The Parliamentary budget, known as the ‘annual financial statement,’ outlines the government’s estimated receipts and expenditures for the financial year. Presented by the President to both Houses of Parliament, it includes revenue and capital estimates, past financial data, and future economic policies. This comprehensive document forms the foundation for India’s fiscal management, ensuring transparency and accountability in government spending.

Understanding India’s Annual Financial Statement: The Parliamentary Budget Process

Constitution: The Constitution describes the budget as the ‘annual financial statement.‘

- To put it differently, the Constitution does not use the term ‘budget.‘ Instead, it refers to the ‘annual financial statement,’ as outlined in Article 112 of the Constitution.

- Presidential Responsibility: The Constitution specifies that the President shall in respect of every financial year cause to be laid before both the Houses of Parliament, a statement of estimated receipts and expenditure of the Government of India in a financial year, which begins on 1 April and ends on 31 March of the following year.

- Elements of the Budget: Budget contains the following:

- Estimates of revenue and capitaI receipts;

- Ways and means to raise the revenue;

- Estimates of expenditure;

- Details of Past Financial Year: Information on actual receipts and expenditures from the preceding financial year, along with explanations for any deficit or surplus.

- Economic and Financial Policy for the Future: This includes taxation proposals, revenue expectations, spending programs, and the introduction of new schemes or projects for the upcoming year.

Enroll now for UPSC Online Course

Constitutional Provisions Regarding Budget Enactment

Statement of Estimated Receipts and Expenditure: For every financial year, the President is required to present a statement of the estimated receipts and expenditure of the Government of India to both Houses of Parliament (Article 112).

- Recommendation for Demands for Grants: No demand for a grant can be made without the recommendation of the President (Article 113).

- Withdrawal from the Consolidated Fund of India: Withdrawal of money from the Consolidated Fund of India is only permitted under appropriation made by law (Article 114).

- Introduction of Money Bills: A money bill imposing tax must be introduced in Parliament only on the recommendation of the President and cannot be introduced in the Rajya Sabha (Article 117).

- Authority for Taxation: Taxation cannot be levied or collected except by authority of law (Article 265).

- Reduction or Abolition of Taxes: While Parliament can reduce or abolish a tax, it cannot increase it (Article 117).

- Roles of Both Houses in Budget Enactment: The Constitution outlines the roles of both Houses of Parliament in the budget enactment:

- A money bill or finance bill dealing with taxation must be introduced only in the Lok Sabha (Article 109).

- The Rajya Sabha has no power to vote on demands for grants; it is the exclusive privilege of the Lok Sabha (Article 113).

- The Rajya Sabha should return the money bill (or finance bill) to the Lok Sabha within fourteen days. The Lok Sabha can either accept or reject the recommendations made by the Rajya Sabha in this regard (Article 109).

- Separate Estimates for Consolidated Fund of India: The budget’s estimates of expenditure must separately show the expenditure charged on the Consolidated Fund of India and the expenditure made from it (Article 112).

- Distinction Between Revenue and Other Expenditures: The budget must distinguish expenditure on revenue accounts from other expenditures (Article 112).

- Discussion on Consolidated Fund of India: Expenditure charged on the Consolidated Fund of India is not subject to the vote of Parliament but can be discussed by the Parliament (Article 113).

- Demands for Grants: The Lok Sabha can approve, refuse, or reduce any demand but cannot increase it (Article 113).

- Restrictions on Amendments to Appropriation Bill: No amendment can be proposed to the appropriation bill that alters the amount or destination of any grant voted or changes the amount of any expenditure charged on the Consolidated Fund of India (Article 114).

- Vote on Account: The Lok Sabha can make a grant in advance (Vote on Account) in respect to the estimated expenditure for a part of the financial year pending the completion of voting for demands for grants and the enactment of the appropriation bill (Article 116).

