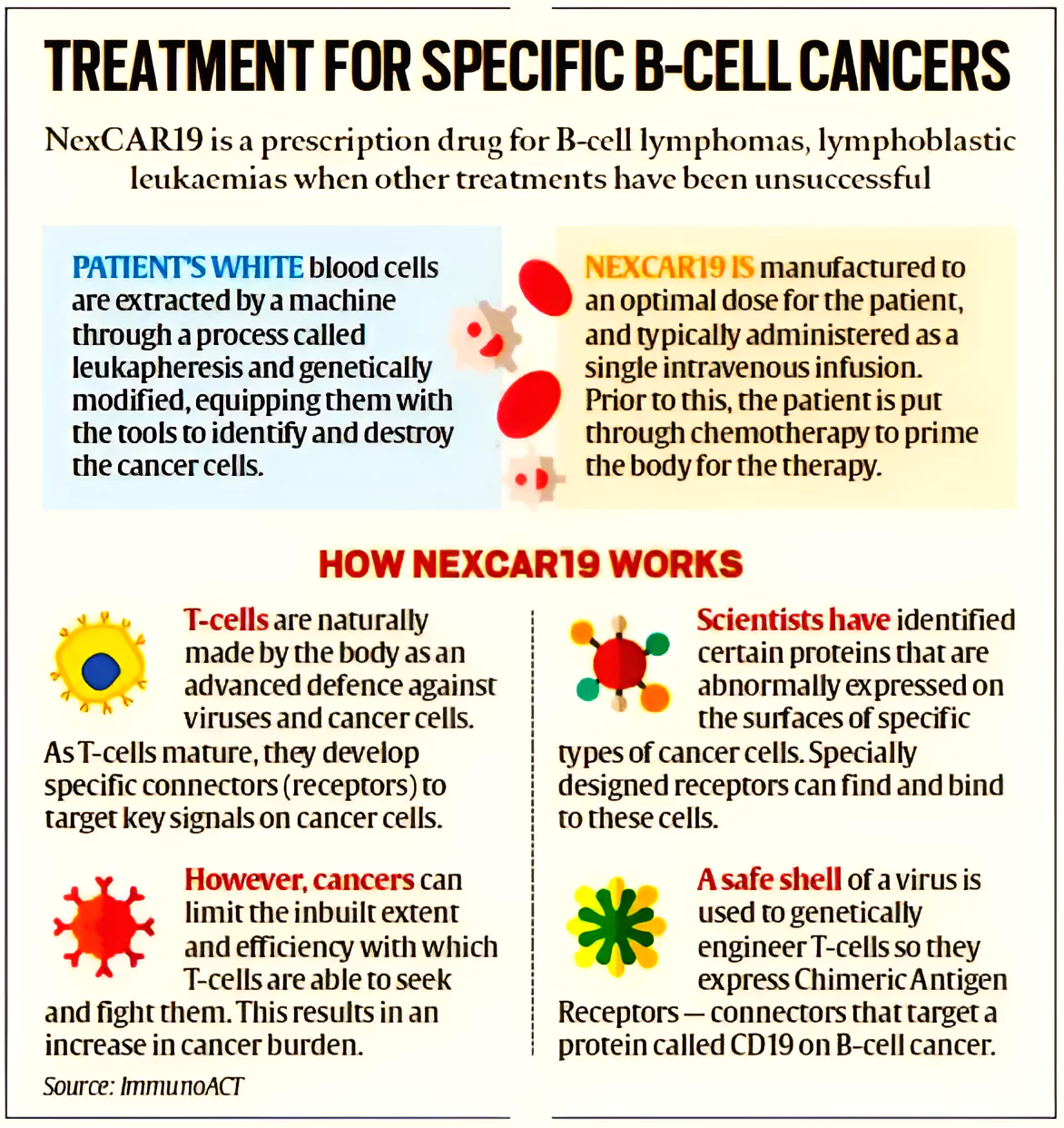

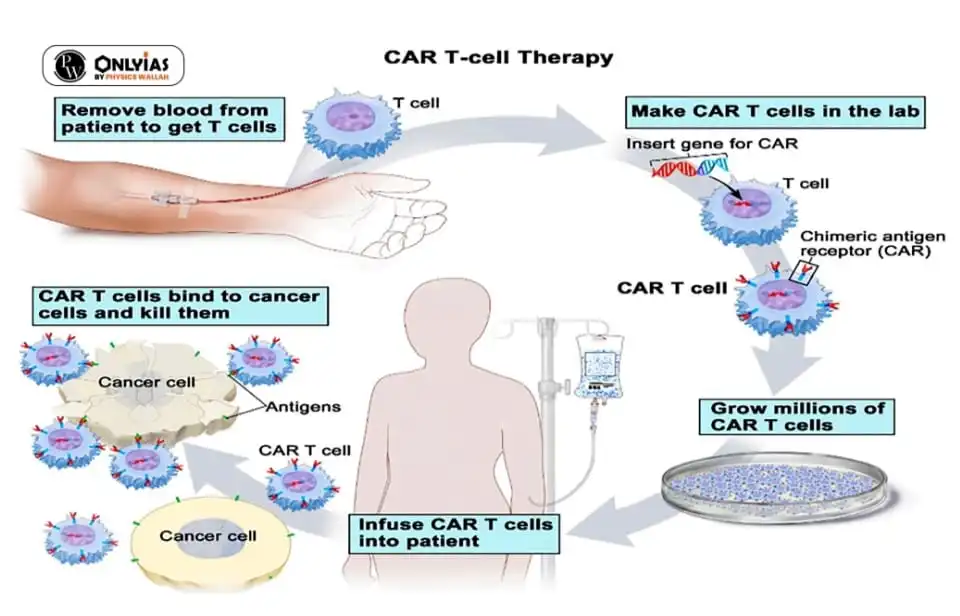

The first commercial patient who underwent CAR T Cell Therapy was declared cancer-free.

The genetically modified cells express chimeric antigen receptors (CARs) specific to cancer cells.

The genetically modified cells express chimeric antigen receptors (CARs) specific to cancer cells. News Source: Indian Express

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently Rajya Sabha Passed Water Prevention and Control of Pollution Amendment Bill 2024.

| Provisions | Water Prevention and Control of Pollution Act 1974: | Water Prevention and Control of Pollution Amendment Bill 2024 |

| Consent exemptions for establishing industries | As per the Water Prevention and Control of Pollution Act 1974, prior consent of the SPCB is required for establishing any industry or treatment plant, which is likely to discharge sewage into a water body, sewer, or land. |

|

| In the Appointment of Chairman of State Board |

|

|

| Discharge of polluting matter |

|

|

| Tempering with Monitoring devices |

|

|

| Penalty for other offences |

|

|

| Cognizance of offences: |

|

|

| Offences by government departments |

|

|

About the Water Prevention and Control of Pollution Act 1974:

|

|---|

The Central Pollution Control Board (CPCB)

|

|---|

News Source : The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently, The Lok Sabha passed the Constitution Jammu and Kashmir Scheduled Tribes Order Amendment Bill, 2023 to add the Paharis community to the ST list.

The National Commission for Scheduled Tribes (NCST):

|

|---|

Scheduled Tribes in India

Criteria to Establish ST Status of a CommunityThe Registrar General of India categorizes a community as an Schedule Tribe on the basis of certain traits given by the Lokur Committee 1965.

