INSAT 3DS satellite, designed for enhanced meteorological observation, has been flagged off to launch from Satish Dhawan Space Centre in Sriharikota.

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

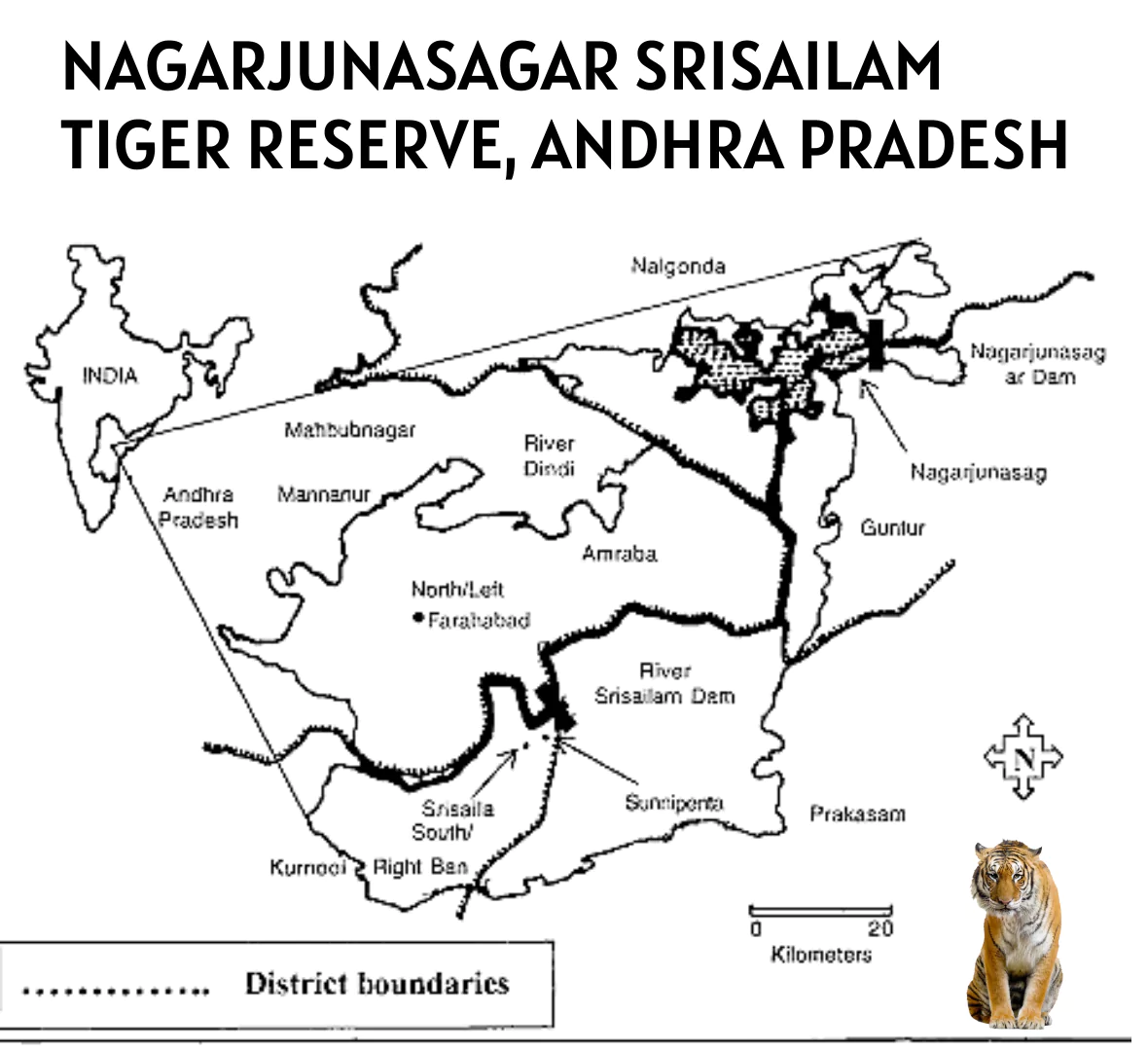

An operation was launched by experts from Nagarjuna-Srisailam Tiger Reserve to rescue an adult male tiger sighted in Elluru Forest Range, Andhra Pradesh.

