The Dashboard will evaluate ULBs based on indicators across five pillars:

News Source: PIB

News Source: PIB

About Global Trade Research Initiative (GTRI):

|

|---|

News Source: Financial Express

News Source: Livemint

News Source: PIB

News Source: Financial Express

Geographical indication (GI):

|

|---|

News Source: The Hindu

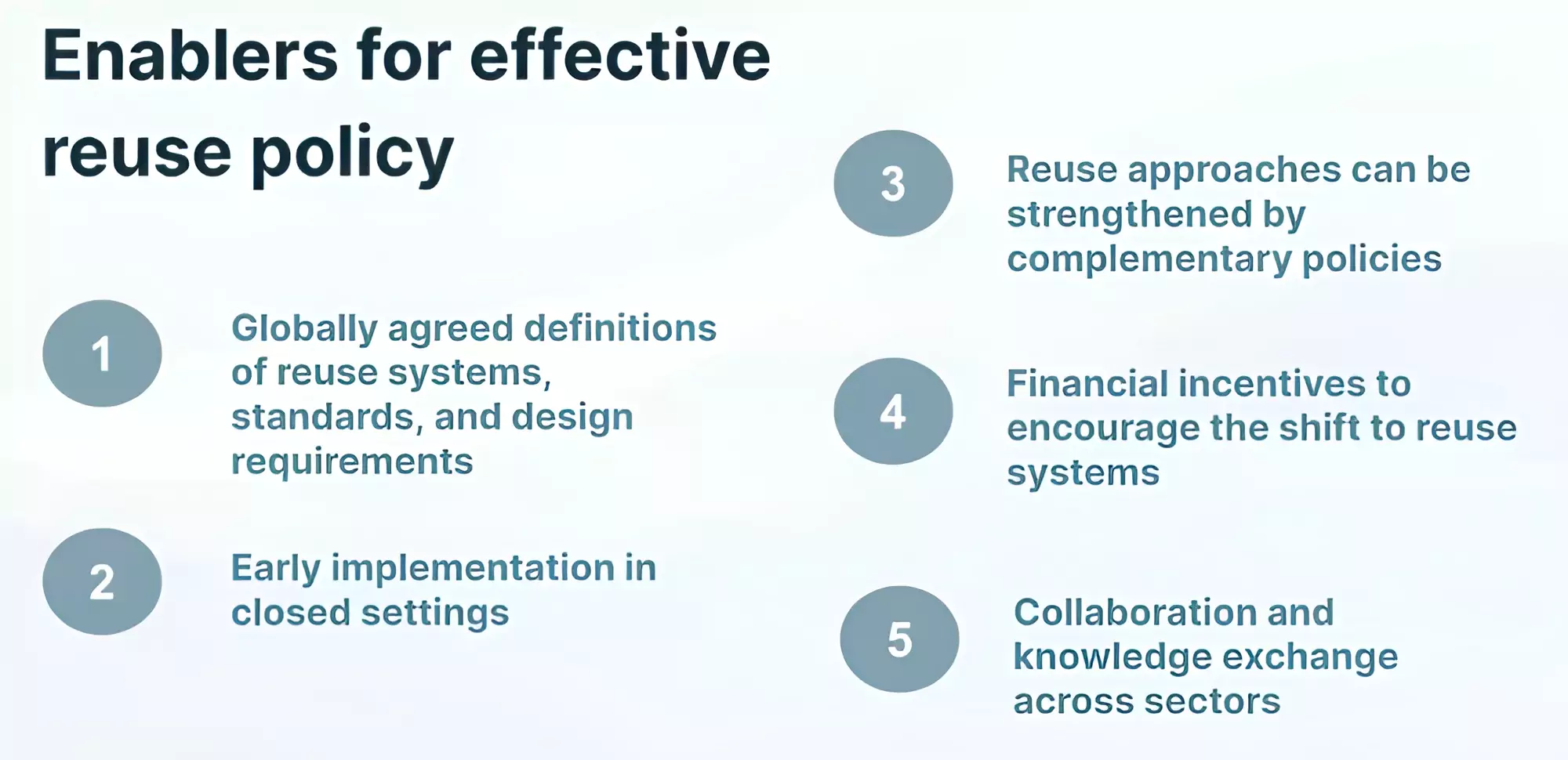

Zero Draft text

Break Free From Plastic (BFFP):

|

|---|

News Source: DTE

| Advantages | Disadvantages |

Innovative benefits: One of the key features of disruptive technology is its ability to offer consumers new and notable benefits.

|

Unrefined inventions: New technology is typically untested and unrefined during its early stages and development can continue for years. During this time, businesses offering the technology may struggle to market an innovative product.

|

| Startup Opportunities: Disruptive technology provides opportunities for startup companies to gain a significant foothold in existing industries.

