The 15th Finance Commission, constituted on November 27, 2017, under the chairmanship of NK Singh, played a crucial role in redefining fiscal federalism in India. This came in the wake of significant economic changes, such as the abolition of the Planning Commission and the introduction of the Goods and Services Tax (GST). The Commission’s recommendations focused on the devolution of taxes and various fiscal matters, aiming to ensure fair distribution of resources across the country.

The 15th Finance Commission: An Overview of Recommendations and Implications

Role and Establishment

- Role: The Finance Commission is a constitutional body established by the President of India to provide recommendations on financial relations between the central and state governments.

- Constitution of the Fifteenth Finance Commission: The Government of India, with the approval of the Hon’ble President, established the Fifteenth Finance Commission on November 27, 2017, under Article 280 of the Constitution and the Finance Commission Act, 1951.

- The Commission will provide recommendations for a five-year period starting from April 1, 2020.

- Commission Leadership

-

-

- Chairman: Shri N.K. Singh, former Member of Parliament and Secretary to the Government of India.

-

- Members:

-

-

-

- Shri Shaktikanta Das, former Secretary to the Government of India

- Dr. Anoop Singh, Adjunct Professor at Georgetown University

-

-

- Part-time Members:

-

-

-

- Dr. Ashok Lahiri, Chairman (Non-executive, part-time) at Bandhan Bank

- Dr. Ramesh Chand, Member of NITI Aayog

- Secretary: Shri Arvind Mehta

-

-

- Reports Submitted by the 15th Finance Commission

- First Report: Recommendations for the 2020-21 financial year, submitted to Parliament in February 2020.

- Final Report: Recommendations for the 2021-26 period, submitted to Parliament on February 1, 2021.

Enroll now for UPSC Online Course

Key Recommendations for 2021-26

- Share of States in Central Taxes: The 15th Finance Commission recommended that the share of states in central taxes for the 2021-26 period be 41%, the same as for 2020-21.

- This is a decrease from the 42% share recommended by the 14th Finance Commission for the 2015-20 period.

- The 1% reduction accounts for the resources allocated to the newly formed union territories of Jammu and Kashmir and Ladakh.

- Vertical and Horizontal Devolution by the 15th Finance Commission

- Vertical Devolution: It recommended maintaining the vertical devolution at 41% – the same as in the report for 2020-21.

- This vertical devolution is less than the 42% share recommended by the Finance Commission-XIV for 2015-20 period.

- The adjustment of 1% is to provide for the newly formed union territories of Jammu and Kashmir, and Ladakh from the resources of the centre.

- Horizontal Devolution

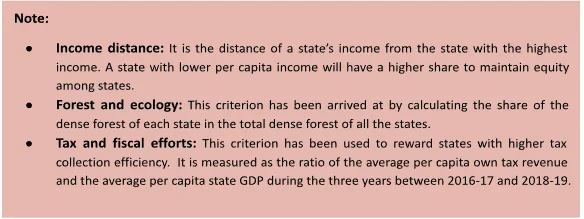

- In determining the criteria for horizontal sharing it seeks to harmonise the principles of expenditure needs, equity and performance by broadly assigning appropriate weightages.

- The need-based principles include the criteria of population, area, forest and ecology.

- The equity based principles envisage income distance.

- In respect of the performance criteria, it assigned weightages to demographic performance as well as tax and fiscal efforts.

Horizontal Devolution Criteria and Weights

| Criteria | 14th Finance Commission 2015-20 | 15th Finance Commission 2021-26 |

| Population (1971) | 17.5 | – |

| Population (2011) | 10 | 15 |

| Area | 15 | 15 |

| Forest cover | 7.5 | – |

| Forest & ecology | – | 10 |

| Demographic performance | – | 12.5 |

| Income Distance | 50 | 45 |

| Tax & fiscal efforts | – | 2.5 |

- Grants

- Revenue deficit Grant: “Revenue deficit” is defined as the difference between revenue or current expenditure and revenue receipts, that includes tax and non-tax revenue.

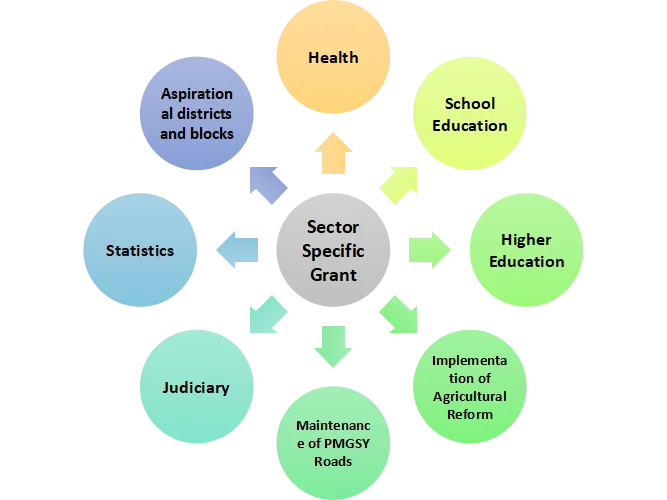

- Sector-specific Grants: A portion of these grants will be performance-linked.

