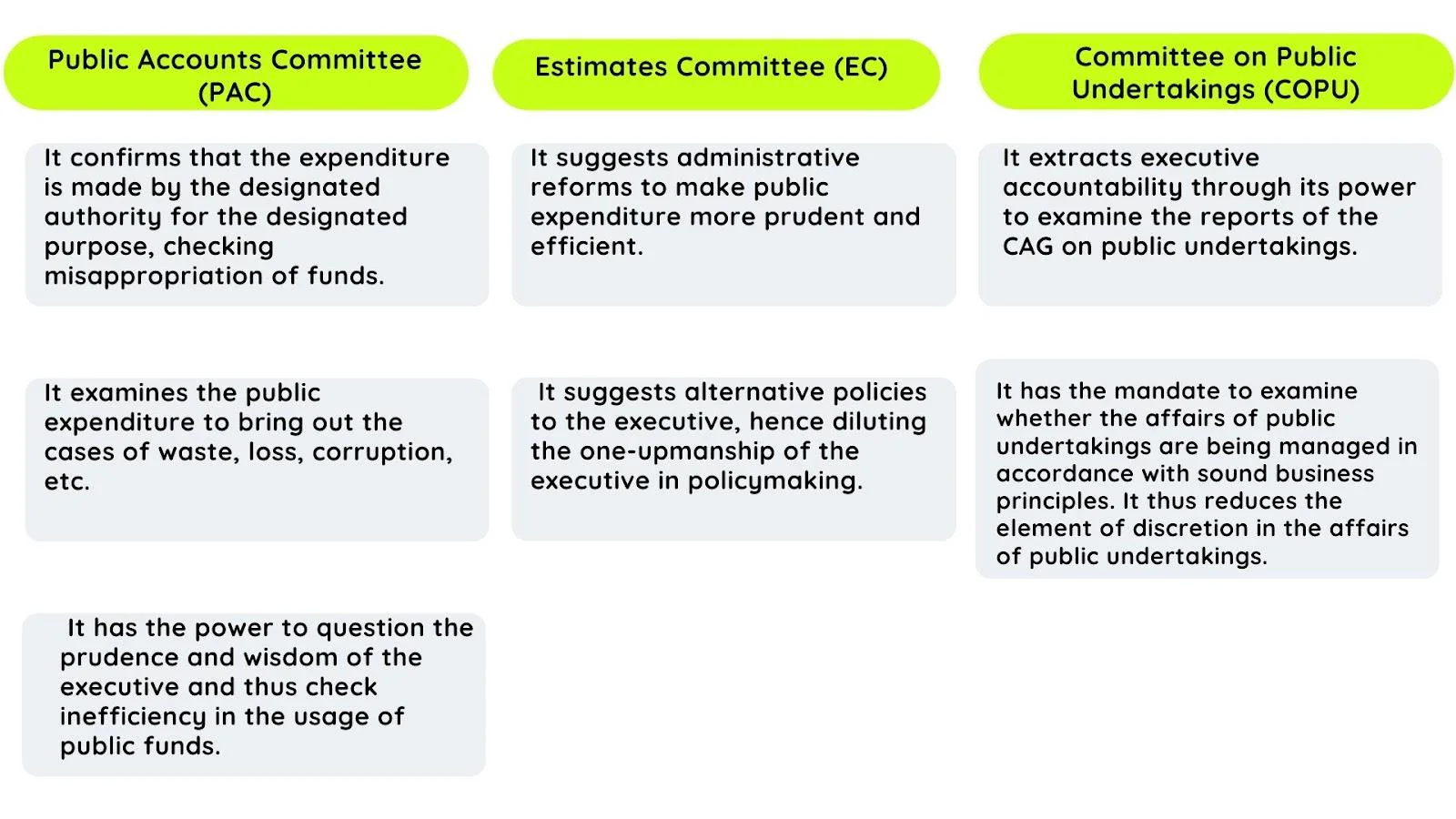

Financial committees are essential for ensuring executive accountability within the parliamentary system. The three primary financial committees—the Public Accounts Committee, the Estimates Committee, and the Committee on Public Undertakings—play pivotal roles in scrutinizing government expenditure and financial decisions. These committees work to enhance transparency, efficiency, and fiscal prudence in government operations.

Enhancing Accountability: The Role and Challenges of Financial Committees in India

Public Accounts Committee

-

- Historical Background: This committee was set up on recommendations of the Montague-Chelmsford Report.

