The Indian Constitution recognizes the unique needs of certain states by granting them special provisions. These provisions, rooted in historical injustices and cultural distinctiveness, aim to provide administrative autonomy and address the specific challenges faced by these regions. Special Category Status (SCS) is allocated based on criteria such as geographical challenges, economic backwardness, and strategic significance, reflecting the commitment to equitable development across the nation.

Special Category Status in India: Recognition and Implications

Background, Allocation, and Funding Mechanisms

-

- Special Provisions in the Indian Constitution: The Indian Constitution includes special provisions for certain states, recognizing the unique needs and circumstances of these regions.

- These provisions aim to address historical injustices, preserve cultural distinctiveness, and provide administrative autonomy to certain areas.

- The allocation of Special Category Status (SCS) to states in India was traditionally based on a set of criteria that primarily focused on recognizing the unique challenges faced by certain regions.

- Special Category Status:

- Origin: The concept of Special Category Status (SCS) was introduced in 1969 by the Planning Commission during the Fourth Five-Year Plan.

- Purpose: It aimed to provide higher plan assistance to certain states facing challenges due to their location and socio-economic factors.

- Objective: The main goal was to achieve balanced regional development across the country.

- Special Provisions in the Indian Constitution: The Indian Constitution includes special provisions for certain states, recognizing the unique needs and circumstances of these regions.

Enroll now for UPSC Online Course

- Initial Allocation

-

-

- First States: Initially, only three states—Jammu and Kashmir, Assam, and Nagaland—were granted this status.

- Expansion: Later, all northeastern states, as well as Uttarakhand and Himachal Pradesh, also received special category status.

-

- Funding Mechanism

-

-

- Plan Assistance: The National Development Council (NDC) allocated funds to states using the Gadgil formula, which gave more weight to population and economic deprivation.

- Reserved Funds: The formula reserved 30% of funds specifically for special category states (SCS).

-

- Recognition by Finance Commission

-

-

- Initial Recognition: The Finance Commission (FC) also acknowledged Jammu and Kashmir, Assam, and Nagaland as SCS in 1969.

- Budget Support: The Commission incorporated elements of the Gadgil formula to address the budget deficits of these states and to help design criteria for tax devolution.

- Increased Transfers: Since the Fifth Finance Commission in 1969, there has been a trend of higher per capita financial transfers to special category states.

-

- States with Special Category Status

- Current States: 11 states currently hold Special Category Status: Arunachal Pradesh, Assam, Himachal Pradesh, Jammu & Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, and Uttarakhand.

- Requests for Status: States such as Andhra Pradesh, Odisha, Rajasthan, Bihar, Chhattisgarh, Telangana, and Jharkhand have requested Special Category Status.