Project Tiger:

Also Read: 50th Anniversary Of Project Tiger |

|---|

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

About Cancer Genomics

The Cancer Genome Atlas Program (TCGA)

|

|---|

Government Initiatives Related to Cancer Treatment

|

|---|

Also Read:

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

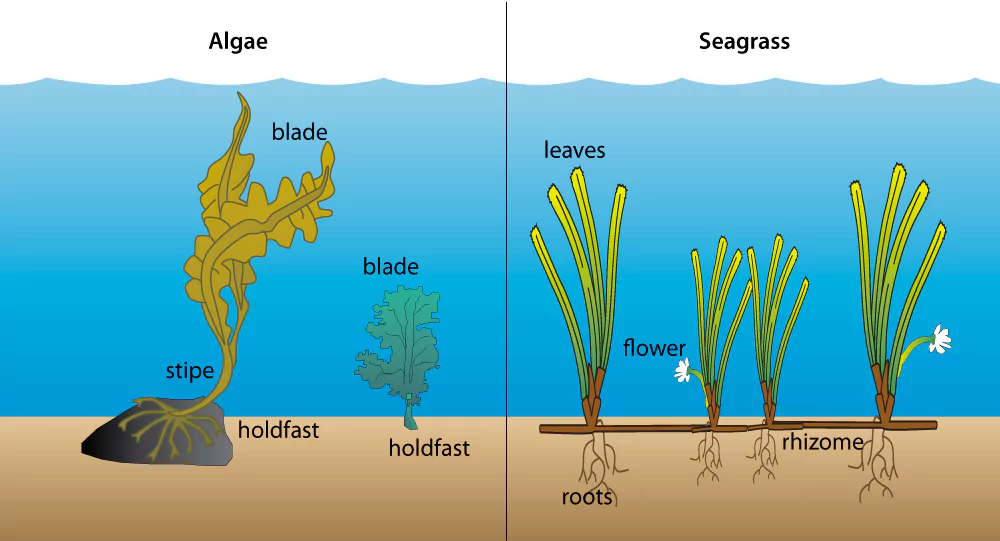

The National Conference on Promotion of Seaweed Cultivation was chaired by the Union Minister of Fisheries, Animal Husbandry & Dairying at Koteshwar (Kori Creek), Kutch, Gujarat.

Seagrasses:

|

|---|

News Source: PIB

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

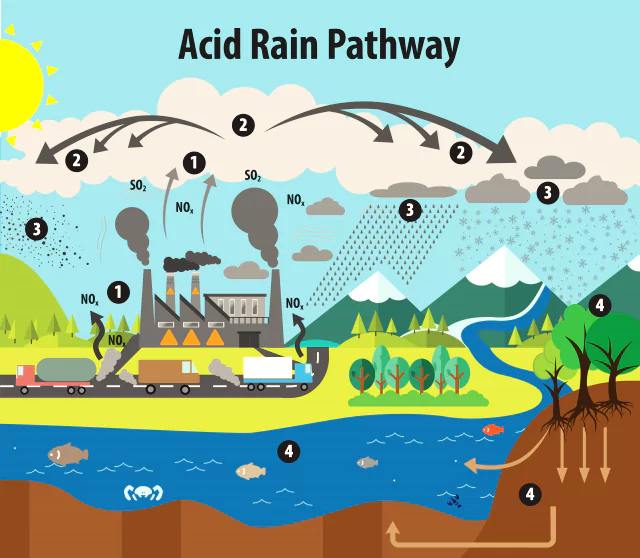

Iran faces the severe challenge of air pollution and acid rain.

Formation: It results when sulphur dioxide (SO2) and nitrogen oxides (NOX) are emitted into the atmosphere and transported by wind and air currents.

