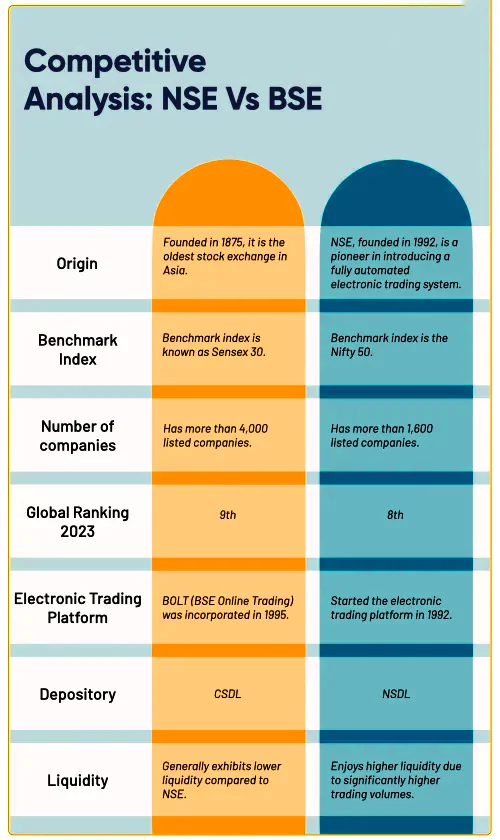

The Indian stock market has become the 4th largest globally, surpassing Hong Kong.

About Security and Exchange Board of India

|

|---|

News Source: Indian Express

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

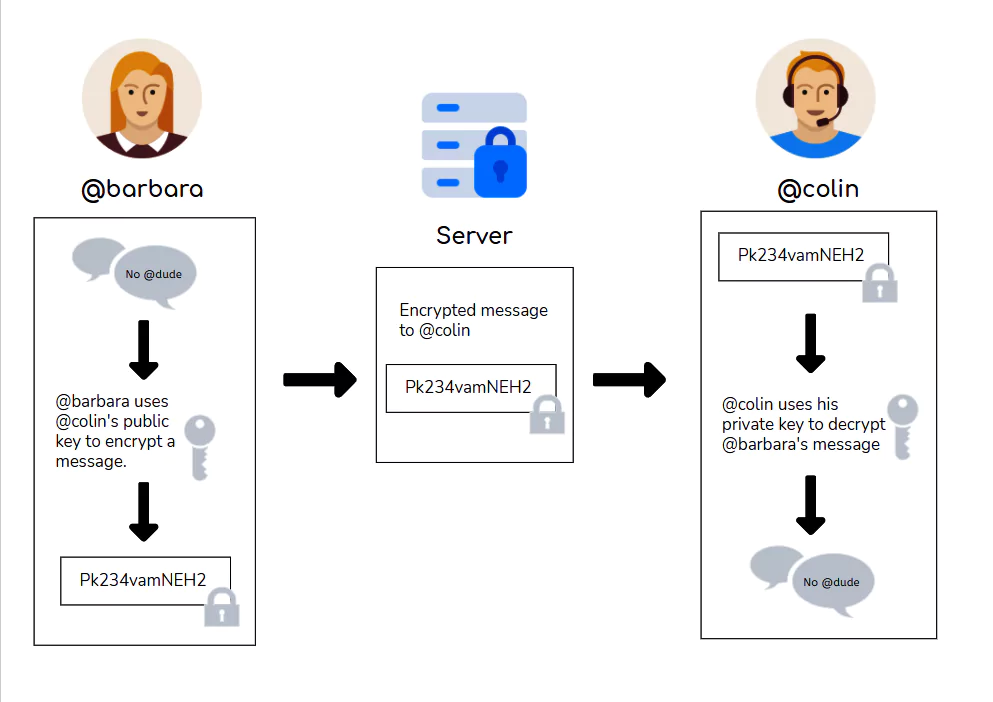

End to End encryption has fundamentally shifted the landscape of data privacy and control, impacting various stakeholders profoundly.

Can End to End Encryption Be Cracked?

