India’s federal structure involves a complex interplay between Central and State legislative powers, with mechanisms for extraordinary intervention. These include parliamentary legislation in State matters under exceptional circumstances and controls over State legislation to ensure national coherence. Understanding these dynamics is crucial for navigating legislative relations and addressing challenges in Indian federalism.

Legislative Relations and Challenges in Indian Federalism

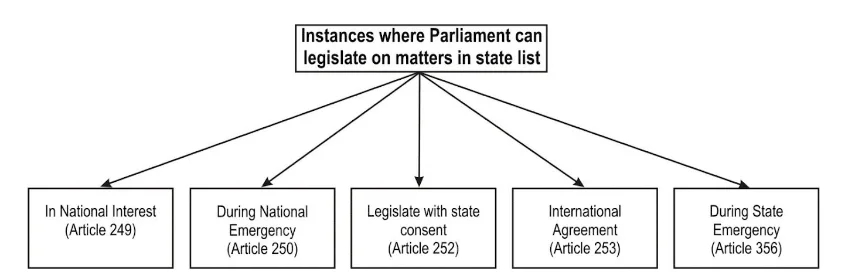

Parliamentary Legislation In The State Field

- Normal Distribution of Legislative Powers: The distribution of legislative powers between the Central government and the State governments outlined above is intended to be maintained during normal times.

- Modification Under Exceptional Circumstances: However, under exceptional circumstances, this distribution may be modified or even suspended.

- Modification Under Exceptional Circumstances: In other words, the Constitution grants the Parliament the authority to legislate on any matter listed in the State List in the following five extraordinary situations:

Enroll now for UPSC Online Course

When Rajya Sabha Passes a Resolution (Article 249)

- Rajya Sabha Resolution for GST or State List Matters: If the Rajya Sabha declares that it is necessary for the national interest for the Parliament to make laws with respect to Goods and Services tax (GST) or a matter in the State List, then the Parliament becomes authorised to make laws on that matter.

- Duration of the Resolution: Such a resolution must be supported by two-thirds of the members present and voting.

- Renewal of the Resolution: The resolution remains in force for one year, it can be renewed any number of times but not exceeding one year at a time.

- Effect of Laws Made Under the Provision: The laws made under this provision cease to have effect six months after the resolution has ceased to be in force.

- Relationship with State Legislatures: This provision does not restrict the power of a State legislature to make laws on the same matter.

- However, in case of inconsistency between a State law and a Parliamentary law, the latter is to prevail.

During National Emergency (Article 250)

- Parliament’s Power During National Emergency: During the proclamation of a national emergency, the Parliament acquires the power to legislate with respect to Goods and Services tax (GST) or matters in the State List.

- Duration of Laws: These laws become inoperative six months after the emergency has ceased to operate.

- State Legislature’s Power: The power of a State Legislature to make laws on the same matter remains unrestricted.

- However, in case of repugnancy between a State law and a Parliamentary law, the latter prevails.

When States Make a Request (Article 252)

- Parliament’s Power Upon State Resolutions: If the legislatures of two or more States pass resolutions requesting the Parliament to enact laws on a matter in the State List, the Parliament can then make laws to regulate that matter.

- Application and Adoption of the Law: A law enacted in this manner applies only to the States that have passed the resolutions.

- However, any other State can adopt the law at a later time by passing a similar resolution to that effect in its legislature.

- Amendment and Repeal of the Law: Such a law can only be amended or repealed by the Parliament and not by the legislatures of the concerned States.

- Effect on State Legislative Power: The effect of passing a resolution under this provision is that the Parliament gains the authority to legislate on a matter for which it would not normally have the power to make a law.

- Conversely, the State legislature loses the power to make a law with respect to that matter.

- The resolution acts as an abdication or surrender of the State legislature’s power over that matter, placing it entirely in the hands of the Parliament, which then becomes the sole authority to legislate on that matter.

- Examples: Laws passed under this provision include the Prize Competition Act of 1955, the Wild Life (Protection) Act of 1972, the Water (Prevention and Control of Pollution) Act of 1974, the Urban Land (Ceiling and Regulation) Act of 1976, and the Transplantation of Human Organs Act of 1994.

To Implement International Agreements (Article 253)

- Parliament’s Authority: The Parliament has the authority to make laws on any matter in the State List to implement international treaties, agreements, or conventions.

- Purpose of the Provision: This provision empowers the Central Government to fulfil its international obligations and commitments.

