Context:

More about the news:

Thali meal economics:

|

Impact of tomato and onion:

News Source: Indian Express

Context:

Sovereign Gold Bond (SGB)Scheme:

Sovereign Gold Bond (SGB):

|

Features of the scheme:

News Source: PIB

Context:

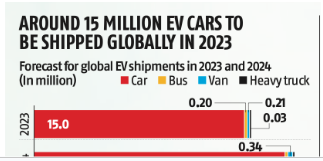

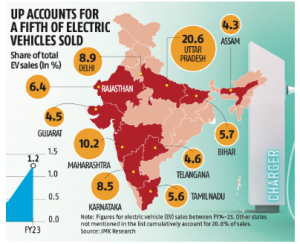

Research forecasts 15.4 million electric vehicles (EVs) to be shipped globally in 2023.

More on News:

In 2022-23 (FY23), EV sales surged by 173.6 percent to 1.25 million, up from 460,000 in the previous year. In 2018-19, EV sales in India were at 150,000.

In 2022-23 (FY23), EV sales surged by 173.6 percent to 1.25 million, up from 460,000 in the previous year. In 2018-19, EV sales in India were at 150,000.News Source: Business Standard

Context:

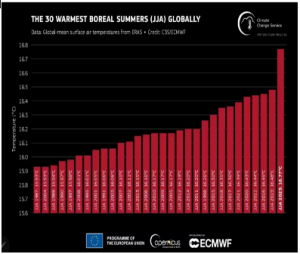

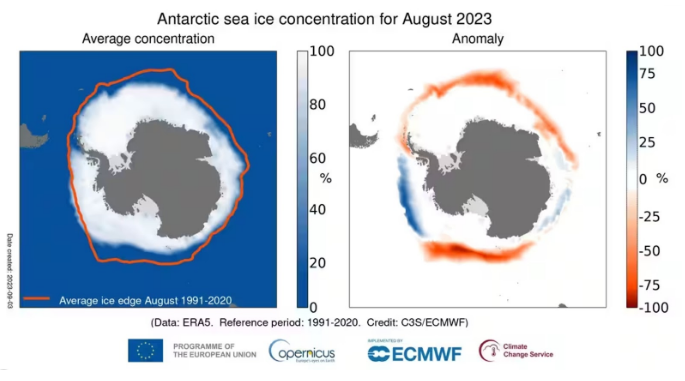

Climate records broken in the summer of 2023:

World Meteorological Organization (WMO):

|

With rising temperatures and the onset of El Nino conditions, 2023 is potentially becoming the warmest year in history.

With rising temperatures and the onset of El Nino conditions, 2023 is potentially becoming the warmest year in history.

News Source: Indian Express

Context:

More about the news:

Why was I-CRR needed?

Cash reserve ratio (CRR):

Incremental Cash Reserve Ratio (I-CRR):

|

News Source: The Hindu

Context:

The International Monetary Fund (IMF) and the Financial Stability Board (FSB), released a policy paper, at the request of the Indian G20 Presidency, which recommended against an outright ban on crypto-assets.

More on News:

Financial Stability Board (FSB):

|

What is Cryptocurrency?

International Monetary Fund (IMF):

|

Implications of crypto-assets on the Financial Ecosystem:

Cryptocurrency regulation in India:

|

Way Forward:

About International Organization of Securities Commissions (IOSCO):

|

News Source: The Indian Express

Context:

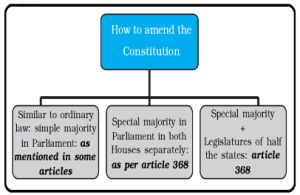

As we move into the new Parliament building and leave the old one that gave us the Constitution, there is a growing call for amending the Constitution according to the changing realities of our time.

More on News:

About Constitution as a Living Document:

Flexibility: This concept is based on the idea that a constitution should not remain static but should be flexible enough to accommodate societal changes over time.

Flexibility: This concept is based on the idea that a constitution should not remain static but should be flexible enough to accommodate societal changes over time.India: Nation or Union of States:

|

There have been discussions and debates about various aspects of the Indian Constitution and the need for constitutional reforms, the idea of completely replacing the existing constitution with a new one is becoming a widely debated topic.

Arguments in Favour of the Need for a New Constitution:

While some may argue for a new constitution for India, there are also strong arguments against it. The existing Constitution of India has endured for decades and has been amended multiple times to accommodate changing needs.

Arguments Against the Need for a New Constitution:

Way Forward:

Conclusion:

Extreme positions may be theoretically very correct and ideologically very attractive, but logic demands that everyone is prepared to moderate their extreme views and reach a common minimum ground.

News Source: The Indian Express

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>