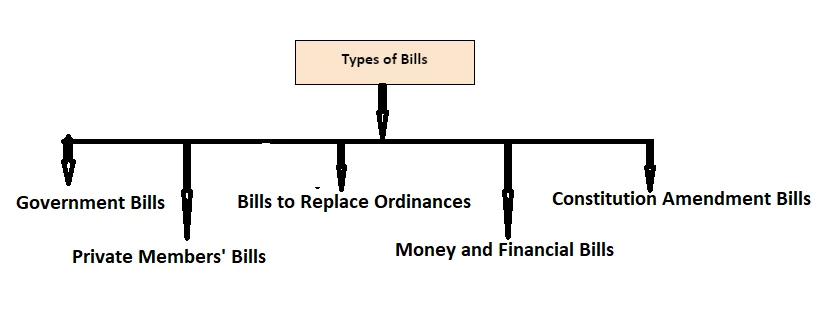

Understanding the different types of bills in the Indian Parliament is crucial for comprehending the legislative process. These bills, including Money Bills, Financial Bills, and Constitution Amendment Bills, have distinct procedures and significance. This section delves into these types, highlighting their specific characteristics and the legislative processes involved.

Understanding the Parliamentary Bills

Why the Special Treatment for Money Bills?

- Purview of the Lok Sabha: A Money Bill is completely within the purview of the Lok Sabha.

- Role of the Rajya Sabha: The Rajya Sabha plays a recommendatory role in such bills, and its input can be overridden by the Lok Sabha.

- Justification for Lok Sabha’s Dominance: This dominance is justified because the provisions of a Money Bill exclusively pertain to financial matters critical for the administration of the country.

- Speaker’s Authority: The Speaker of the Lok Sabha has the final say on whether a bill is a money bill. This decision is not challengeable in any court or by either House of the Parliament.

- Since the elected government, enjoying a majority in the Lok Sabha, is accountable for the administration, the Constitution outlines this distinctive procedure for Money Bills, requiring only the approval of the Lok Sabha. It’s crucial to note that the defining characteristic in the below definition is the term “only.” Hence, bills focusing solely on financial matters, as per the definition, are categorized as Money Bills.

Enroll now for UPSC Online Course

Aadhaar Judgment of 2018:

|

Financial Bills

- Introduction to Financial Bills: Besides Money Bills, as defined under Article 110(1) with a special procedure for passage, the Constitution, under Article 117, outlines Financial Bills that also address financial matters.

- Financial Bills of Category A: A Financial Bill of Category A (or Category I) includes provisions related to matters specified in Article 110(1) and other matters of general legislation (Art 117).

- Distinction Between Money Bills and Financial Bills: It’s essential to note that a Bill dealing only with matters specified in 110(1) is a Money Bill, whereas a Bill addressing those matters along with other general issues is a Financial Bill of Category A.

- For instance, a Bill focused on land acquisition for government projects may also cover provisions regarding borrowings by the Government of India to meet the acquisition’s cost.

- This falls under a Financial Bill of Category A as it involves provisions related to borrowings (110(1)(b)] along with land acquisition procedures.

- Distinction Between Financial Bill and Financial Bill B

| Aspect | Financial Bill A of Category A | Financial Bill of Category B |

| Introduction | Only in Lok Sabha, on President’s recommendation | Either in Lok Sabha or Rajya Sabha, without President’s recommendation during introduction |

| Article Reference | Article 117 (1) | Article 117 (3) |

| Contents | Includes matters specified in Article 110(1) and other general legislation | Involves expenditure from the Consolidated Fund of India, but does not include matters specified in Article 110(1)(a) to (f) |

| Example | Bill involving borrowings by Government of India and land acquisition procedures | President’s Emoluments and Pension Act providing facilities like free travel and telephone to retired Presidents |

| Post-Passage Treatment | Treated like an ordinary bill; Rajya Sabha has no restrictions | Follows the standard procedure for any ordinary bill |

| Resolution of Disagreements | Joint sitting | Joint sitting |

| President’s Recommendation | Required for introduction in Lok Sabha | Required before consideration in the house where it is introduced. |

Constitution Amendment Bills

- Introduction of Constitution Amendment Bills: A Constitution Amendment Bill may be introduced in either House.

- Passage Requirements: It is required to be passed by more than 50% of the total membership of each House and at least two-thirds of the members present and voting.

- There is no provision of Joint session.

- Ratification by State Legislatures: Certain Bills (such as those amending the list of subjects in the Union / State / Concurrent List) also have to be ratified by at least 50% of the state legislatures by simple majority.

- For example, the 2016 Constitution Amendment Bill introducing GST was ratified by more than 50% of the states. Constitutional amendments bills are dealt in the chapter “The Making of the Constitution”.

- Presidential Assent: The President is bound to give his assent to the bill if it has been passed in accordance with the provisions of Article 368.

Ordinance Replacing Bills

What is an Ordinance?

- Definition: A law issued by the President when Parliament is not in session and immediate action is needed.

- Nature: Emergency power for emergent situations.

- Example: 2011 ordinance for IIIT – Kancheepuram’s national importance status.

Ordinance Procedure When Parliament Meets

- Laying Before Parliament: Within 6 weeks of Parliament’s first sitting.

- Outcome: Parliament can pass it into law or let it lapse.

- Bill Introduction: Government introduces a Bill explaining the ordinance’s necessity.

Ordinance Replacing Bills

-

- Purpose: Ordinance Replacing Bills are brought before Parliament to replace an Ordinance, with or without modifications, promulgated by the President under article 123 of the Constitution of a subject.

- Requirement: Passed by Parliament and assented to by the President within six weeks of Parliament’s reassembly.

- Example: Criminal Law (Amendment) Ordinance 2013

- Issued: February 3, 2013.

- Amends: Indian Penal Code, Criminal Procedure Code, Indian Evidence Act.

- Context: Example used to explain ordinances, their creation, and usage.

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

In conclusion, Money Bills, Financial Bills, and Constitution Amendment Bills play crucial roles in the Indian legislative framework.

- Each type follows specific procedures and has distinct implications for governance.

- Recognizing these differences enhances our understanding of the legislative process and its impact on the country’s administration.

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

| Related Articles | |

| Indian Parliament | Money Bill (Article 110) |

| Aadhaar Card is Not Proof of Citizenship and Date of Birth | Major Constitutional Amendments: Evolution of India’s Constitution |

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program