Prevention of MITM Attacks:

|

|---|

Hash functions

Example Of Hash Function:

|

|---|

End to End Encryption is a powerful tool with significant implications for individuals, organizations, and society as a whole. It raises broader questions about individual autonomy, government overreach, and the ethical responsibilities of technology companies in the digital age.

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

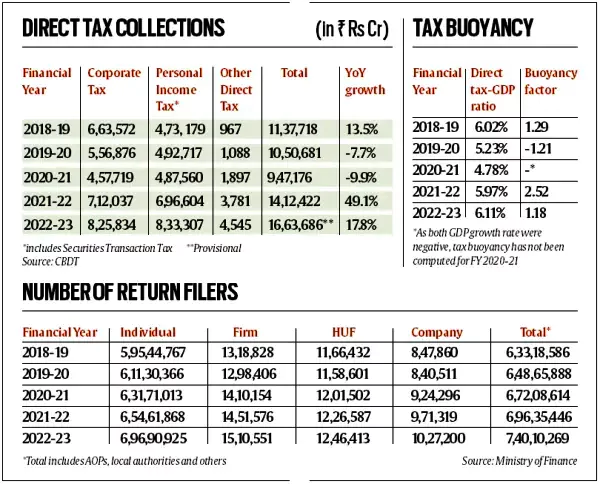

The Central Board of Direct Taxes (CBDT) under the Ministry of Finance has released time-series data

Growth rate for taxes: It is 17.79 per cent in 2022-23, higher than 15.11 per cent nominal GDP growth.

Growth rate for taxes: It is 17.79 per cent in 2022-23, higher than 15.11 per cent nominal GDP growth.

Direct Tax

Indirect Tax

Who is a taxpayer?