- Examples: Laws enacted under this provision include the United Nations (Privileges and Immunities) Act of 1947, the Geneva Convention Act of 1960, the Anti-Hijacking Act of 1982, and legislations related to the environment and TRIPS.

During President’s Rule (Article 256)

- Parliament’s Authority During President’s Rule: When the President’s Rule is imposed in a State, the Parliament gains the authority to make laws regarding any matter in the State List pertaining to that State.

- Duration of Laws: Such laws enacted by the Parliament remain in effect even after the President’s Rule is lifted.

- State Legislature’s Powers: This implies that the validity of these laws is not tied to the duration of the President’s Rule.

- However, the State legislature retains the power to repeal, amend, or re-enact these laws.

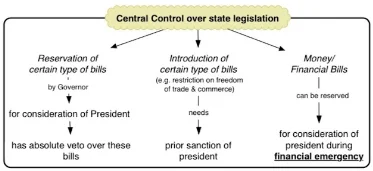

Centre’s Control Over State Legislation

In addition to the Parliament’s power to directly legislate on State subjects under exceptional circumstances, the Constitution grants the Centre the authority to exert control over the States’ legislative matters in the following ways:

- Governor’s Reservation of Bills: The Governor has the authority to withhold certain types of bills passed by the State legislature for the President’s consideration.

- The President possesses absolute veto power over these bills, meaning they cannot become law without the President’s approval.

- President’s Sanction for Certain Bills: Bills pertaining to specific topics listed in the State List can only be introduced in the State legislature with the prior approval of the President.

- Example: Bills that impose restrictions on the freedom of trade and commerce require the President’s sanction before being introduced.

- Reservation of Financial Bills During Emergencies: During a financial emergency, the Centre can instruct the States to hold back money bills and other financial bills passed by the State legislature for the President’s consideration.

- This allows the Centre to safeguard the nation’s financial stability during times of crisis.

- Central Government Oversight: These mechanisms enable the Central Government to maintain a degree of oversight over the States’ legislative activities, ensuring that State laws align with national interests and do not conflict with the overall framework of the Constitution.

- Dominance in Legislative Matters: The Constitution establishes Central dominance in the legislative sphere, allowing the Central Government to oversee and override State legislation, ensuring harmony and avoiding conflicts.

-

- This federal supremacy is vital for coherence and effective governance, preventing chaos from conflicting laws and preserving unity in diversity

Current challenges in the Legislative Field

Dam safety Act

-

- Purpose: To ensure the safety of India’s vast network of dams.

- Background: The Act was enacted in response to concerns about the potential for dam failures to cause catastrophic disasters.

- Implementation: The Act is implemented within the framework of India’s federal structure, where legislative powers are shared between the Central government and the States.

- Key Features:

-

-

- Establishes a National Committee on Dam Safety and State Dam Safety Organizations.

- Requires regular inspections of dams.

- Mandates the preparation of dam safety manuals.

- Provides for emergency preparedness and disaster management.

-

- Concerns:

-

- Dam owners are not explicitly represented on the National Committee or the State Dam Safety Organizations.

- There is a need for ongoing efforts to ensure effective implementation of the Act.

Wealth Tax Issue

- Supreme Court Ruling: The Supreme Court ruled in the case of Union of India vs H S Dhillon that the Central government has the authority to enact laws on matters that do not explicitly fall within the State List or the Concurrent List, unless they are specifically excluded from the Central government’s jurisdiction.

- Principle of Residuary Power: This principle of residuary power ensures flexibility in legislative power distribution and allows the Central government to address emerging issues that may not fit neatly into the existing legislative framework.

COVID-19 Pandemic Prompts Central Government to Invoke Residuary Power

- Invocation of Residuary Power: Faced with the unprecedented COVID-19 pandemic, the Central government invoked its residuary power under Article 248, read with Entry 97 of List I, to enact the Disaster Management Act.

- Departure from Traditional Approach: This decision deviated from the traditional approach of using the Epidemic Diseases Act, which empowers State governments to address disease outbreaks.

- Unified and Coordinated Response: The Central government’s choice reflected the unique nature of the COVID-19 pandemic and the need for a unified, coordinated response.

- The Disaster Management Act provided broader powers to implement measures like lockdowns, travel restrictions, and resource mobilisation.

- Addressing Exceptional Circumstances: The use of residuary power underscores the Central government’s ability to address exceptional circumstances that may not readily fit into the existing legislative framework.

FARM BILLS

- Agriculture in the Seventh Schedule: The word “agriculture” appears in multiple entries of all three Lists in the Seventh Schedule of the Constitution of India.