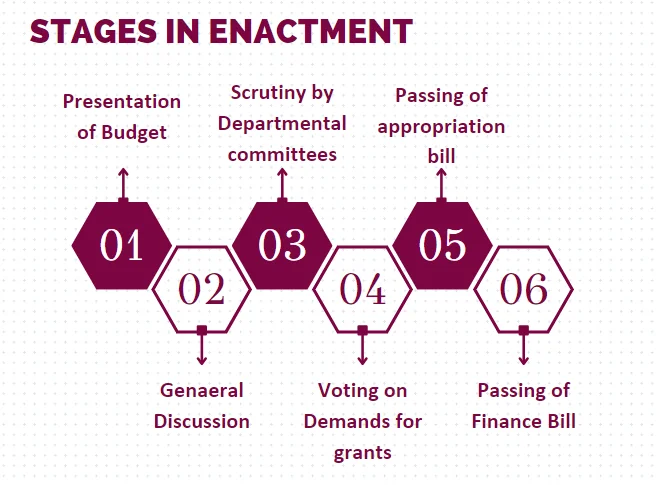

Presentation of Budget in the Parliament

Budget Presentation Date: Traditionally, the finance minister used to present the budget to the Lok Sabha on the last working day of February.

- However, since 2017, the budget presentation has been moved up to the 1st of February.

-

- Presentation in Parts: Alternatively, the Budget can be presented in two or more parts.

- In such cases, each part is treated as if it were the complete budget.

- Notably, there is no discussion on the budget on the day it is presented to the House.

- Budget Speech: The finance minister introduces the budget along with a speech referred to as the ‘budget speech.’ After the speech in the Lok Sabha, the budget is placed before the Rajya Sabha.

- Role of Rajya Sabha: The Rajya Sabha can discuss the budget but lacks the authority to vote on the demands for grants.

- Important Documents Tabled: Some important documents that are tabled at the time of presentation of the Union Budget include the following:

- Presentation in Parts: Alternatively, the Budget can be presented in two or more parts.

- Budget Speech

- Annual Financial Statement

- Demands for Grants

- Appropriation Bill

- Finance Bill

- Statements mandated under the FRBM Act:

-

- (a) Macro-Economic Framework Statement

- (b) Fiscal Policy Strategy Statement

- (c) Medium Term Fiscal Policy Statement

-

- Expenditure Budget

- Receipts Budget

- Expenditure Profile

- Memorandum Explaining the Provisions in the Finance Bill

- Budget at a Glance

- Outcome Budget ( Output-outcome monitoring framework)

- Economic Survey: The Economic Survey was traditionally presented to the Parliament concurrently with the budget.

- However, the current practice involves presenting it a day or a few days before the budget presentation.

- Preparation and Purpose: Prepared by the finance ministry, this report provides an overview of the current state of the national economy.

General Discussion

Commencement of Budget Discussion: The comprehensive discussion on the budget typically commences a few days following its presentation.

- This discourse occurs in both Houses of Parliament and typically spans three to four days.

- Scope of Discussion in Lok Sabha: Throughout this phase, the Lok Sabha has the liberty to deliberate on the budget in its entirety or focus on any fundamental question related to it.

- Restrictions on Proposing Cut Motions: However, no cut motion can be proposed, and the budget cannot be subjected to a vote.

- General Response by the Finance Minister: The Finance Minister retains the right to provide a general response at the conclusion of the discussion.

Scrutiny by Departmental Committees

- Adjournment of Houses After Budget Discussions: Following the conclusion of the general budget discussions, the Houses go into adjournment for approximately three to four weeks.

- Examination of Demands for Grants: During this interim period, the Parliament’s 24 departmental standing committees thoroughly examine and discuss the demands for grants associated with the respective ministers.

- Formulation of Detailed Reports: Subsequently, they formulate detailed reports on these matters, which are then presented for consideration to both Houses of Parliament.

- Enhancement of Parliamentary Financial Oversight: The standing committee system, initiated in 1993 and expanded in 2004, enhances the Parliamentary financial oversight of ministries by providing a more detailed, close, in-depth, and comprehensive examination.

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

The Parliamentary budget process, governed by constitutional provisions, ensures a thorough examination of the government’s financial plans.

- Through presentations, discussions, and committee scrutiny, the budget facilitates informed decision-making and effective oversight by Parliament.

- This structured approach not only upholds democratic principles but also fosters fiscal responsibility and economic stability in India.

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

| Related Articles | |

| Houses of Parliament | Money Bill (Article 110) |

| Fiscal Deficit Management | Parliament Budget Session 2024 Live Updates |

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program