|

|---|

News source: The Indian Express

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

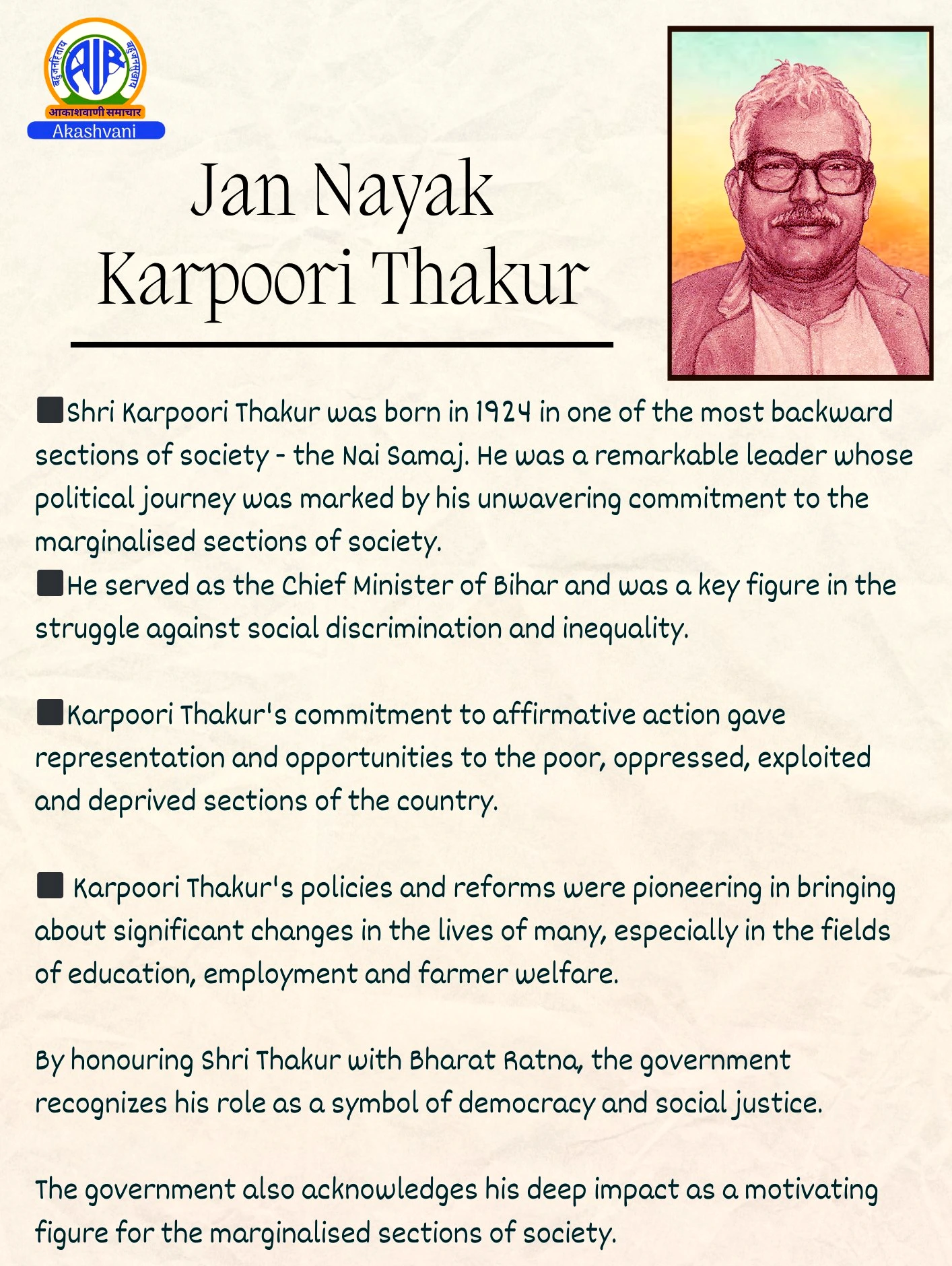

Former Bihar Chief Minister Karpoori Thakur will posthumously be honored with Bharat Ratna.

It was announced on his 100th birth anniversary.

MungeriLal Commission Report (1977-78)

|

|---|

It is the highest civilian award of the Republic of India, instituted on 2 January 1954.

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently, the Supreme Court criticized Gujarat police for violating the DK Basu Vs State of West Bengal case guidelines, in a case of publicly flogging of a particular community.

