Context:

More about the news:

What are Microfinance institutions (MFIs)?

Regulatory Framework:

History of Microfinance Institutions in India:

|

Groups Organized by Microfinance Institutions in India:

Grameen Model Bank:

|

4. Rural Cooperatives: The resources of poor people are pooled in and financial services are provided from this fund.

How are MFIs Funded:

Significance of MFIs:

Status in India:

Challenges Faced by MFIs in India:

Way Forward:

News Source:Business Standard

| G20 Anti-Corruption Ministerial Meet |

|

| National Apprenticeship Promotion Scheme (NAPS) |

|

| LAUNCH OF Y – 3024 (VINDHYAGIRI) |

|

| SEBI Disgorgement orders |

|

| Aditya-L1 Mission |

|

Context:

India has been engaging in a series of agreements, and it is now in discussions with European nations, including Switzerland, to finalize migration agreements.

About Migration Agreement:

India’s Migration Agreements:

News Source: Livemint

Context:

As per the Ministry of Finance, In the fiscal year 2022-23 (FY23), remittances to India witnessed a substantial growth of 26%, reaching a total of $112.5 billion. In FY22 the remittance was $89.1 billion.

About Remittance:

Remittances vs. FDI:

Top Source of Remittance for India::

News Source: The Financial Express

Context:

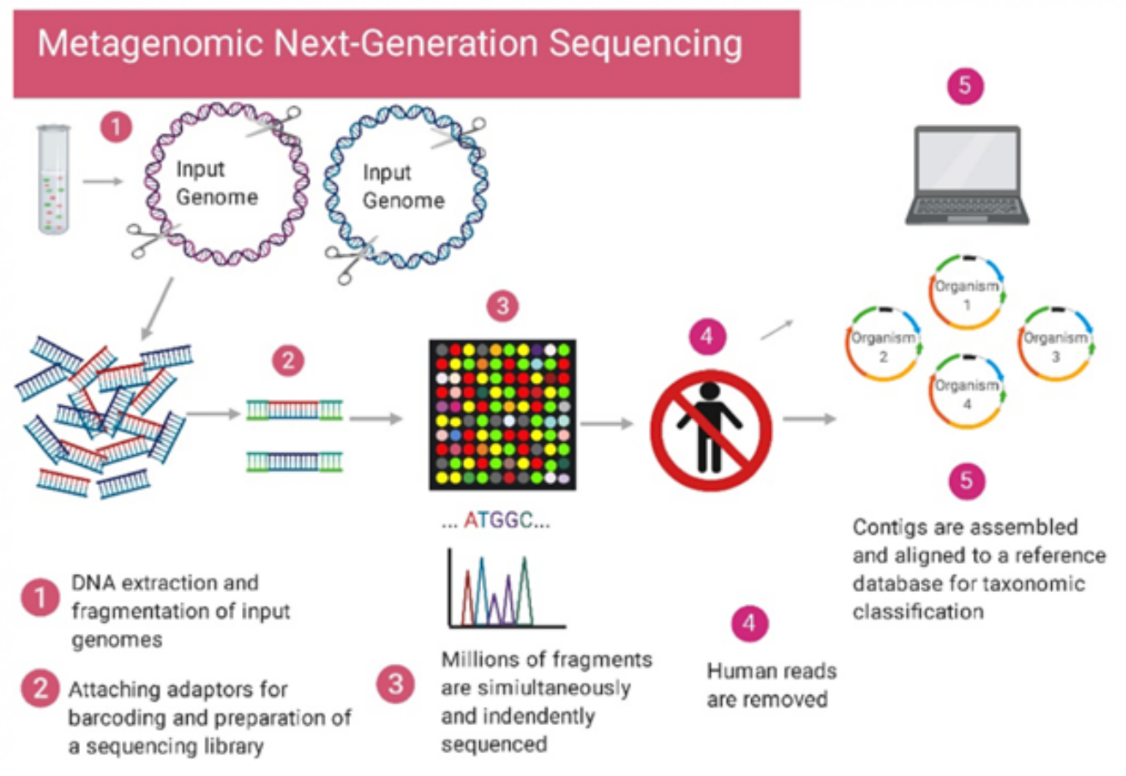

Recently, scientists from the Nigerian Centre for Disease Control applied metagenomic sequencing for pathogen surveillance and detection in three cohorts of patients.

