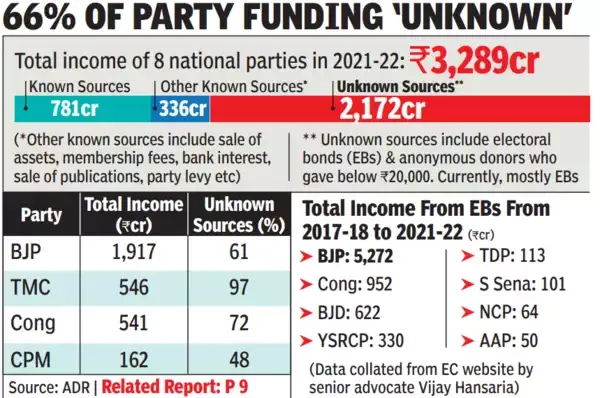

Electoral Bonds are financial instruments introduced by the Indian government in 2017 to facilitate anonymous donations to political parties. Issued by the State Bank of India, these bonds aim to enhance transparency in political funding while preserving donor anonymity. Eligible political parties can encash these bonds through their designated bank accounts. This system, however, has sparked debate over its potential impact on transparency and fairness in the electoral process.

Enroll now for UPSC Online Course

Electoral Bonds in India: A Controversial Path to Political Funding Reform

Overview and Eligibility Criteria for Electoral Bonds in India

- Purpose of Electoral Bonds: The electoral bonds are financial instruments introduced by the Government of India as a means for individuals, companies, and unions to make donations to registered political parties while maintaining donor anonymity.

- Implementation: It was introduced in 2017 by way of a Finance bill and it was implemented in 2018.

- Authorised Issuer: State Bank of India (SBI) is the authorised issuer.

- Eligibility of Political Parties: The political parties eligible to receive electoral bonds are

- Parties who are registered under Section 29A of the Representation of the People Act, 1951

- Secured not less than 1% of the votes polled in the last general election to the Lok Sabha or the Legislative Assembly.

Features of Electoral bonds

- Nature of the Bonds: Electoral Bonds are bearer instruments, functioning as promissory notes, and are interest-free banking instruments.

- They can be purchased by Indian citizens or entities incorporated in India.

- Denominations and Purchase: Electoral Bonds can be issued and purchased in the following denominations: ₹1,000, ₹10,000, ₹1,00,000, ₹10,00,000, and ₹1,00,00,000.

- These can be obtained from specified branches of the State Bank of India (SBI).

- KYC Compliance and Usage

-

-

- To purchase Electoral Bonds, buyers must comply with all existing KYC norms and make payments from a bank account.

- The bonds do not carry the name of the payee.

- Payable to the bearer on demand and interest-free.

- Purchased by Indian citizens or entities established in India.

- Can be bought individually or jointly with other individuals.

- They are valid for only 15 days and can be used for donations exclusively to political parties registered under Section 29A of the Representation of the People Act, 1951, which received at least 1% of the votes in the last general election.

-

- Purchase Period: Electoral Bonds are available for purchase for 10 days in January, April, July, and October, as specified by the Central Government.

- In the year of a General Election to the House of People, an additional 30-day purchase period will be allowed.

-

-

- Electoral Bonds can be purchased digitally or through cheques.

- Parties must disclose their bank account with the Election Commission of India.

-

- Encashment by Political Parties: Eligible political parties can encash the bonds only through a designated bank account with an authorized bank.

Benefits of Electoral Bonds

- Transparency: It enhances transparency in political party funding.

- The donations are made through banking channels, which ensures transparency and political parties are obligated to explain utilisation of the funds received.

- Accountability: The parties disclose their bank account donation utilisation with the Election Commission of India.

- Parties must disclose their bank account

- Discouragement of cash transactions: Electoral Bonds can be purchased digitally or through cheques.

- Preservation of donor anonymity.

Legal Framework for the Electoral Bond Scheme

- Introduction of Foreign Donations: On May 14, 2016, the Finance Act, 2016 came into effect, amending the Foreign Contribution Regulation Act (FCRA) of 2010.