News Source: The Indian Express

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

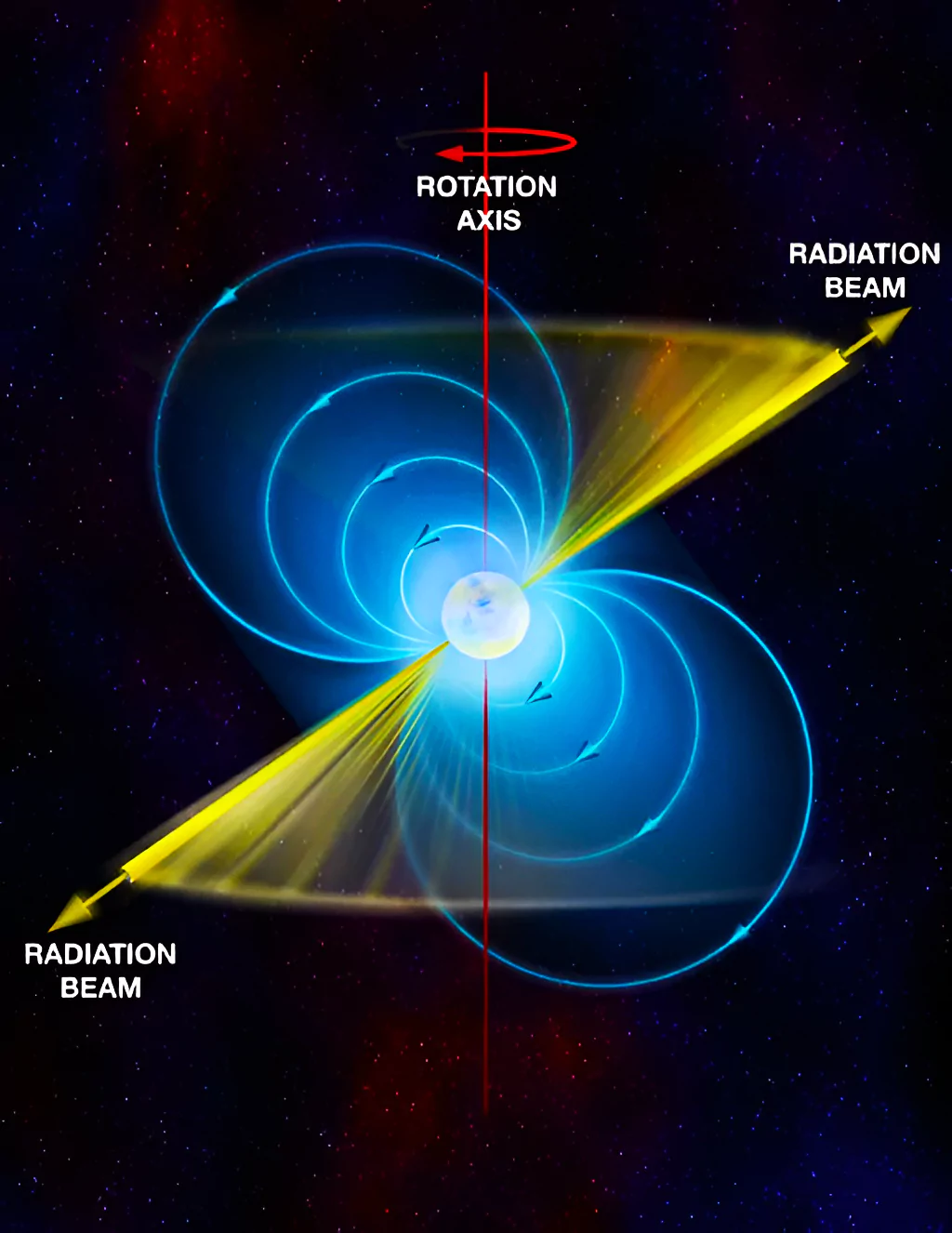

The first pulsar (PSR B1919+21) was discovered by scientist Jocelyn Bell Burnell and Antony Hewish in 1967.

What are Neutron stars?

|

|---|

Also Read:

News source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The Delhi high court set aside an order of the Central Information Commission (CIC) directing the income-tax department to disclose information related to the grant of tax exemption status to the PM CARES Fund.

Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund or PM CARES Fund is a public charitable trust. It is a dedicated fund with the primary objective of dealing with any kind of emergency or distress situation, posed by the COVID-19 pandemic and providing relief to the affected.

Prime Minister’s National Relief Fund (PMNRF)

|

|---|

News Source: Economic Times

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Lake Victoria is facing numerous environmental challenges which demand collective efforts for restoration and conservation.

Bordering Countries: Tanzania, Uganda, Kenya.

Bordering Countries: Tanzania, Uganda, Kenya. News Source: DTE

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The Serum Institute of India (SII) to join the CEPI network of vaccine producers in the Global South.

Also Read:

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

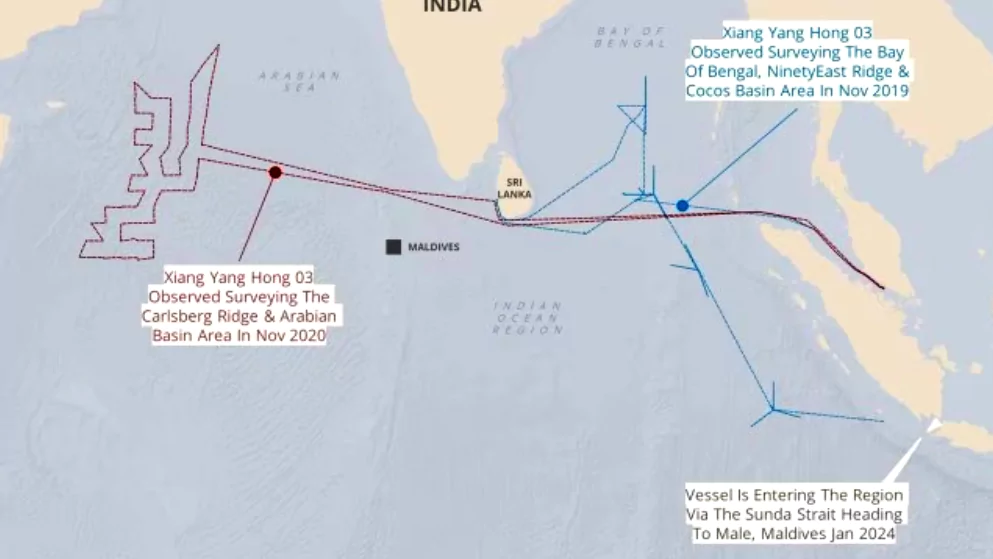

A Chinese research and survey vessel Xiang Yang Hong 03, authorized by the Maldivian government, is scheduled to dock at a port in the Maldives.