- Limitations on Central Government’s Power: However, in List I, where the Centre has primary legislative power, the word “agriculture” is accompanied by qualifiers like “other than” or “exclusive of” indicating that the Central government’s power over agriculture is limited.

- Central Government’s Confined Authority: This implies that the Central government cannot enact laws directly related to agriculture.

- Instead, the Central government’s authority over agriculture is confined to the specific aspects listed in Entry 41 of List III (Concurrent List), which pertains solely to agricultural land designated as evacuee property.

- Exclusion of Broader Agricultural Laws: This restriction excludes the three farm laws in question, as they address broader aspects of agriculture beyond evacuee property.

- Predominance of State Authority: In essence, the Centre’s legislative power over agriculture is significantly restricted, with the vast majority of agricultural matters falling under the purview of the States.

Challenges in Legislative Federalism

Gridlock and Inaction: The division of legislative power between multiple levels of government can lead to gridlock and inaction, especially when there is disagreement or political polarisation.

- This can result in delayed policy implementation and a lack of responsiveness to pressing issues.

- Inconsistent Legislation: The absence of unified legislative action can lead to inconsistencies in laws and regulations across different jurisdictions.

-

- This can create confusion for businesses and citizens, hinder Interstate commerce, and complicate law enforcement.

- Difficulties in Achieving Consensus: Reaching consensus among diverse legislative bodies with varying interests and priorities can be challenging.

- This can impede the passage of critical legislation and hinder progress on urgent issues.

- Balancing National and Local Priorities: Legislators must balance national priorities and concerns with the specific needs and interests of their constituents.

- This balancing act can be complex and often leads to compromises or delays in addressing local issues.

- Representation and Minority Rights: Ensuring fair representation and protection of minority rights can be challenging in a legislative federal system.

- The division of power can create disparities in the influence of different groups, potentially marginalising minority voices.

Positive Changes in Legislative Federalism

- Enhanced Cooperation and Collaboration: There has been a growing recognition of the need for increased cooperation and collaboration among different levels of government.

- This has led to the development of new mechanisms for coordination, such as intergovernmental conferences, joint legislative committees, and model legislation.

- Streamlined Legislative Processes: Efforts to streamline legislative processes have helped reduce delays and improve efficiency.

- This includes reducing procedural hurdles, establishing clear timetables for legislative review, and utilising technology to enhance communication and collaboration.

- Data-Driven Policymaking: The increasing use of data and evidence-based approaches in policy making has improved the quality and effectiveness of legislation.

- This involves gathering, analysing, and using data to inform policy decisions and evaluate their outcomes.

- Public Participation and Consultation: Greater efforts to engage the public in the legislative process have enhanced transparency and accountability.

- This includes public hearings, online consultations, and citizen feedback mechanisms.

- Comparative Learning and Sharing Best Practices: Subnational governments are increasingly learning from each other’s experiences and sharing best practices.

- This helps improve the quality and effectiveness of legislation across jurisdictions.

Articles Related to Centre-State Legislative Relations

| Article Number | Subject Matter |

| 245 | Extent of laws made by Parliament and by the Legislatures of States |

| 246 | Subject Matter of Laws Made by Parliament and by the Legislatures of States |

| 246A | Special provision with respect to Goods and Services Tax |

| 247 | Power of Parliament to provide for the establishment of certain additional courts |

| 248 | Residuary Powers of Legislation |

| 249 | Power of Parliament to legislate with respect to a matter in the State List in the national interest |

| 250 | Power of Parliament to legislate with respect to any matter in the State List if a Proclamation of Emergency is in operation |

| 251 | Inconsistency between laws made by Parliament under Articles 249 and 250 and laws made by the Legislatures of States |

| 252 | Power of Parliament to legislate for two or more States by consent and adoption of such legislation by any other State |

| 253 | Legislation for giving effect to international agreements |

| 254 | Inconsistency between laws made by Parliament and laws made by the legislatures of States |

| 255 | Requirements as to recommendations and previous sanctions to be regarded as matters of procedure only |

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

The Indian Constitution provides a robust framework for managing Centre-State legislative relations, balancing federal authority with state autonomy.

- Despite the challenges such as gridlock and inconsistent legislation, efforts to enhance cooperation, streamline processes, and engage the public are fostering improvements.

- These provisions and practices aim to maintain harmony and effectiveness in India’s diverse legislative landscape.

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

| Related Articles | |

| Veto Power of the President in India | GST (Goods and Services Tax) Council |

| Federalism | State Legislature in India |

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program