Formation: It results when sulphur dioxide (SO2) and nitrogen oxides (NOX) are emitted into the atmosphere and transported by wind and air currents.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

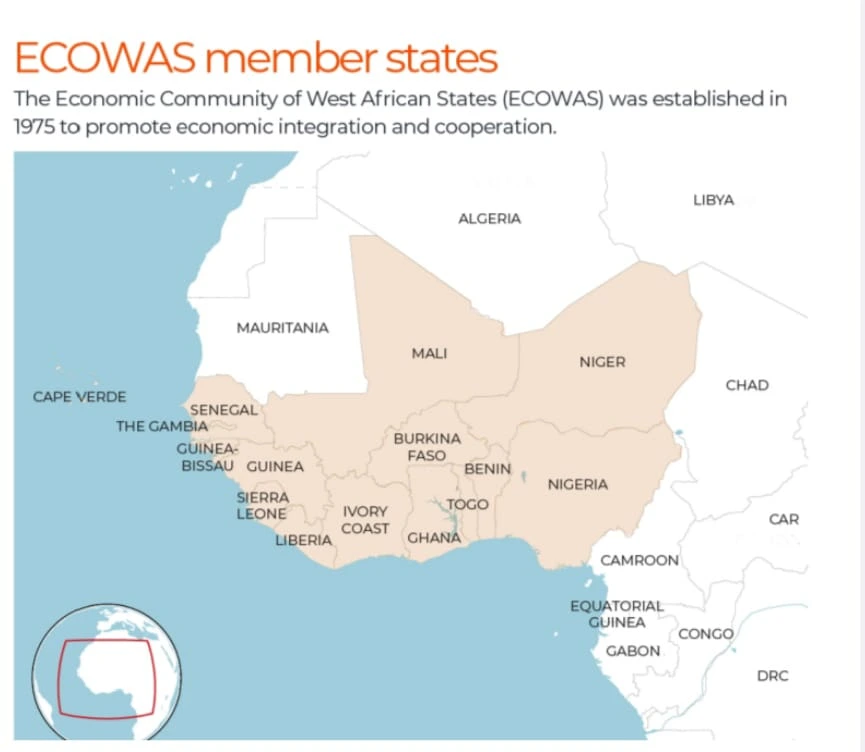

The Junta (military rule) led countries in Burkina Faso, Mali, and Niger have declared their abrupt withdrawal from the ECOWAS (Economic Community of West African States).

Relations Between ECOWAS and India

|

|---|

News Source: BBC

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The policy to dereservation any reserved faculty positions in UGC’s draft guidelines has been scrapped as clarified by the Education Ministry and the University Grants Commission (UGC).

Reservation in Government Jobs

|

|---|

News Source: The Indian Express

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently, a working group (WG) constituted by the Reserve Bank of India (RBI) made certain recommendations to address issues relating to guarantees extended by State governments.

About State Guarantee

|

|---|

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Assam Chief Minister laid the foundation of the first yoga and naturopathy hospital in the northeast.

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

As per diplomatic sources, Germany has presented a proposal to sell six advanced conventional submarines to India under the Navy’s Project 75i procurement program.

Strategic Partnerships Model:

The following four segments have been identified for acquisition under Strategic Partnership (SP) route:

|

|---|

Advantages of AIP for Conventional Submarine

|

|---|

| Submarine Class | Description |

| SSBN (Ballistic Missile Submarines) |

|

| SSN (Nuclear Attack Submarines) |

|

| SSK (Original Diesel-Electric Submarine) |

|

How Are Submersibles Different from Submarines?

|

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The Laughing Gull, a North American bird, was discovered in Chithari Estuary in Kasaragod in Kerala, marking the first recorded instance of this species being observed in India.

News Source: TH

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

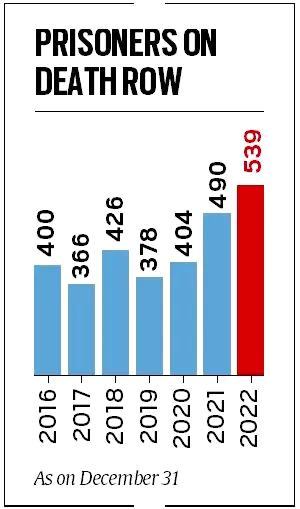

This article is based on the news “Death by nitrogen: Why this Alabama execution is polarising” which was published in the Indian Express. In Alabama, USA a convict has been executed using nitrogen hypoxia for the first time as a method of capital punishment.

| Relevancy for Prelims: Nitrogen hypoxia, UNGA, Right to Life, Fundamental Rights (Article 12-35), Law Commission, and Death Penalty In India.