|

|---|

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Delimitation of Constituencies for Lok Sabha & State Legislatures is to be carried out based on the first census after 2026.

Delimitation Commission & Its Composition

|

|---|

| Constitutional Requirement of Delimitation Commission:

Article 82 mandates the parliament that after every census there should be enactment & Constitution of Delimitation Act & Delimitation Commission. Article 170 provides for the division of territorial constituencies of states after every census. |

|---|

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently, Rajya Sabha passed the Constitution (Scheduled Tribes) Order Amendment Bill, 2024 and Constitution (Scheduled Castes and Scheduled Tribes) Order Amendment Bill, 2024.

| State | Synonym/Sub-Tribes Added | Existing Tribe |

| Odisha | Pauri Bhuyan and Paudi Bhuyan | Bhuyan tribe |

| Chuktia Bhunjia | Bhunjia tribe | |

| Bondo | Bondo Poraja tribe | |

| Mankidia | Mankirdia tribe | |

| Andhra Pradesh | Bondo Porja

Khond Porja |

Porja tribe |

| Konda Savaras | Savaras tribe |

About Particularly Vulnerable Tribal Groups PVTGs

|

|---|

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

CBSE has established rules for how private residential schools under its affiliation should execute the SHRESHTA scheme (Residential Education for Students in High Schools in Targeted Areas).

The scheme operates in two modes:

News Source: PIB

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The Indian Air Force (IAF) Exercise Vayu Shakti-24 will be conducted on February 17 at the Pokhran air-to-ground range near Jaisalmer in Rajasthan.