For example, 3D printing is an additive method of manufacturing. It uses blueprints from digital files or scans a three-dimensional object, uploads the image to a digital file, and then renders that image layer by layer. A Dutch design company, MX3D, and Autodesk are collaborating with the City of Amsterdam to 3-D-print a metal bridge over one of the city’s canals. |

Unproven applications: It can take time for a disruptive technology to find its place in the marketplace. The potential applications for the innovation are at first unproven.

|

| Business Growth: When an established business willingly embraces disruptive technology, it enjoys prime opportunities for growth either within its current industry or within a new industry that’s been created by the technology.

For example, Uber a rapidly growing ride-sharing service, has become the poster child for disruptive innovation. The traditional taxi cab business has suddenly been changed forever by a mobile platform connecting consumers who need rides with drivers willing to provide them. |

Resistance in adoption: Disruptive innovations can be met with resistance from established players in the market. These players may try to protect their market share by blocking or delaying the adoption of the disruptive innovation.

|

News Source: The Hindu

Who are the Houthis?

Global 200 Ecoregion:

|

|---|

News Source: The Indian Express

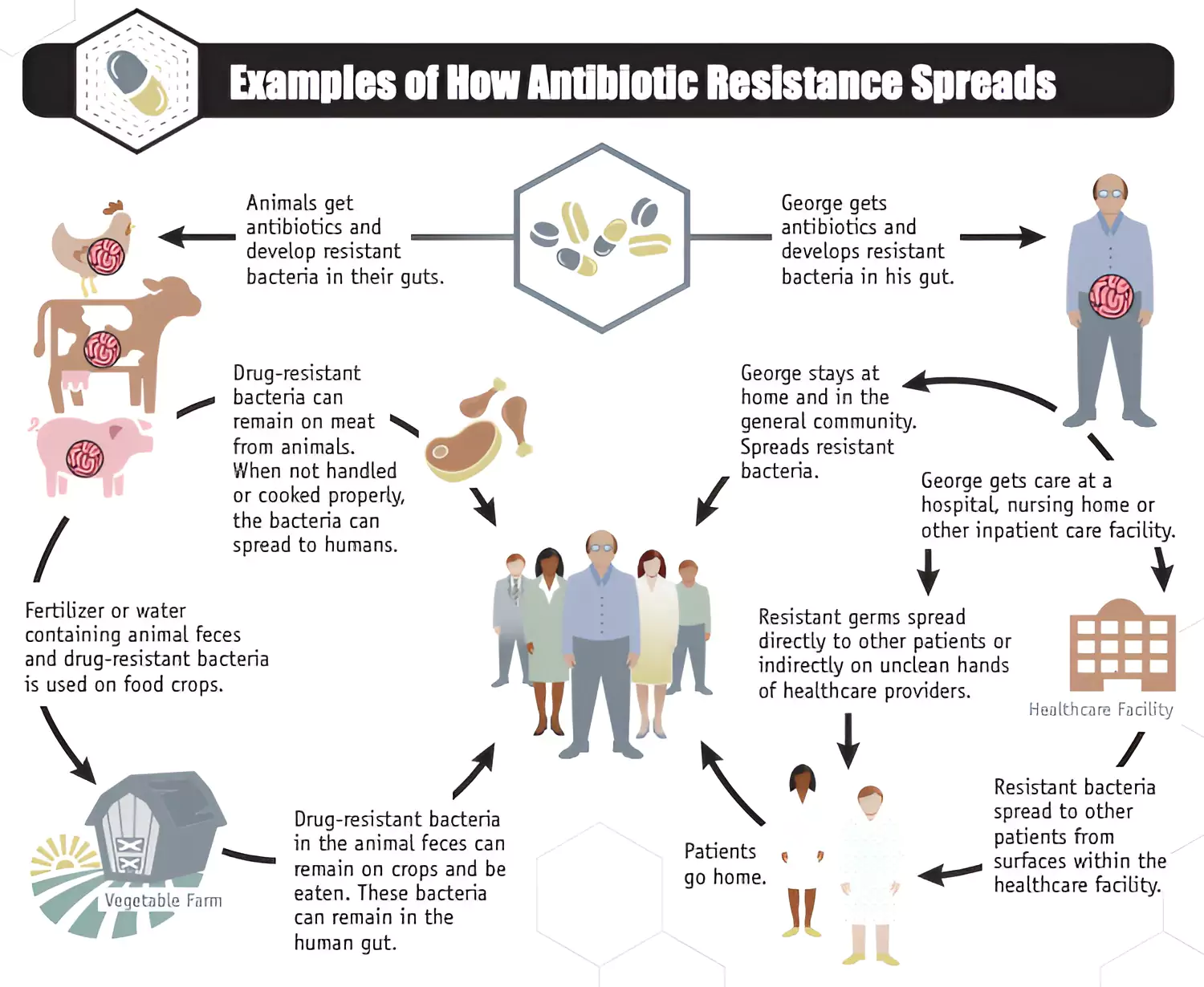

Global Initiatives to Combat Antimicrobial Resistance: The Global Antimicrobial Resistance and Use Surveillance System (GLASS): GLASS has been conceived to progressively incorporate data from surveillance of AMR in humans.

|

|---|

News Source: DTE

Indian Medical Association (IMA)

Trained Nurses’ Association of India (TNAI):

|

|---|

News Source: The Hindu

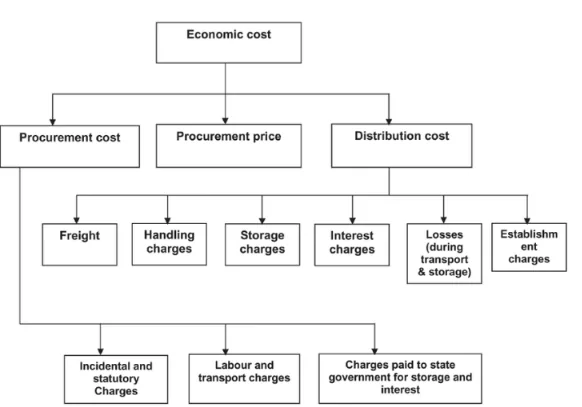

Also Read: Centre Approves Minimum Support Prices (MSPs) for Rabi Crops 2024-25

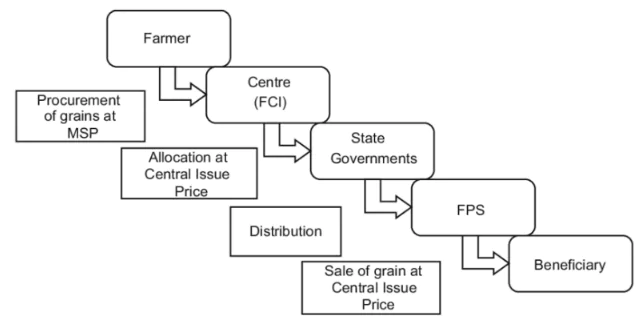

About Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY):

Eligibility for the scheme:

Public Distribution System (PDS):

Targeted Public Distribution System (TPDS):

About the National Food Security Act, 2013 (NFSA):

|

|---|

Sugarcane subsidy:

|

|---|

Also Read: World Food India 2023: Nurturing Agriculture and Food Processing

Addressing rising costs, crop patterns, and delivery issues is vital for the long-term success of India’s food subsidy programme.

| Mains Question: Discuss how the Green Revolution technology made a remarkable contribution in transforming the Indian economy and helped India achieve food security. (250 Words, 15 Marks) |