News Source: IE

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

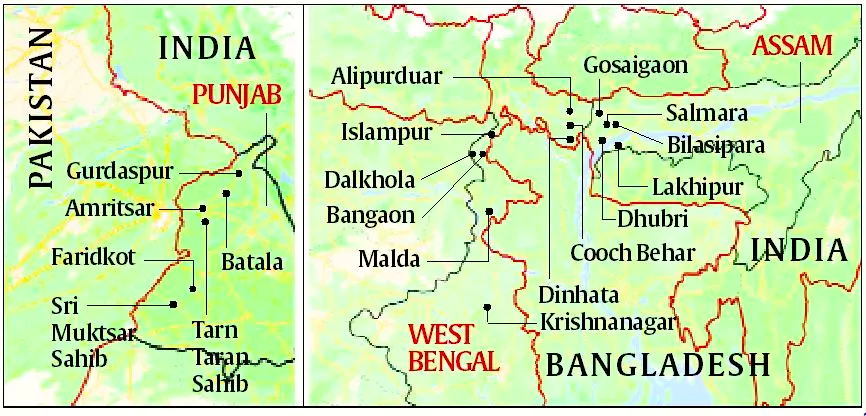

This article is based on the news “Limits and borders: On the territorial jurisdiction of the Border Security Force” which was published in the Hindu. The Supreme Court decided to examine the questions that arise from the expansion of the Border Security Force’s (BSF) jurisdiction by the Central Government.

| Relevancy for Prelims: Supreme Court, BSF (Border Security Force), Articles In The Constitution Of India, and Border Disputes Of India.

Relevancy for Mains: BSF Territorial Jurisdiction and Security Challenges And Their Management In Border Areas. |

|---|

Article 131 of Indian Constitution:

|

|---|

About BSF (Border Security Force)

|

|---|

Constitutional Prerogative of Union Government

|

|---|

Naga People’s Movement of Human Rights versus Union Of India case, 1997:

