed by Rajasthan Assembly.

| Probable Question:

Q. What are the challenges that the Gig Economy faces in India, and what steps can be taken to ensure its sustainable growth? |

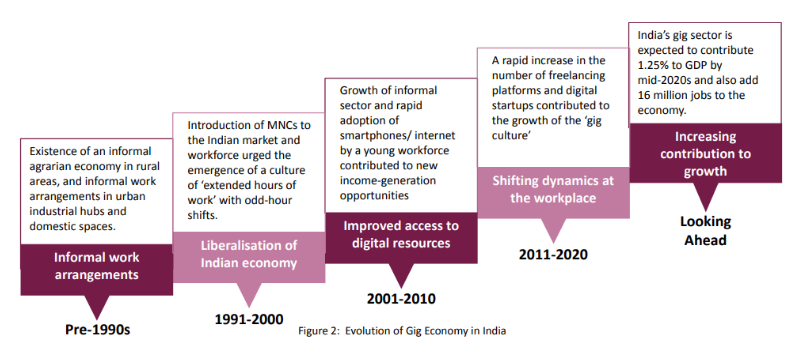

About Gig Economy:

Gig Economy in India:

Need of Gig Economy in India:

Steps taken to Promote Gig Economy in India:

Concern Associated with Gig Economy:

Way Forward:

Conclusion:

News Source: The Hindu

Context:

Recently, the United States handed over 105 trafficked antiquities to India.

| Probable Question:

Q. What are the challenges faced by India in preserving and protecting its antiquities and art treasures, and what measures has the country taken to address these challenges? Additionally, how does India demonstrate its commitment to safeguarding its cultural heritage on an international level? |

More on News:

Image Credits: mysteryofindia.com

Image Credits: mysteryofindia.com

What are Antiquities?

Art Treasure:

What is the ‘Provenance’ of antiquity?

Magnitude of Missing Antiquities:

According to the ASI list, 322 of the 486 antiquities were reported missing since 1976.

Constitutional, Legislative and International Provisions Related to Indian Heritage:

| Union List (Item 67) | State List( Item 12) | Concurrent List (Item 40) |

|

|

|

Salient Features of The Antiquities and Art Treasures Act, 1972 (AATA):

|

Mechanism of Bringing Back Antiquities to India:

There are three categories of antiquities which has been moved out of India:

What do international conventions say?

Challenges in Conservation of antiquities:

Way Forward:

| Additional Information:

About Advanced Antiquities Management System:

National Mission on Monuments and Antiquities (NMMA):

|

News Source: The Indian Express

Context:

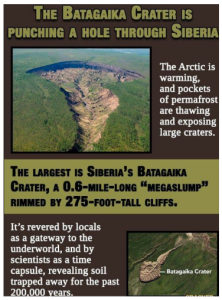

About Batagaika crater:

What is Permafrost?

Impact of permafrost thawing:

News Source: India Today

Context:

What is Countervailing Duty?

Directorate General of Trade Remedies (DGTR):

|

| Additional Information:

Anti-dumping duty:

Safeguard Duty

|

News Source: Live Mint

| Mihir Bhoj |

|

| Mhadei Wildlife Sanctuary |

|

| National Geoscience Awards |

|

| India Climate Energy Dashboard (ICED) 3.0. |

|

Context:

About the CBFC:

What is the film certification process?

News Source: Indian Express

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>