|---|

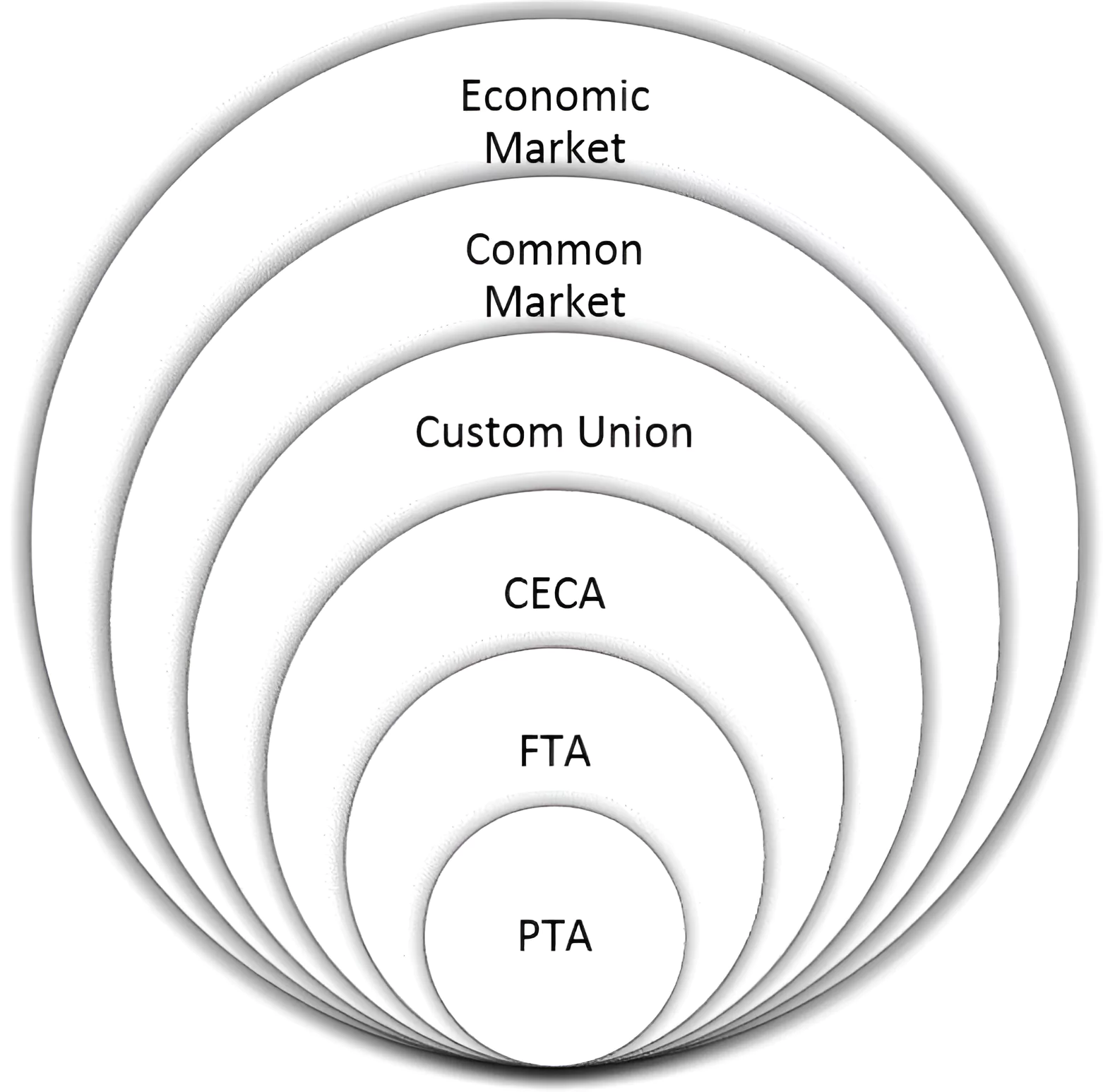

Know More about the INDIA-UK FTA deal here.

| India’s Trade Agreements with Partner Countries/region | Names of Trade Agreements |

| ASEAN | India-ASEAN FTA |

| Japan | India-Japan CEPA |

| South Korea | India-South Korea CEPA |

| Mauritius | India-Mauritius Comprehensive Economic Cooperation and Partnership Agreement (CECPA) |

| United Arab Emirates | India-UAE CEPA |

| Australia | India-Australia Economic Cooperation and Trade Agreement (Ind-Aus ECTA) |

In summary, India is adapting its trade strategy with evolving Free Trade Agreements, emphasizing lessons from past deals, and needs clear policies and agility to navigate global shifts for economic growth and meaningful contributions to international trade.

| Prelims Question (2018)

Consider the following countries: 1. Australia 2. Canada 3. China 4. India 5. Japan 6. USA Which of the above are among the ‘free-trade partners’ of ASEAN? (a) 1, 2, 4 and 5 (b) 3, 4, 5 and 6 (c) 1, 3, 4 and 5 (d) 2, 3, 4 and 6 Ans: (c) |

|---|

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>