-

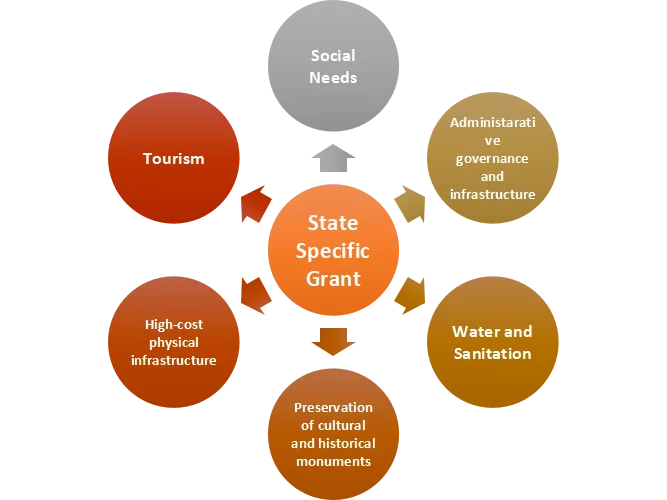

- State-specific Grants: The Commission recommended a high-level committee at state level to review and monitor utilisation of state-specific and sector-specific grants.

-

- Grants to Local Governments: Grants to local governments (other than health grants) will be distributed among states based on population and area, with 90% and 10% weightage, respectively.

- No grants will be released to local governments of a state after March 2024 if the state does not constitute the State Finance Commission and act upon its recommendations by then.

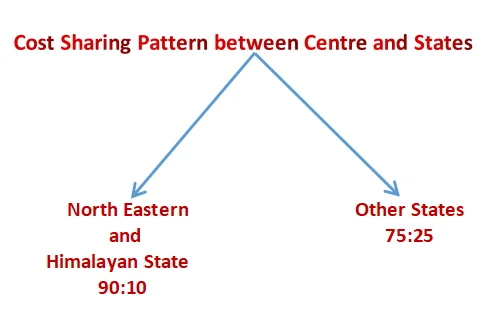

- Grants for Disaster Management: The Commission recommended retaining the existing cost-sharing patterns between the centre and states for disaster management funds.

Fiscal Roadmap

- Framework for Public Financial Management: The commission recommended the development of a comprehensive framework for Public Financial Management.

- Establishment of an Independent Fiscal Council: An independent Fiscal Council (only having an advisory role) should be established with powers to assess records from the centre as well as states.

- Amendments to Fiscal Responsibility Legislation: States should amend their fiscal responsibility legislation to ensure consistency with the centre’s legislation, in particular, with the definition of debt.

Other Recommendations

- Health: It recommended that states should increase spending on health to more than 8% of their budget by 2022.

- Primary healthcare expenditure should be 2/3rd of the total health expenditure by 2022.

- All India Medical and Health Service should be established.

- Defence: A dedicated non-lapsable fund called the Modernisation Fund for Defence and Internal Security (MFDIS) will be constituted to primarily bridge the gap between budgetary requirements and allocation for capital outlay in defence and internal security.

Positive Implications of the 15th FC’s Recommendations

- Demographic Performance and Resource Distribution:

- Reward for Socio-Economic Development: States emphasising socio-economic development are rewarded through horizontal devolution of taxes by considering demographic performance criteria and reducing weightage for distance-to-income.

- Weightage Shift to Demography: The reduced weightage for demographic performance (12.5%) compared to the 1971 population factor (17.5%) and the increased emphasis on the 2011 population highlight the importance of demography in resource distribution.

- Urban Development and Public Services: Million-plus cities receive challenge funds to promote performance-linked grants to Urban Local Bodies (ULBs), incubation of new cities, and shared municipal services, enhancing urbanisation with good governance and improved public services.

- Resource Mobilization and Fiscal Management: States with higher tax collection efficiency are rewarded using tax and fiscal efforts criteria, encouraging resource mobilisation and improved fiscal management.

- Fiscal Management Enhancement: The creation of a fiscal council, as recommended by the 15th and 14th Finance Commissions, can enhance fiscal management and contribute to achieving debt sustainability.

Negative Implications of the 15th FC’s Recommendations

- Resource Allocation: Some states argue that the Commission’s resource allocation formula favours certain states at the expense of others, potentially leading to economic imbalances.

- Population Data: The use of the 2011 census data for resource allocation has been contested, as it disadvantages states that have effectively controlled their population growth.

- This may discourage population control efforts.

- Centralization: Critics believe that the Commission’s recommendations, such as the formation of high-level committees at the state level, may strengthen the central government’s authority.

- These high-level committees are intended to review and monitor the utilization of state-specific and sector-specific grants, which some argue could undermine the power of state governments.

- This shift in power dynamics is seen as a potential threat to fiscal federalism, as it may reduce the autonomy of state governments in managing their finances.

- Reduced Grants: Some states have expressed concerns that their share of central tax grants has been reduced, impacting their fiscal autonomy and development projects.

- Lack of Data Transparency: Concerns have been raised about the transparency of the Commission’s data and methodology, which can affect the credibility of its recommendations.

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

The 15th Finance Commission’s recommendations have both positive and negative implications. While it promotes socio-economic development and improved fiscal management, some states feel disadvantaged by the resource allocation formula and the use of 2011 census data.

- The formation of high-level committees and reduced grants have also raised concerns about centralization and fiscal autonomy.

- Despite these challenges, the Commission’s efforts contribute significantly to the fiscal stability and equitable resource distribution in India.

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program