- It was first set up in 1921, making it one of the oldest parliamentary committees in India.

- Historical Background: This committee was set up on recommendations of the Montague-Chelmsford Report.

- Functions:

- Examination of Appropriation Accounts: It examines the appropriation accounts and reports of the CAG related to the expenditures incurred by the government.

- Ensuring Proper Use of Funds: It ensures that the funds granted by Parliament are used for the purposes for which they were allocated.

- Scrutiny of Audit Reports: The committee scrutinizes the audit reports prepared by the CAG, highlighting instances of financial irregularities, waste, or inefficiency in government spending.

- Government Accountability: It plays a crucial role in holding the government accountable for its financial decisions and actions.

- Principles of Fiscal Prudence: It aims to ensure that public money is spent efficiently, economically, and in accordance with the principles of fiscal prudence.

- Reporting to Parliament: PAC submits its reports to Parliament, containing its findings, recommendations, and observations.

- Government Response: The government is required to respond to these reports, and Parliament may consider the committee’s recommendations for policy improvements.

Enroll now for UPSC Online Course

Estimates Committee

- Historical Background: It was set up on recommendations of the John Mathai Committee, in 1947 after independence.

- Functions:

- Examination of Budget Estimates: The committee thoroughly examines the budget estimates presented by the government, focusing on the justification of expenditures proposed in various departments.

- Assessment of Expenditure Justification: It assesses whether the money is well laid out within the limits of the policy implied in the estimates.

- Evaluation of Government Spending: The committee looks into the economy, efficiency, and effectiveness of government spending.

- Reporting to the Lok Sabha: The Estimates Committee presents its reports to the Lok Sabha, highlighting its findings and observations on the budget estimates.

- Insights into Fund Allocation: These reports are instrumental in providing valuable insights into the allocation and utilization of funds.

- Recommendations for Policy Improvement: The committee makes recommendations for improving the policies and administration in the areas examined.

Committee on Public Undertakings

- Historical Background: It was created in 1964 on the recommendation of the Krishna Menon Committee.

- Functions:

- Examination of Reports and Accounts: The committee examines the reports and accounts of public undertakings to ensure financial prudence and effective utilization of resources.

- Accountability of Public Undertakings: It holds public undertakings accountable for their performance and adherence to prescribed norms and guidelines.

- Evaluation of Efficiency and Economy: The committee evaluates the efficiency and economy in the administration of public undertakings, recommending measures for improvement.

- Performance Audit: It conducts a performance audit of selected public undertakings to assess their achievements against predetermined objectives.

- Recommendations for Improvement: Based on its examinations, the committee makes recommendations for enhancing the functioning, profitability, and overall efficiency of public undertakings.

Hurdles in Effective Functioning

Certain hurdles remain in their effective functioning, such as:

- Post-Mortem Examination: The committees usually perform a post-mortem examination of the accounts.

- By the time committees make their scrutiny, the executive has already made the expenditure.

- Delayed Reporting: Reports of the committees are often not tabled before the parliament or are tabled with considerable delays, reducing their efficacy.

- Advisory Nature of Recommendations: Its recommendations are largely only advisory in nature.

- This is a serious limitation on the ability of the committees to hold the executive accountable.

- Conflict of Interest: Parliament, dominated by the executive, has the authority to take action on the reports of the committees, creating a conflict of interest.

- Lack of Technical Expertise: The committees lack the technical expertise and manpower to critically scrutinize the public expenditure made by the executive.

Steps to Improve Efficacy of Financial Committees

To improve the efficacy of these committees we need to take comprehensive steps like:

- Adequate Secretarial Staff: The committees should be provided with adequate secretarial staff. Also, expert guidance on technical matters must be made available.

- Timely Tabling of Reports: The reports of the committees should be mandatorily tabled before the parliament on a timely basis.

- Extended Duration: Their duration may be extended beyond a year to enable more prolific scrutiny of public expenditure.

- Fixed Schedule: The schedule of the committees must be fixed, to ensure devoted time on matters of public importance.

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

Despite their significant role in maintaining fiscal oversight, financial committees face challenges such as delayed reporting and limited technical expertise.

- Addressing these issues through better staffing, timely reporting, and extended tenures can enhance their effectiveness.

- Strengthening these committees is crucial for ensuring accountable and efficient governance.

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program