|

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

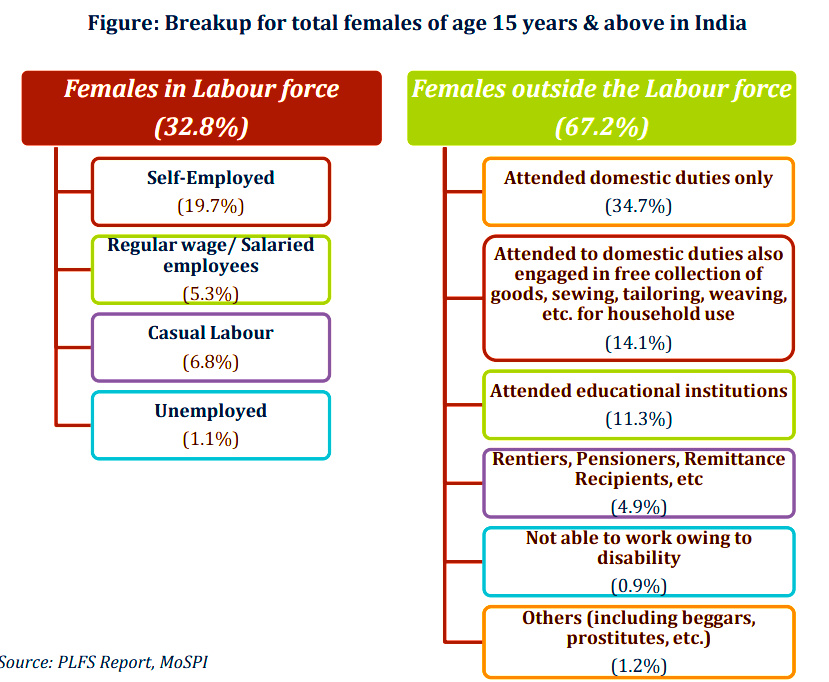

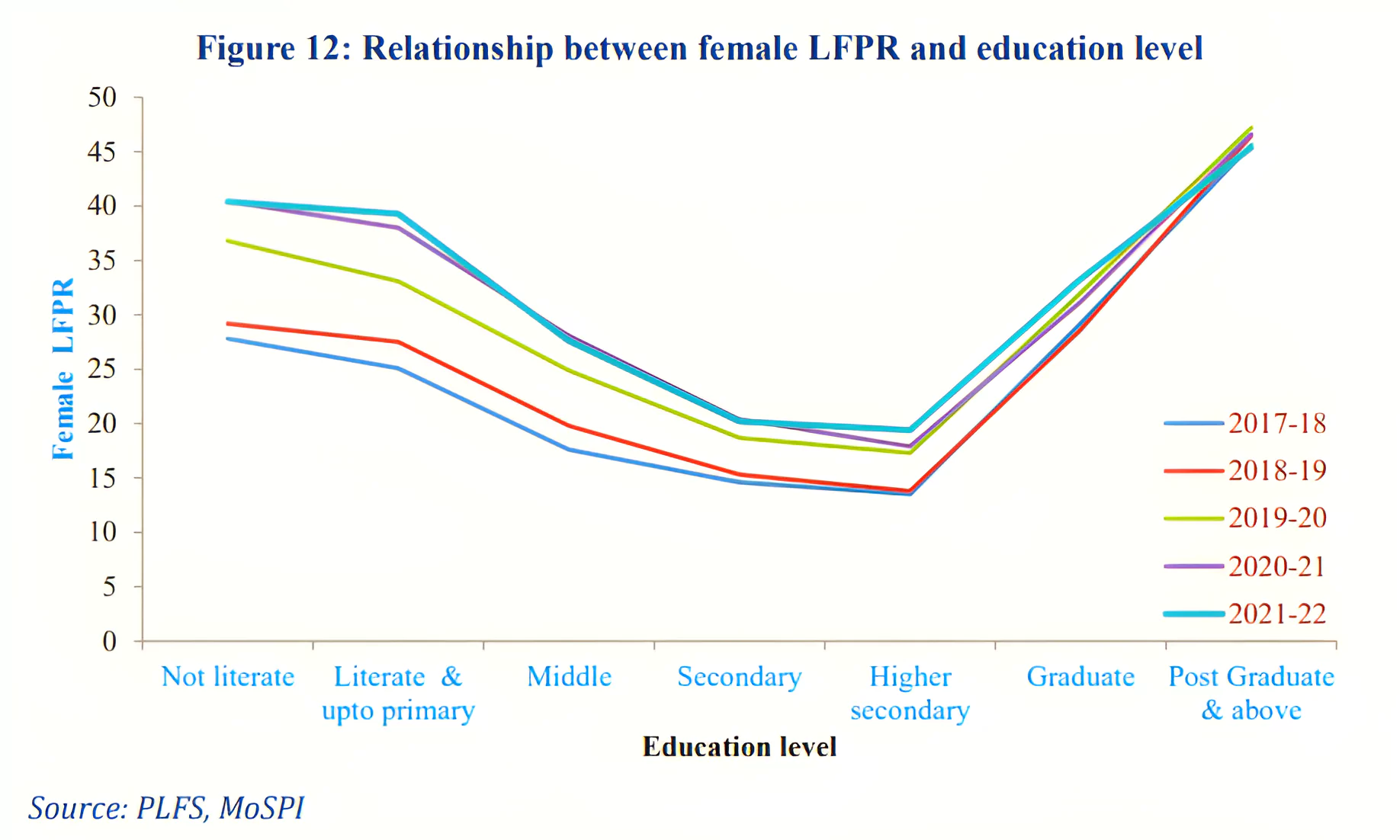

This article is based on the news “Intersectionality of gender and caste in women’s participation in the labour force” which was published in the Hindu. According to Periodic Labour Force Survey (PLFS) 2021-22, Female Labour Force Participation Rate (LFPR) in India has been significantly increasing over the years and around 1/3rd of women have joined the labour force.

| Relevancy for Prelims: Women Participation In Workforce, Female Labour Force Participation Rate (LFPR), and Periodic Labour Force Survey (PLFS) Annual Report 2022.