More on News:

| Metagenomic sequencing is a sequencing method whereby billions of nucleic acid fragments can be simultaneously and independently sequenced. |

About Genome:

Genome sequencing:

Impact of COVID-19 on Genomic Surveillance:

Image Source: American Society for Microbiology

Image Source: American Society for Microbiology

Transformative Technologies and Applications:

Advantages and Future Prospects:

News Source: The Hindu

Context:

The Government of India has put restrictions on the import of laptops, PCs, tablets, etc.

About the Placed Restrictions:

News Source: The Indian Express

Context:

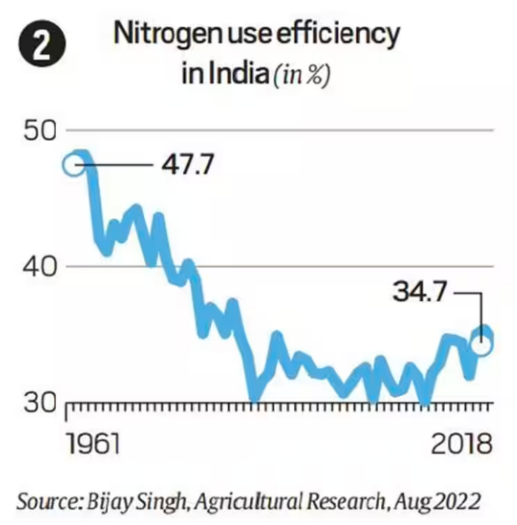

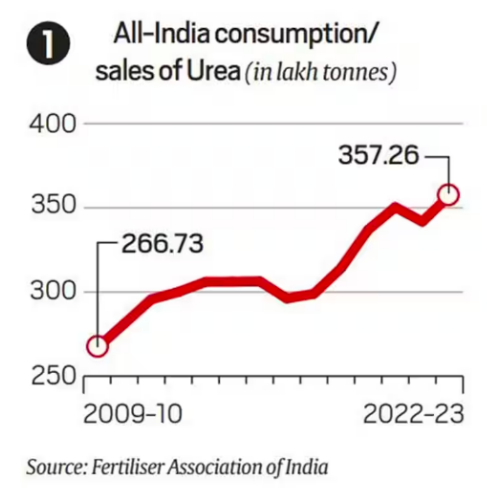

Recently, Prime Minister Narendra officially launched ‘Urea Gold’ fertilizer.

About Urea Gold:

Concerns Over Rising Urea Consumption:

Comparison with China: India’s annual urea consumption of nearly 36 mt ranks second only to China’s 51 mt, which primarily relies on coal-based production.

Comparison with China: India’s annual urea consumption of nearly 36 mt ranks second only to China’s 51 mt, which primarily relies on coal-based production.Way Forward:

News Source: The Indian Express

Context:

Kerala, Tamil Nadu, and West Bengal are three out of 14 states and union territories that have not yet signed a crucial Memorandum of Understanding (MoU) with the Union Education Ministry.

More on News:

About PM-USHA:

MoU Signing and Implementation:

News Source: The Hindu

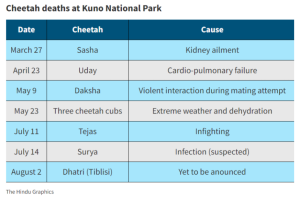

Context: Recently, a female cheetah ‘Dhatri‘, brought under Project Cheetah to India, was found dead in Madhya Pradesh’s Kuno National Park.

More on News

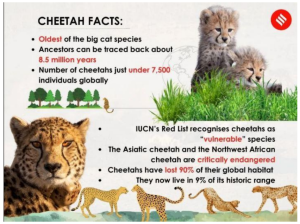

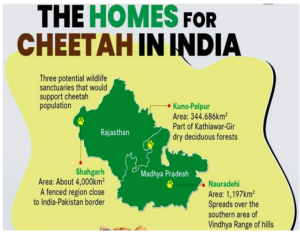

About Project Cheetah

Cheetahs were declared extinct in India in 1952.

Cheetahs were declared extinct in India in 1952.Reason for High Mortality of Cheetah at KNP:

Other Concerns with Cheetah Relocation in india:

Previous Cheetah Relocation Programs

Way Forward

Conclusion

News Source: Indian Express

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>