- This change allowed foreign companies with a majority share in Indian companies to donate to political parties, lifting the previous prohibition.

- Subsequent Amendments: On March 31, 2017, the Finance Act, 2017 introduced several key amendments:

-

-

- Income Tax Act: It exempt political parties from maintaining detailed records of contributions received through electoral bonds.

- Reserve Bank of India Act: It grants the Union government the authority to authorize any scheduled bank to issue electoral bonds.

- Representation of the People Act: It added a provision to Section 29C, exempting political parties from disclosing contributions received through electoral bonds in their “Contribution Reports,” which are required for donations over ₹20,000.

- Companies Act: Removing the limit on corporate donations to political parties, which was previously capped at 7.5% of the company’s average net profit over three years.

-

- Challenges to the Amendments: Shortly after the amendments were made, two NGOs—Association for Democratic Reforms (ADR) and Common Cause—along with the Communist Party of India (Marxist), filed petitions in the Supreme Court in September 2017 and January 2018.

- Legal Grounds for Challenge: The petitions contended that the Finance Acts were improperly passed as money bills to evade closer scrutiny by the Rajya Sabha.

- This challenge is part of a broader dispute regarding the use of money bills under Article 110.

- Concerns Raised: The petitioners argued that the electoral bond scheme fostered “non-transparency in political funding” and legitimized electoral corruption on a large scale.

Challenges of Electoral Bonds

- Donor identity is anonymous: The donors’ identities are hidden to political parties.It may compromise about “Right to Know”, which is a part of the right to freedom of expression under Article 19 of the Constitution.

- Anonymity may be compromised by government access to donor data.

- It implies that the government in power can leverage this information and disrupt free and fair elections.

- Rise of Crony capitalism: It may lead to risk of crony capitalism and infusion of black money.

- Loopholes in Companies Act: There is a loophole in Companies Act,2013 regarding transparency for corporate entities and donation limits.

- A company can make a political contribution only if its net average profit of three preceding financial years is at 7.5%.

- The removal of this clause along with the advent of Electoral bonds has raised concerns of black money in political funding through shell companies.

- Changes to Previous Restrictions: The introduction of electoral bonds removed several restrictions:

-

-

- Foreign companies were previously prohibited from donating to political parties.

- Companies had to disclose political donations in their annual accounts.

- With the electoral bond scheme, any company—Indian or foreign—can now donate to political parties without disclosure.

-

- Supreme Court’s Stance on Electoral Bonds: On April 12, 2019, the Supreme Court instructed political parties to report donations received through electoral bonds to the Election Commission of India (ECI).

- It also proposed reducing the bond purchasing window from 10 days to 5 days.

Supreme Court Ruling in 2024

|

- Election Commission of India’s Position: The Election Commission expressed support for electoral bonds but opposed anonymous donations.

- During court hearings, they emphasized the need for full disclosure and transparency regarding donations.

- Reserve Bank of India’s Concerns: The Reserve Bank of India (RBI) criticized the electoral bond scheme, warning that it could undermine trust in Indian banknotes and promote money laundering.

Ongoing Debate on Political Fundraising

- The ideal approach to control political fundraising in India will probably remain a topic of discussion and debate among the general public, even after the Supreme Court’s ruling.

- Stakeholder Involvement: A wide range of stakeholders, including the public, specialists, political parties, and civil society organisations, should be involved in this conversation.

- Goals for the Future: Creating an accountable, transparent system that provides equal opportunities for all political actors should be the aim.

- Complexity of the Issue: It is crucial to remember that there isn’t a single, universally applicable answer to the electoral bond problem.

- A number of variables, such as the ruling of the Supreme Court, the stance of the administration, and public opinion, will determine the best course of action.

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

The introduction of Electoral Bonds has stirred a debate on political funding transparency and donor anonymity in India.

- While they offer benefits like reduced cash transactions and improved funding transparency, concerns about government access to donor information and the risk of crony capitalism remain.

- The Supreme Court’s stance and public discourse will shape the future of this political fundraising mechanism. Creating a balanced system that ensures accountability and fairness for all political actors is essential.

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program