Relevancy for Mains: Female Labour Force Participation in India: Current Status, Significance, Challenges, and Way Forward. |

|---|

Labour Force Participation Rate (LFPR): Labour Force Participation Rate is defined as the percentage of persons in labour force (i.e. working or seeking or available for work)in the population.

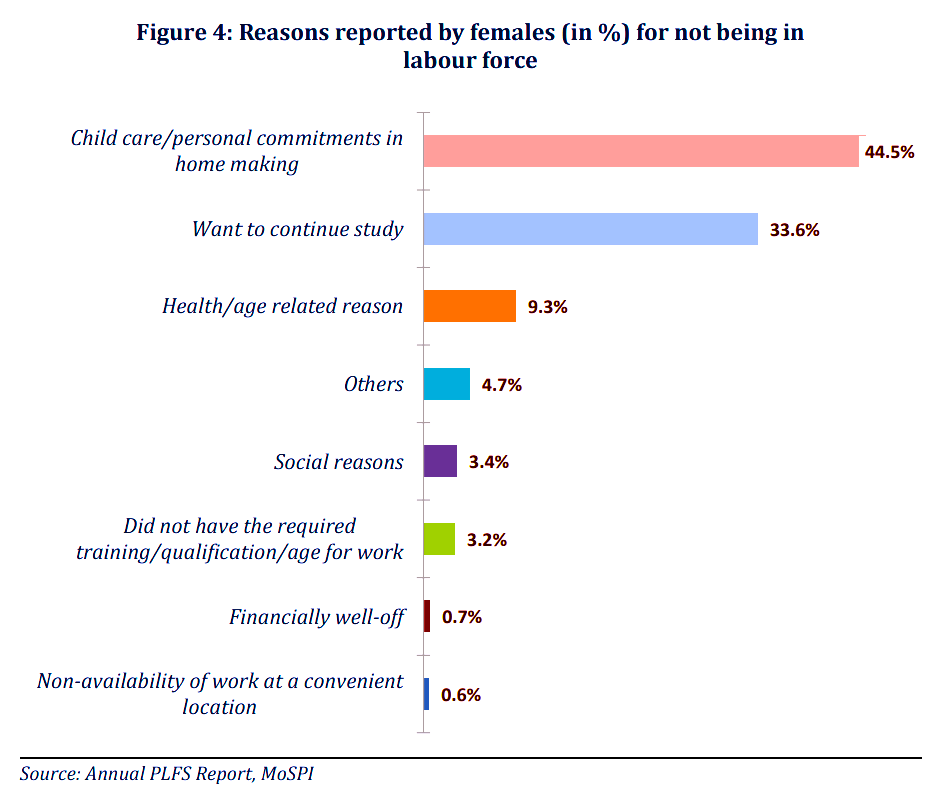

Labour Force Participation Rate (LFPR): Labour Force Participation Rate is defined as the percentage of persons in labour force (i.e. working or seeking or available for work)in the population. Around 3.4% women were outside the labour force due to social reasons and most of the work of women is home based such as caregiving.

Around 3.4% women were outside the labour force due to social reasons and most of the work of women is home based such as caregiving.  In 2023, male self-employed workers earned 2.8 times that of women. In contrast, male regular wage workers earned 24% more than women and male casual workers earned 48% more than women.

In 2023, male self-employed workers earned 2.8 times that of women. In contrast, male regular wage workers earned 24% more than women and male casual workers earned 48% more than women.

| Mains Question: Women empowerment in India needs gender budgeting. What are the requirements and status of gender budgeting in the Indian context? (150 words, 10 marks) |

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>