Bills are legislative proposals presented to the Indian Parliament in draft form. They follow a specific format and include essential components like titles, clauses, and schedules. Depending on their nature and purpose, bills are categorized into various types, including Ordinary Bills, Money Bills, Financial Bills, and Constitution Amendment Bills. Understanding these categories helps in comprehending the legislative process in India.

Understanding the Types of Bills in Indian Parliament

Bills in the Indian Parliament: An Overview

- Introduction to Legislative Proposals: All legislative proposals in India are presented to Parliament in the form of bills.

- A bill is essentially a statute in draft form and must follow a specific format, including elements such as long and short titles, enacting formula, date of commencement, and extent of application.

- Structure of a Bill: It is structured into clauses, sub-clauses, and items, and may also contain schedules.

- Besides these standard components, a bill must be accompanied by several important documents to provide a comprehensive understanding of its purpose and implications.

Enroll now for UPSC Online Course

Components of a Bill

Statement of Objects and Reasons: This section outlines the aims and purposes of the proposed legislation, providing a rationale for why the bill is necessary.

- Memorandum Regarding Delegated Legislation: This indicates any delegation of power to a subordinate authority to make rules and regulations, explaining how the bill’s provisions will be implemented.

- Financial Memorandum: This contains details on the financial aspects of the bill, including potential costs and funding sources if the bill is enacted.

- Presidential Recommendation: Some bills require the President’s recommendation for introduction or consideration, ensuring executive oversight on significant legislative proposals.

- Annexure: For bills amending existing laws, the sections proposed for amendment are reproduced in an annexure.

- This helps lawmakers compare the current and proposed texts.

- Arrangement of Clauses: If a bill contains more than 25 clauses, an arrangement of clauses is appended to help navigate the bill’s provisions.

- However, this is not required for amending bills.

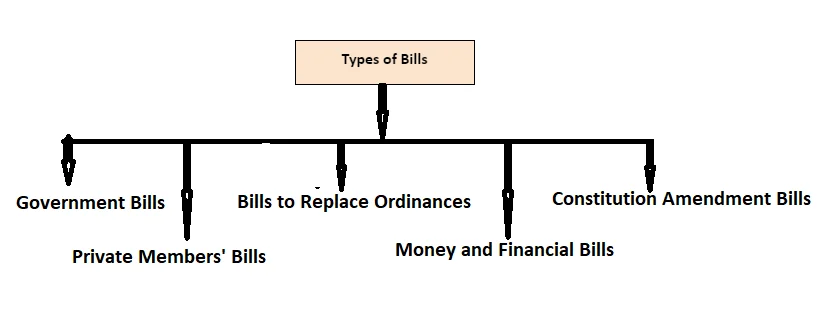

Categories of Bills

Bills in the Indian Parliament can be categorized based on their origin, purpose, and procedural requirements:

- Government Bills: Initiated by Ministers, these bills represent the government’s legislative agenda and are typically backed by substantial political support.

- Private Members’ Bills: Introduced by members of Parliament who are not Ministers, these bills allow individual MPs to propose legislation.

- Although they rarely become law, they highlight issues and can influence government policy.

- Bills to Replace Ordinances:

- When Parliament is not in session, the President can promulgate ordinances.

- These bills are introduced to replace such ordinances once Parliament reconvenes, ensuring continuity and legal validity.

- Money and Financial Bills:

- Governed by specific constitutional provisions, these bills deal with financial matters like taxation and government expenditure.

- Money Bills can only be introduced in the Lok Sabha and have a distinctive passage procedure, while Financial Bills can be introduced in either House but also involve financial provisions.

- Constitution Amendment Bills:

- These bills proposed changes to the Constitution and required a special procedure for passage, including a higher threshold of approval in both Houses and, in some cases, ratification by state legislatures.

Ordinary Bills

Definition: Ordinary Bills are legislative proposals that deal with a wide range of subjects and are not classified as Money Bills, Financial Bills, or Constitution Amendment Bills.

- They are the most common type of legislation introduced in Parliament

Key Features

-

- Introduction: Ordinary Bills can be introduced in either House of Parliament: the Lok Sabha or the Rajya Sabha.

- They do not require the President’s recommendation for introduction.

- Introduction: Ordinary Bills can be introduced in either House of Parliament: the Lok Sabha or the Rajya Sabha.

- Procedure:

-

-

- Lok Sabha: If an Ordinary Bill is introduced in the Lok Sabha and passed, it is sent to the Rajya Sabha for consideration.

- The Rajya Sabha can suggest amendments, and the Lok Sabha can either accept or reject these suggestions.

- Rajya Sabha: If introduced in the Rajya Sabha, the procedure is similar.

- After passage, the bill is sent to the Lok Sabha for approval.

- Lok Sabha: If an Ordinary Bill is introduced in the Lok Sabha and passed, it is sent to the Rajya Sabha for consideration.

-

- Passage:

-

-

- An Ordinary Bill requires a simple majority in both Houses for passage.

- If there is a disagreement between the two Houses regarding the bill, it can be resolved through a joint sitting of Parliament.

-

- Assent: After passing both Houses, the bill is sent to the President for assent. The President can:

- Give assent to the bill.

- Withhold assent.

-

-

- Return the bill (if it is not a Money Bill) for reconsideration.

-

- Key Examples: Laws related to education, health, social welfare, and many other areas typically fall under Ordinary Bills.

Money Bills

Article 109 outlines a distinctive procedure for Money Bills, summarized as follows:

-

- Introduction of Money Bills: Money Bills cannot be introduced in the Council of States; they are exclusively introduced in the Lok Sabha.

- Presidential Recommendation: A Money Bill can only be introduced with the President’s recommendation (Article 117).

- Passage in the House of the People: After the House of the People passes a Money Bill:

-

- Certification and Transmission: It is sent to the Council of States for recommendations after it is certified as a money bill by the Speaker.

- Council of States’ Review: The Council of States must return the bill within 14 days, along with its recommendations.

- House of the People’s Consideration: The House of the People can accept or reject any or all of the Council of States’ recommendations.

- Acceptance and Non Acceptance of Recommendations: If the House of the People:

- Accepts any of the Council of States’ recommendations, the Money Bill is considered passed by both Houses with the accepted amendments.

- Does not accept any recommendations, the Money Bill is deemed to have passed both Houses in its original form, without the Council of States’ amendments.

- Non-Return Within 14 Days: If the Money Bill is not returned to the House of the People within 14 days, it is considered passed by both Houses in the form approved by the House of the People.

Definition and Scope of Money Bills

- Article 110 provides the definition of a Money Bill, stating that a bill shall be deemed as such if it contains provisions dealing solely with:

- Non-Money Bill Financial Provisions: However, a bill is not considered a Money Bill solely because it involves fines, pecuniary penalties, fees for licenses or services, or the regulation of taxes by a local authority for local purposes.

- Government Accounts in Money Bills: Therefore, a bill focusing solely on finance or audit matters falls under the category of a Money Bill.

- In this context, a brief explanation of the various accounts maintained by the Government, forming part of the definition of a Money Bill, is provided below.

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

In summary, the diverse types of bills in Parliament serve distinct purposes and follow unique procedures.

- From Ordinary Bills addressing a range of topics to specialized Money Bills and Constitution Amendment Bills, each plays a vital role in the legislative framework.

- Recognizing these differences enhances our understanding of the Indian legislative process and its impact on society.

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

| Related Articles | |

| Indian Parliament | Member of Parliament |

| State Legislature in India | Major Constitutional Amendments: Evolution of India’s Constitution |

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program