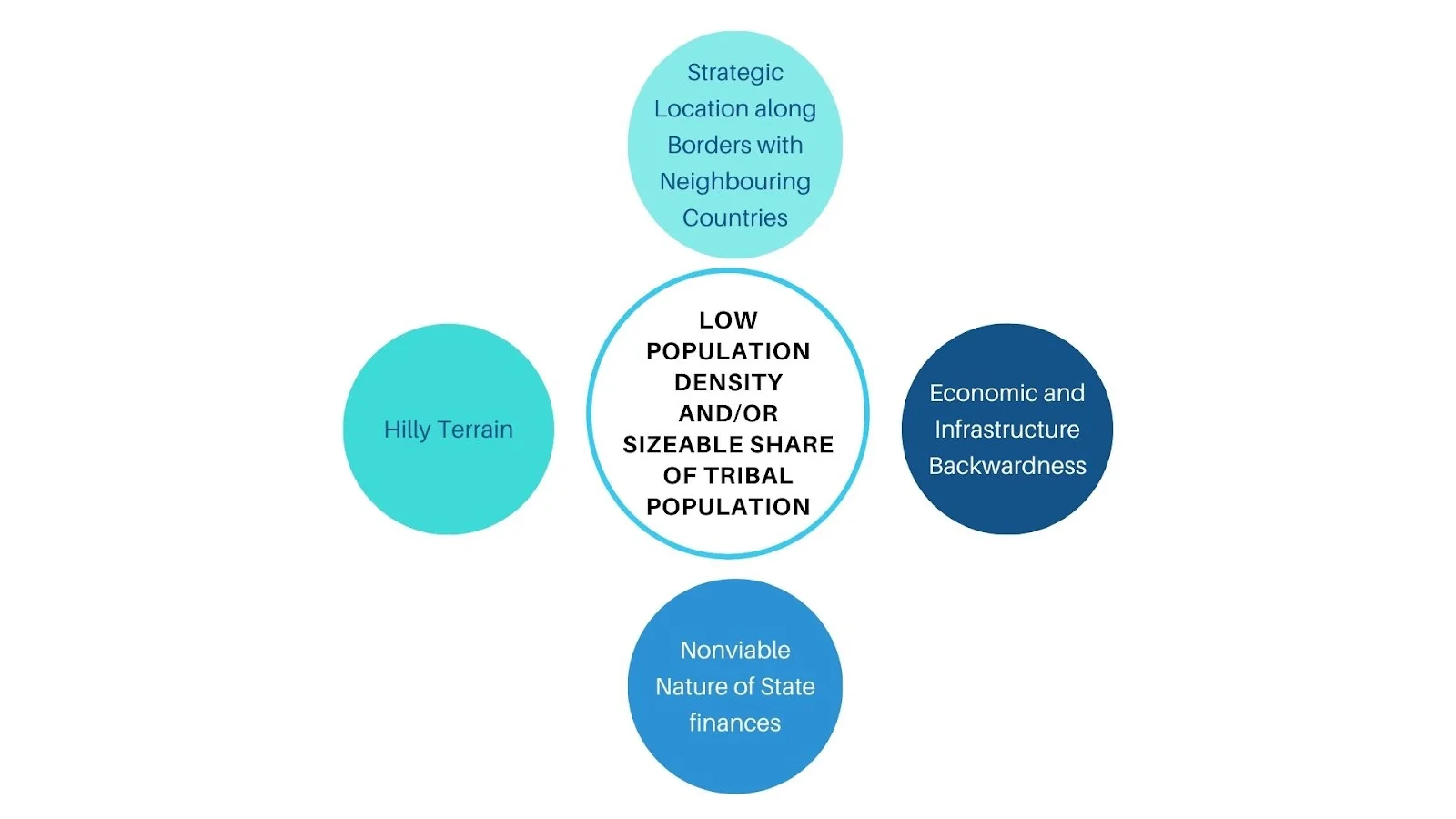

Special Category Status Criteria

Special Category Status for plan assistance has been previously granted by the National Development Council (NDC) to certain states that exhibit specific characteristics requiring special consideration. These characteristics include:

- Hilly and Difficult Terrain: States with a significant portion of hilly or difficult terrain were considered for SCS, as these geographical features pose challenges in terms of connectivity, infrastructure development, and higher costs of building infrastructure.

- Example – Himachal Pradesh

- Low Population Density or Sizeable Share of Tribal Population: States with low population density or a significant tribal population were given preference.

- This was because such areas often lag in socio-economic development and need special attention to uplift the standard of living of their indigenous communities.

- Example – Arunachal Pradesh

- Strategic Location along International Borders: States located along international borders were often considered for SCS to ensure their economic stability and security, as these areas are crucial from a national security perspective.

- Example: Jammu and Kashmir (before the constitutional changes in 2019)

- Economic and Infrastructural Backwardness: States lagging in economic development and lacking adequate infrastructure were prime candidates for SCS.

- This criterion was aimed at bridging the development gap between these states and more developed regions.

- Example: Uttarakhand

- Non-Viable State Finances: States with a weak financial position, which struggled to mobilize resources for their developmental needs, were also considered for this special status. This was to ensure that these states could maintain reasonable financial stability.

- Example: Manipur

Parameters of SCS: Based on Gadgil Formula

Benefits of Special Category Status

Funding Allocation: The Centre pays 90% of the funds required in a centrally-sponsored scheme to special category status states as against 60% or 75% in case of other states, while the remaining funds are provided by the State Governments.

-

- Carry Forward of Unspent Funds: Unspent money in a financial year does not lapse and is carried forward.

- Tax Concessions: Significant concessions are provided to these states in excise and customs duties, income tax and corporate tax.

- Budget Distribution: 30% of the Centre’s Gross Budget goes to Special Category states.

- Normal Central Assistance (NCA): Special Category States receive preferential treatment in NCA.

- Lower State Share: These states, especially in the North Eastern region, typically have a lower state share in Centrally Sponsored Schemes compared to General Category States.

- Special Plan Assistance: Only Special Category States receive Special Plan Assistance (90% grant) and Special Central Assistance grants (100% grant).