Relevancy for Mains: Capital Punishment in India: Current Status, Arguments, and Way Forward. |

|---|

About Nitrogen Hypoxia:

How Does It Work?

|

|---|

Buddhism and Capital Punishment

|

|---|

| Mains Question: Critically analyse whether the death penalty is justified in modern times. (10 marks |150 words) |

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

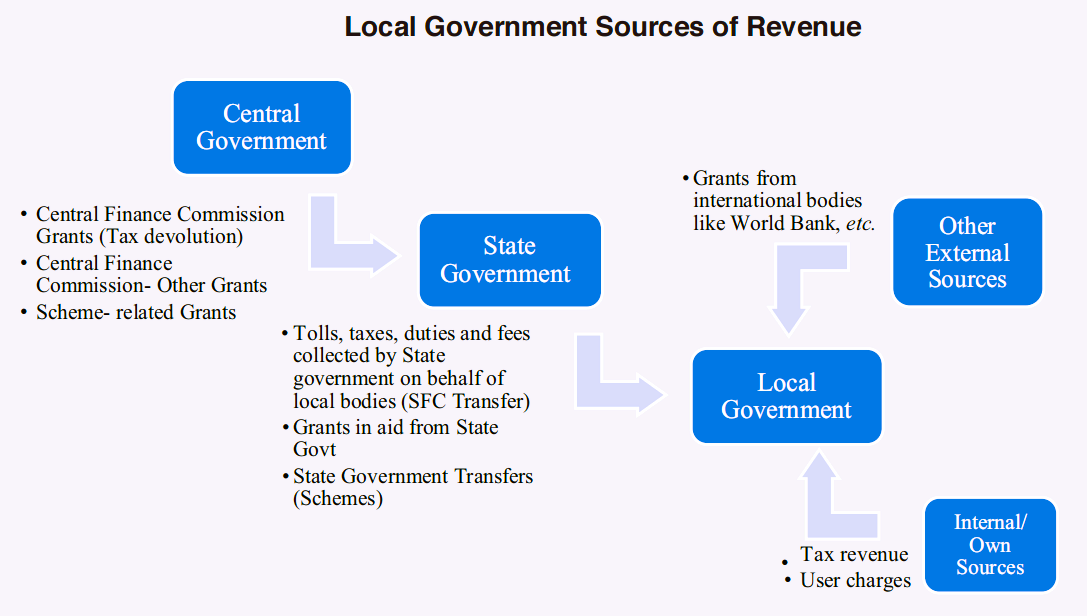

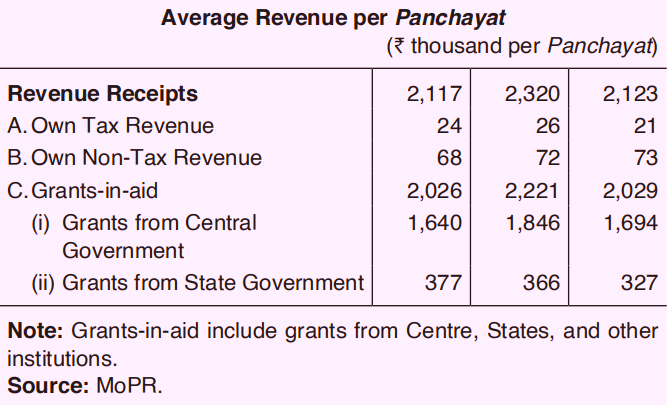

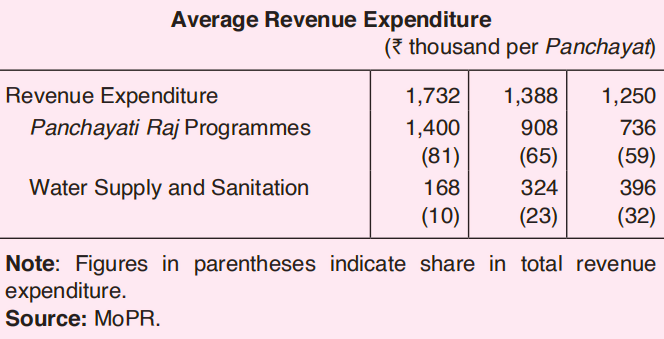

This article is based on the news “Our Panchayati Raj system is in need of funding empowerment” which was published in the Live Mint. Recently, the Reserve Bank of India (RBI) released its report titled “Finances of Panchayati Raj Institutions” for the years 2020-21 to 2022-23.

| Relevancy for Prelims: Reserve Bank of India (RBI), Panchayati Raj In India, Central Finance Commissions (CFCs), Sansad Adarsh Gram Yojana (SAGY), and Panchayat Development Index.