News Source: ET

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

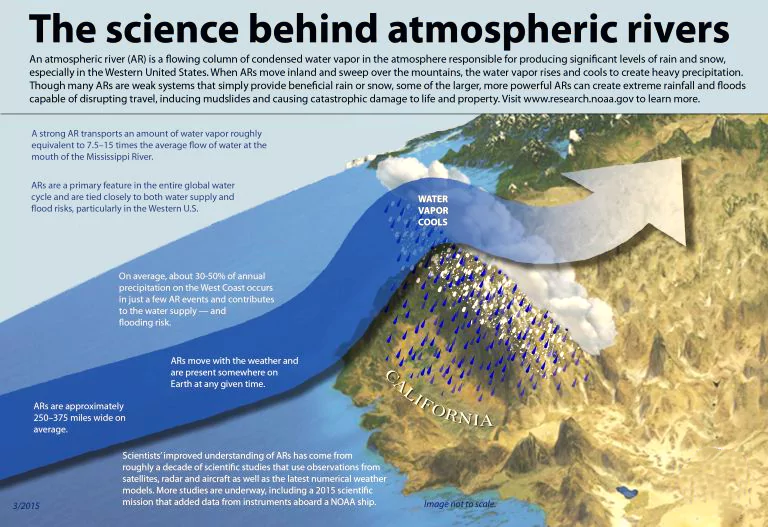

Recently, a dangerous storm blew in California, USA. It threatened coastal areas and caused flooding and mudslides

News Source: PIB

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The 24th meeting of PM-STIAC (The Prime Minister Science Technology and Innovation Advisory Council) discussed issues related to medical and health industries in India.

Central Drugs Standard Organisation (CDSCO)

|

|---|

News Source: PIB and The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

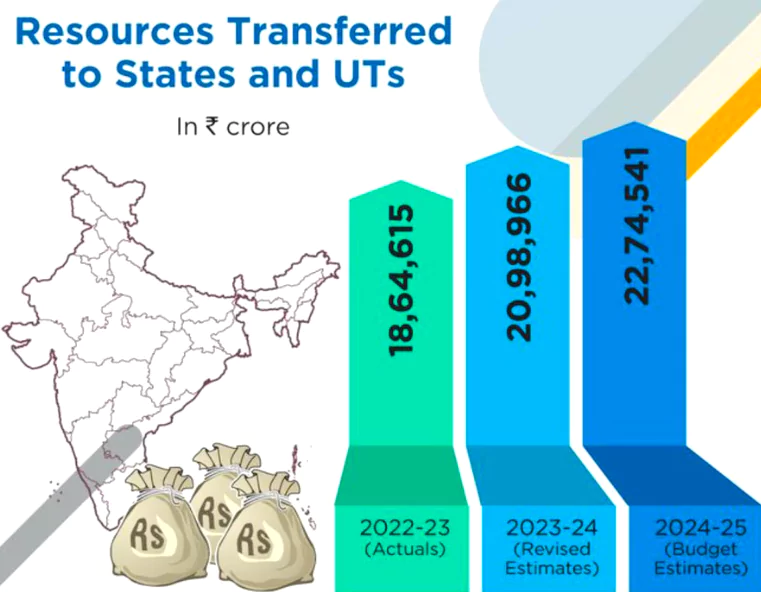

This article is based on the news “Why is fiscal consolidation so important? | Explained” which was published in the Hindu. The states of Karnataka and Kerala are bringing their protest against the Centre’s alleged biased fiscal policies to the national capital, Delhi.

| Relevancy for Prelims: Fiscal Federalism, Parliament Budget Session 2024 Live Updates, Union Budget 2024-25, Interim Budget 2024-2025, , Federalism, and Finance Commission.

Relevancy for Mains: Fiscal Federalism In India: Current Status, Challenges and Way Forward. |

|---|

Broad Principles Associated With Fiscal Federalism:

|

|---|

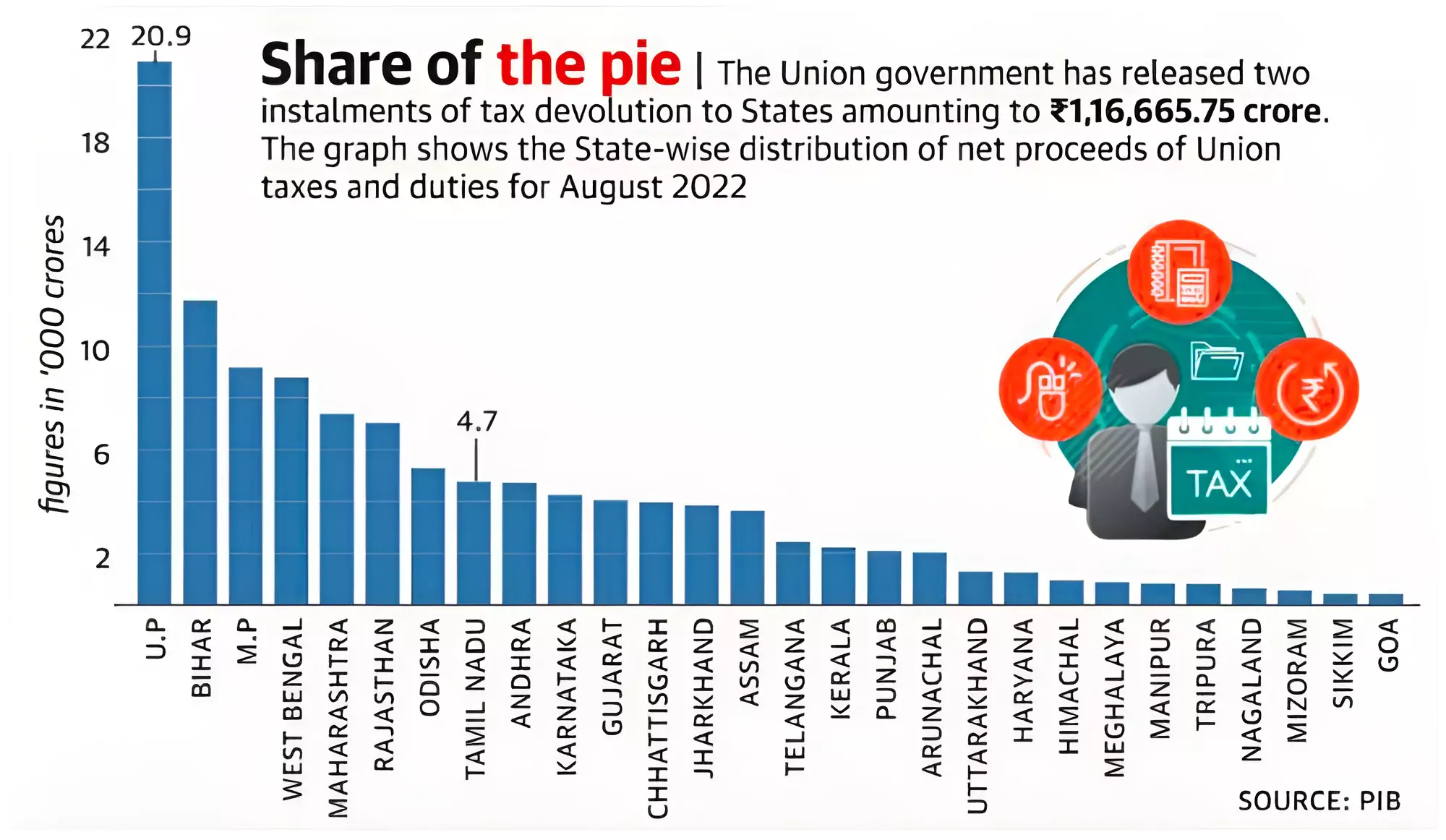

According to the Reserve Bank of India’s (RBI) of State Finances: A Study of Budgets of 2023-24 report, due to increase in cesses and surcharges, the divisible pool has shrunk from 88.6 percent of gross tax revenue in 2011-12 to 78.9 percent in 2021-22 despite the 10-percentage point increase in tax devolution recommended by the 15th finance panel.

According to the Reserve Bank of India’s (RBI) of State Finances: A Study of Budgets of 2023-24 report, due to increase in cesses and surcharges, the divisible pool has shrunk from 88.6 percent of gross tax revenue in 2011-12 to 78.9 percent in 2021-22 despite the 10-percentage point increase in tax devolution recommended by the 15th finance panel.

Views of Earlier Commissions and Committees on Centre State Relations in India |

|

First Administrative Reforms Commission (1966) |

|

Rajamannar Committee (1969) |

|

Sarkaria Commission (1988) |

|

Punchhi Commission (2010) |

|

Report of the Sub-Group of Chief Ministers on Rationalisation of Centrally Sponsored Schemes (2015) |

|

Review Tax-Sharing Principles: In line with India’s evolving fiscal federalism, its mandate could center on consolidating the indirect tax base between the Union and states.

Review Tax-Sharing Principles: In line with India’s evolving fiscal federalism, its mandate could center on consolidating the indirect tax base between the Union and states.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>