- Externally Aided Projects (EAPs): Assistance for EAPs is provided as a 90% grant for Special Category States, while General Category States receive it as back-to-back loans.

- Changes Post-Fourteenth Finance Commission

-

-

- Union Budget 2015-16: The budget does not provide NCA, Special Central Assistance, or Special Plan Assistance as the Fourteenth Finance Commission addressed the total requirements of states.

- Centrally Sponsored Schemes (CSS): Some schemes were discontinued, and changes in the sharing pattern between the Centre and states were proposed, but preferential assistance for EAPs remains at 90% grant.

-

- Fiscal Measures for Andhra Pradesh and Telangana

-

-

- Andhra Pradesh Reorganization Act (APR Act), 2014: This act mandates the Central Government to implement fiscal measures and tax incentives to promote industrialization and economic growth in Andhra Pradesh and Telangana.

-

- Finance Bill, 2015 Incentives:

-

-

- Additional Investment Allowance: A new provision under section 32AD proposes a 15% investment allowance on new assets acquired in backward areas of Andhra Pradesh and Telangana from April 1, 2015, to March 31, 2020.

- Additional Depreciation: Higher depreciation of 35% (instead of 20%) will be allowed on the cost of new machinery installed in manufacturing units in backward areas during the same period.

-

Concerns Regarding Special Category Status

- Government Stance on Special Category Status

-

-

- The central government has repeatedly stated it will not consider demands for Special Category Status from new states.

-

- Finance Minister’s Statement: Finance Minister Nirmala Sitharaman referenced the 14th Finance Commission’s conclusion, confirming that no additional special category status will be granted.

- Financial Devolution: The 14th Finance Commission (2015-20) recommended raising the share of states from the divisible pool of central taxes to 42% from 32%.

-

-

-

- The 14th Finance Commission has done away with the ‘special category status’ for states, except for the Northeastern and three hill states.

-

-

- The 15th Finance Commission (2021-26) maintained this level of tax devolution, arguing it provides states with more resources.

- Changes in Plan Assistance: The concept of plan assistance is no longer in place following the dismantling of the Planning Commission.

-

- Demands Other States: Giving special status to a state leads to demands from other states too.

- For instance, repetitive demand by Orissa and Bihar to grant them Special Category status.

- Demands Other States: Giving special status to a state leads to demands from other states too.

- Increased Burden on Central Finances: Providing additional funds, tax concessions, and other benefits to Special Category Status (SCS) states significantly strains the central government’s budget and raises concerns about long-term financial sustainability.

- Inequitable Distribution of Resources: Granting Special Category Status to some states while denying it to others leads to an uneven distribution of resources across the country.

-

- Reduced Accountability: There are worries that SCS states may become too reliant on central assistance, which could diminish their motivation to generate their own revenue and hinder the development of a self-sustaining economy.

- Permanent Continuation of Temporary SCS Status: Some states that originally received SCS on a temporary basis have continued to benefit from it for decades, with a lack of periodic assessments or reevaluations of their status.

- Lack of Constitutional Basis: The SCS does not have a clear constitutional or legal foundation.

- It is granted based on administrative decisions by the National Development Council or the central government, making it susceptible to changes.

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

The provisions from Articles 371 to 371-J demonstrate India’s approach to federalism through ‘Asymmetric Federalism,’ catering to the diverse needs of its states.

- By ensuring safeguards and tailored support, these provisions enhance national integration while acknowledging regional differences.

- Ultimately, they are designed to promote the well-being and development of various regions, reinforcing the idea that unity in diversity is essential for a thriving democracy.

| Article | State Concerned |

| Article 371 | Maharashtra (Vidarbha and Marathwada) and Gujarat (Saurashtra and Kutch) |

| Article 371A | Nagaland (Naga hills, Tuensang area) |

| Article 371B | Assam (Bodoland territorial area) |

| Article 371C | Manipur (Manipur hill areas) |

| Article 371D | Andhra Pradesh and Telangana |

| Article 371E | Andhra Pradesh (Establishment of Central University in Andhra Pradesh) |

| Article 371F | Sikkim |

| Article 371G | Mizoram |

| Article 371H | Arunachal Pradesh (special provision, law and order) |

| Article 371I | Goa |

| Article 371J | Karnataka (Hyderabad-Karnataka region) |

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

| Related Articles | |

| Making Of The Indian Constitution | India’s Special Category Status: Provisions and Implications |

| National Development Council of India (NDC) | Finance Commission |

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program