Relevancy for Mains: Finance of Panchayati Raj: Role, Significance, Challenges, Government Initiatives, and Way Forward. |

|---|

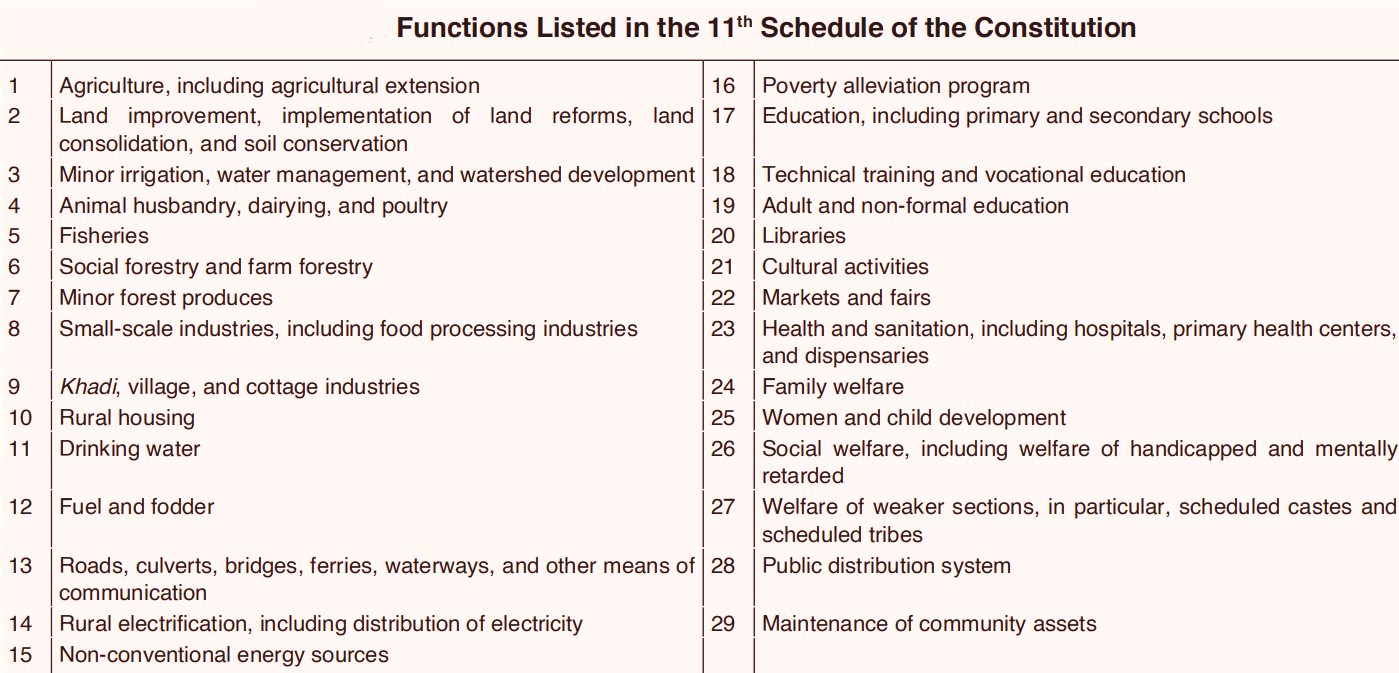

Mahatma Gandhi advocated Gram Swaraj or village self-governance as a decentralised form of governance in which villages would be responsible for their own affairs, serving as cornerstones of India’s political system.

Mahatma Gandhi advocated Gram Swaraj or village self-governance as a decentralised form of governance in which villages would be responsible for their own affairs, serving as cornerstones of India’s political system.

The decisions regarding taxes to be decentralised to local governments are, however, mainly at the discretion of State legislatures.

The decisions regarding taxes to be decentralised to local governments are, however, mainly at the discretion of State legislatures.

Government Initiatives to Strengthen Panchayati Raj Institutions (PRIs)

|

|---|

| The Data Gaps Initiative (DGI) was launched in 2009 by the G20 Finance Ministers and Central Bank Governors (FMCBG) to close the policy-relevant data gaps identified following the global financial crisis. |

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>